Rates – A Burden Too Great

News

|

Posted 23/01/2018

|

6337

There is a lot of talk about US Treasury bond yields and the coming effects of the anticipated US Fed rate rises this year. As we reported last week, gold has dropped beforehand and subsequently rallied after each of the US Fed rate hikes since the GFC. The drops are likely off the narrative that high rates are bad for gold and we’d suggest the rallies thereafter on the dawning realisation that rate rises could well be, and many argue will be, the prick that bursts this ‘Everything Bubble’.

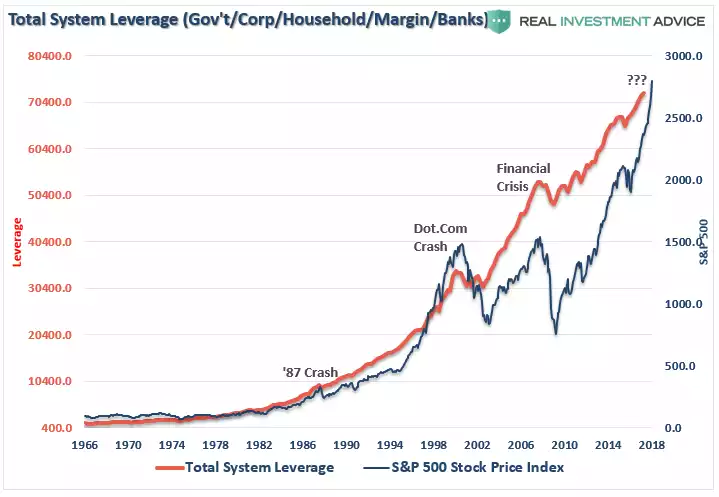

Last night the 10 year UST hit 2.66% off the ending of the Government Shutdown, highs not seen since early 2014. Tax Cuts and general ‘everything’s awesome’ sentiment are seeing a surge in Treasury yields. So what does this mean? That is not a straightforward question in this highly leveraged world. Higher bond yields and higher interest rates may generally seem in lockstep however bonds currently are more about sentiment whereas the reality of higher interest rates may have been missed. Real Investment Advice’s Lance Roberts again covers this nicely. Let’s first remind ourselves of the nosebleed levels of debt and share prices (many have named the “???” the “Everything Bubble”):

Per our article last week, you will again notice examples of the consequences of the decoupling of ‘value’ and debt since, you guessed it, 1971. It’s all about the debt baby….

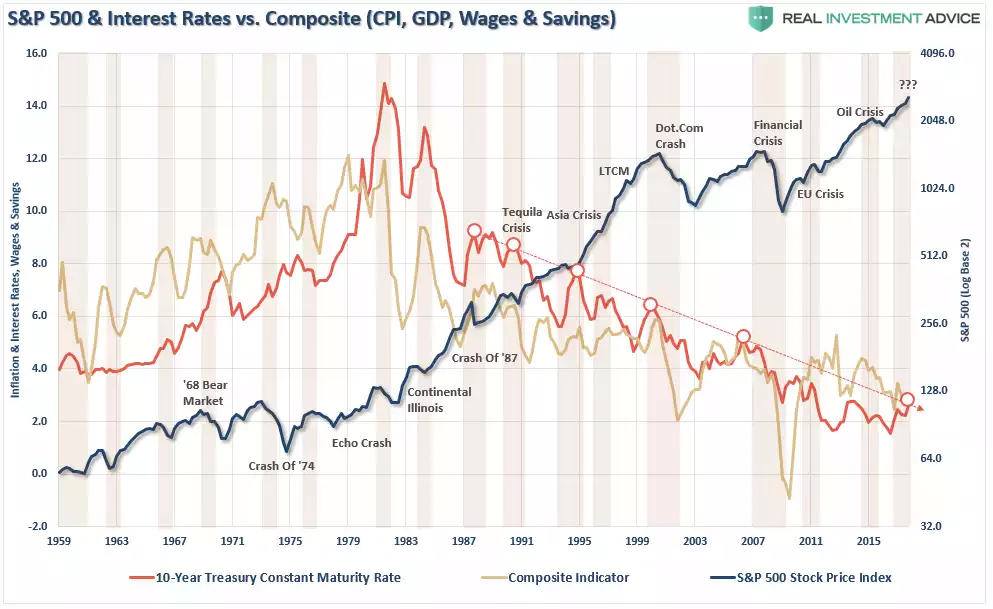

The chart below shows very succinctly the effects of rising 10year UST’s (the red line). Each time they have a spike (circled) the world’s biggest share index (blue line) has corrected.

However, if we go back to the previous graph we are reminded that we have never seen these markets so leveraged with debt. In other words, never before has the market been so susceptible to higher interest rates. However it goes way beyond these markets…

In a previous report Lance stepped through just some of the implications on higher interest rates in our current post GFC and Central Bank stimulus world:

“1) The Federal Reserve has been buying bonds for the last 9- years in an attempt to push interest rates lower to support the economy. The recovery in economic growth is still dependent on massive levels of domestic and global interventions. Sharply rising rates will immediately curtail that growth as rising borrowing costs slows consumption.

2) The Federal Reserve currently runs the world’s largest hedge fund with over $4 Trillion in assets. Long Term Capital Mgmt. which managed only $100 billion at the time nearly brought the economy to its knees when rising interest rates caused it to collapse. The Fed is 45x that size.

3) Rising interest rates will immediately kill the housing market, not to mention the loss of the mortgage interest deduction if the GOP tax bill passes, taking that small contribution to the economy away. People buy payments, not houses, and rising rates mean higher payments.

4) An increase in interest rates means higher borrowing costs which lead to lower profit margins for corporations. This will negatively impact the stock market given that a bulk of the “share buybacks” have been completed through the issuance of debt.

5) One of the main arguments of stock bulls over the last 9-years has been the stocks are cheap based on low interest rates. When rates rise the market becomes overvalued very quickly.

6) The massive derivatives market will be negatively impacted leading to another potential credit crisis as interest rate spread derivatives go bust.

7) As rates increase so does the variable rate interest payments on credit cards. With the consumer being impacted by stagnant wages, higher credit card payments will lead to a rapid contraction in income and rising defaults. (Which are already happening as we speak)

8) Rising defaults on debt service will negatively impact banks which are still not adequately capitalized and still burdened by large levels of bad debts.

9) Commodities, which are very sensitive to the direction and strength of the global economy, will plunge in price as recession sets in.

10) The deficit/GDP ratio will begin to soar as borrowing costs rise sharply. The many forecasts for lower future deficits will crumble as new forecasts begin to propel higher.

I could go on but you get the idea.”

That gold is climbing in an environment of rising Treasure yields is very telling. What’s described above is not being missed by the smart money and they are getting their hedge in. Whilst the top end of town gets hurt more in market crashes, as described above, rising rates when EVERYONE is highly leveraged, including Governments, sees widespread pain and potentially a much broader economic collapse.