Profiting From The High AUD

News

|

Posted 22/03/2016

|

5537

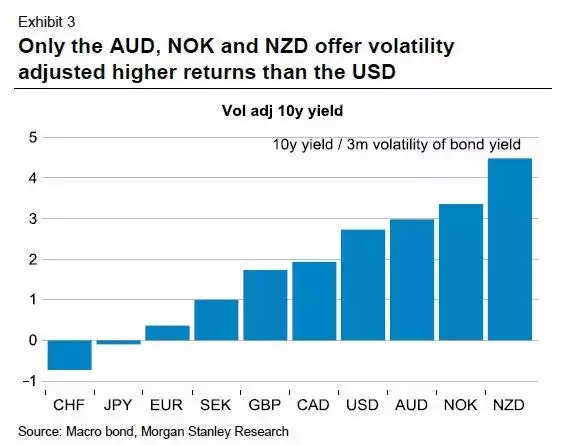

Not many analysts predicted an AUD at 76c around now. A combination of better than expected (but questionable) domestic economic data and the rest of the world sinking into zero or negative rates makes our still yielding dollar look comparatively good. Indeed if you check out the chart below (courtesy of Morgan Stanley Research) only the NOK (Norwegian Krone) and the NZD offer a better return (after volatility adjustments) than the AUD, and all 3 higher than the ‘mighty’ USD. It’s this carry appeal that sees a flight to the AUD and hence a stubbornly high rate in the face of our post mining boom economy.

But the BIG question is ‘for how long?’. Well when the world’s biggest (by far) asset manager is in the press yesterday calling a “mid- to-low 60c level” AUD by year’s end it is certainly worth noting. BlackRock have an incredible US$4.6 trillion of assets under management. For perspective, our biggest bank, CBA is a fifth the size with AU$0.87 trillion.

One thing is certain, our RBA and exporters do not like a circa 76c AUD and there will likely be moves to get it down. The median forecast amongst analysts is 70c by the end of 2016, 8% lower than now but much higher than BlackRock’s call. BlackRock think the RBA will be handed the excuse (need) to cut rates via poor GDP growth for the rest of the year, predicting 2% as opposed to the 3% we saw last year, which they say "will open the door for rate cuts and, if it opens the door for rate cuts, that opens the door for a lower Aussie dollar," …… "Over time, albeit in a fairly volatile fashion, we'll still get to the mid- to-low 60c level by the end of this year."

Gold and silver provide an easy currency play. A move from the current 75.85c to even their high range 65c would see the current price of gold and silver rise nearly 17% to $1915 or $24.40 without any change in the USD spot price.