RBA, AUD, ANZ, ASX & AU

News

|

Posted 04/05/2016

|

6544

Today we briefly cover the plethora of local news from the last day. A new historic low in rates was set at 2:30pm yesterday with the RBA opting to cut rates to 1.75%. This saw a significant drop in the AUD and Australian stocks rocket higher to close with a greater than 110 point (2.1%) gain after starting the day with a 0.5% fall. The chart below maps the fall of the AUD in reference to that resulting from our recent record inflation print.

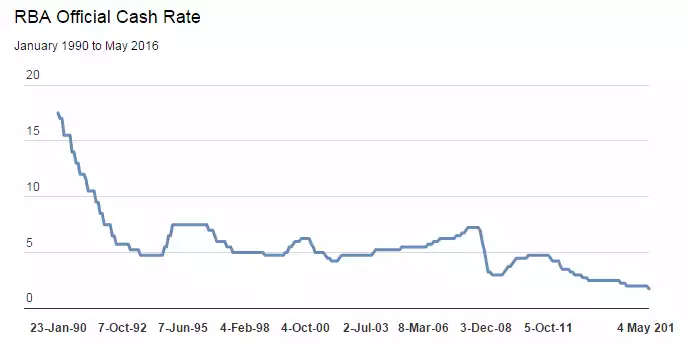

With the AUD currently at about a 5 week low, consensus opinion now is that the RBA will pursue a further cut in August once the next quarterly inflation data is released. In support of this, ANZ representative Felicity Emmett commented that yesterday’s cut is unlikely to be “one and done” in nature and Paul Dales of Capital Economics observed that “if inflation expectations fall again, as they have done in New Zealand, then rates may drop below 1.5 per cent”. For context, the chart below illustrates rates over the last two and a half decades and an interesting observation about this rate move is that it has come prior to a federal election; a rare event.

Yesterday also saw ANZ release figures ultimately weaker than those just released by Westpac. The bank has seen first half profit slump 24% and opted to cut its dividend by 7 per cent. We observe that yesterday marked the first time since the GFC that the ANZ has cut its dividend.

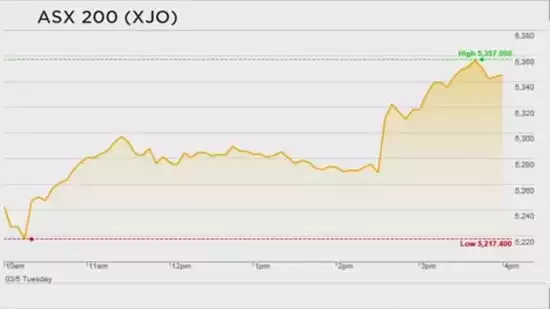

As mentioned, share prices were exuberant yesterday, particularly in afternoon trade following the rate decision. ANZ enigmatically rose 5.6%; somewhat staggering considering that the bank was down by the most part of 4% in early trade. The NAB, CBA and Westpac also rose strongly. Commsec offered speculation of overseas short covering in an attempt to partially explain the stellar financial sector performance for the day and Mike Mangan of 2MG Asset Management observed it was "funny how all the banks tumbled on Monday on a poor WBC result, yet this morning after an even worse ANZ result, all the banks start rallying". Yesterday’s rally is pictured below but is likely to be short lived with weakness overnight in European and U.S. markets pointing to an unwinding in stock prices here upon market open this morning.

Last night also saw Scott Morrison deliver his first budget, the details of which largely aligned with the topics we raised yesterday. Noteworthy however was the focus that analysts placed on the perceived discrepancy between the positive wording framing the budget and the RBA’s rate cut born of negative inflation data; something the treasurer dismissed in interviews.

To touch on gold as a closing note, we have now seen the $1300 level breached thrice in the last two days. Bloomberg is reporting that the gold-backed SPDR saw a 20.8 tonne surge in holdings on Monday representing a single day increase not seen since 2011 and we highlight this article to demonstrate how positive commentary on the metal is now increasingly prevalent.