Pressure on the AUD as NAB Survey “Grim”

News

|

Posted 13/06/2019

|

6059

Since the AUD spiked over 70c after the rate cut last week, it has been on a downward trajectory, reaching lows of around 69.1c as we write.

Yesterday we saw a deceleration of China’s PPI (producer price inflation) to just 0.6%. That is bad news for commodity currencies like the AUD which dropped on the news despite ore prices firming.

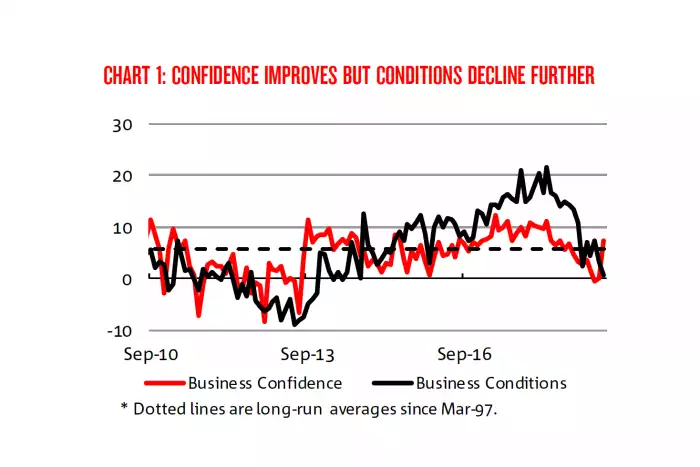

We also saw more concerning news from the latest NAB business survey which saw another 2 point drop in business conditions, 20 points below the early 2018 peak. Retail was the biggest contributor with NAB stating it is “clearly in recession” and that "This has come as no surprise given the trends in household consumption and retail sales data…..In seasonally adjusted terms, conditions in the retail sector are now around levels last seen in the GFC." But it wasn’t just retail with mining, transport and utilities also driving the business conditions result lower.

Curiously there was a bounce in confidence however they noted the survey was just after the surprise win by the coalition and the RBA giving that clear sign they were going to cut rates last week. i.e. a short term sugar hit leaving NAB to observe “Forward-looking indicators suggest that the bounce in confidence is likely to be short-lived and that conditions are unlikely to turn around any time soon.”

Consumption is a major (around 57%) contributor to Australia’s GDP and this collapse in retail is therefore a major concern, together as an indicator of the general health of the economy. From NAB:

“This suggests that the consumer remains highly cautious with anything but spending on essentials because of ongoing slow income growth, high debt levels and possibly some concerns over falling house prices.”

Mr Oster did not want to “overemphasise” the doom and gloom in the sector, but said “readings of -27, which we’ve got in retail, is so grim”.

All eyes will be on the employment figures that come out today but no one is expecting any great news from it. The threat is they come in even weaker than expected, accelerating the fall in the AUD.

Trading View’s collation of technical calls has the AUD firmly in the SELL range with many calls for a retest of the 68c mark soon.

Maybe that is no coincidence either as we are seeing more and more signs of a ramp up of the currency wars we’ve witnessed since the GFC. Last night Trump got stuck into the (independent…) Fed again in the context of the Euro and other currencies being undervalued against his USD saying the Fed is “putting the U.S. at a big disadvantage. The Fed Interest rate way too high, added to ridiculous quantitative tightening! They don’t have a clue!”’

A weaker than expected inflation print helped his cause and yet he Tweeted it “a beautiful thing.” (though maybe just because it does help his cause of getting lower rates not because it lowers the cost of living…).

Either way, as we see the decline in global trade, countries are going to get more and more desperate to deflate their currencies to keep globally competitive. As Deutsche Bank noted last night:

“Global conditions are nicely set for what has colorfully been described as a ‘currency war’ or a currency race to ‘the bottom’"

Gold has always proven to be the best protection against falling currencies.