Rate Hikes Historically No Threat to Gold

News

|

Posted 10/09/2015

|

4431

We wrote yesterday about the 30% market segment that is currently betting on a rate rise this month and it’s easy to appreciate how anticipation over the Fed’s first rate-hike cycle in 9 years has contributed to the gold price slide in recent times. While precious metals offer attributes well suited to safety and diversity in a portfolio, they do not generate an income stream. Gold’s sterile nature fuels a common belief that demand for it falls as rates rise due to the increased yields on offer and mainstream exergasia (many readers will recall the “pet rock” comment) has helped to support this notion in recent years.

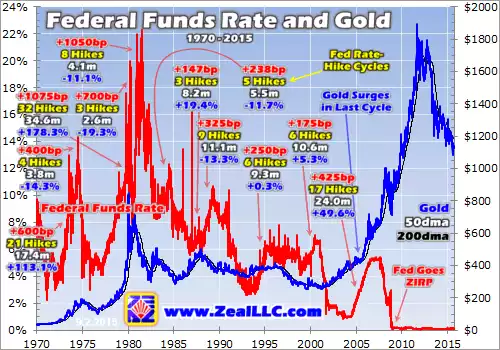

Superficially this bearish hypothesis seems sound but reality tells us a different story. Investors all over the world have utilised gold effectively throughout history as an investment with full knowledge that it lacks yield and Adam Hamilton’s recent study that compares federal funds rate-hike cycles to gold over nearly half a century illustrates this well.

In the attached graph, the red plot shows the free-market FFR (as opposed to the target rate which the FOMC sets – this accounts for the noise in the data) and the blue plot is the gold price in US dollars. The study defines a hike cycle as 3 or more consecutive increases and identifies 11 such cycles since 1971. The data shows that gold appreciated by 638% in the decade ending August 2011 which far surpasses the return offered by the dividend-rich S&P 500 (which depreciated by 1.9% over the same interval). Looking at the 1970s we see a 2332% appreciation in gold at a time when the federal funds rate was upward trending and bond yields were high. In all, gold actually rallied an average of 61% through 6 of the 11 US rate-hike cycles. The losses over the remaining 5 cycles averaged only 13.9% showing that gold is historically very resilient. Indeed 2 of gold’s 5 negative hike cycle periods followed times of strong gold performance so a price adjustment during these stages is somewhat expected.

The study offers a simple explanation for why gold investment demand is positive in rising-rate climates, stating that Fed rate-hikes have detrimental impacts on stock and bond markets; which is a scenario that we’ve previously written about. Certainly the notion that something other than yield is the dominant pricing force in these circumstances makes sense and is supported by the fact that commentary never focuses on increased rates having the consequence of devastating non-dividend stocks. Applying that same argument to gold then seems unfounded.

The lessons from history tell us that gold investors should not fear the prospect of entering a tightening cycle should the Fed decide to depart from ZIRP this month and indeed a diversification into gold could be a good investment in such a scenario.