Precious Metal & Bitcoin Bulls Just Beginning

News

|

Posted 15/10/2020

|

6135

Part of the dilemma for many investors right now is ‘where is safe to put my money’. We are in a rare period of extreme uncertainty where even traditionally safe havens such as Aussie property are looking decidedly shakey and indeed already posting negative returns. In the past going to cash was a common response and yet the combination of effectively zero interest being paid and the new and looming prospect of bank bail in’s is playing on more people’s minds. Moreover, more people are becoming aware of the unprecedented debasement of that ‘cash’ they are holding as governments print more and more of it. Finally, bonds appear zero bound and equities are presenting P/E ratios completely out of sync with the fact we are in a recession, both the result of aforementioned monetary stimulus.

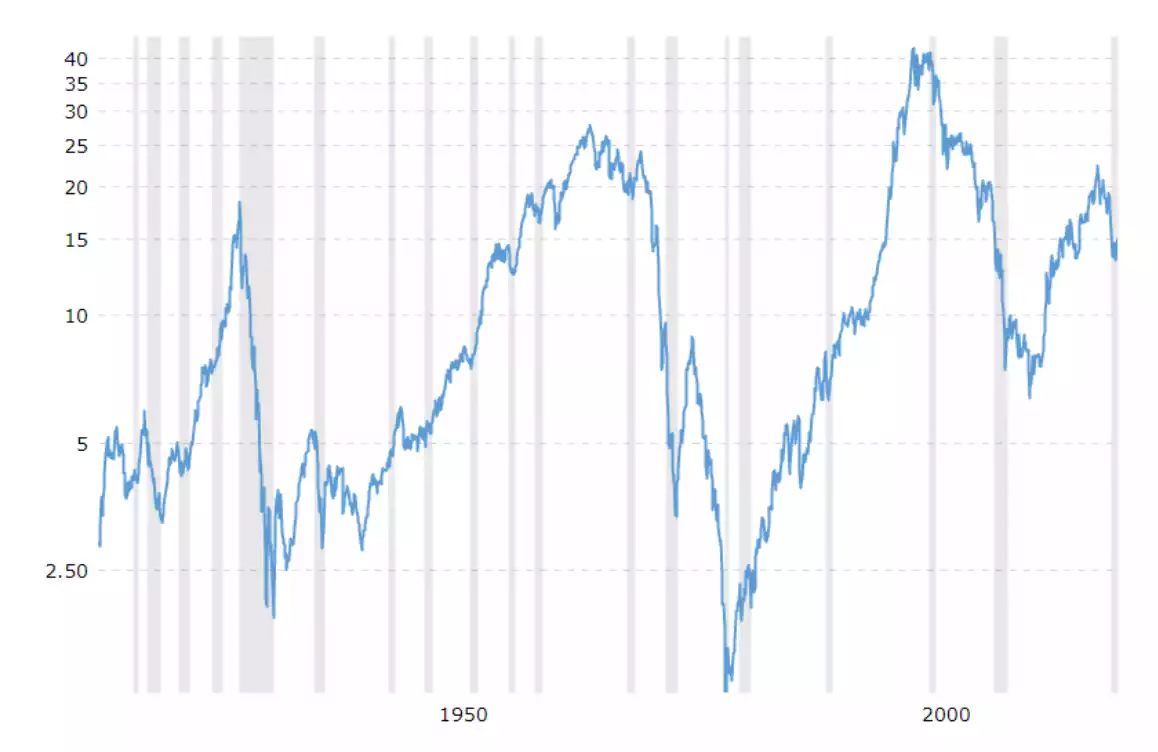

It’s instructive too to look at equities (using the US Dow Jones as the global proxy) compared to the hard asset alternatives. First, looking at gold you can see, despite some ‘feeling’ like it’s at a high, when priced against the Dow is still at rock bottom prices but most certainly starting to make a move to revert toward the mean. Remember when looking at this chart that it is a log scale.

As you can see gold is commencing a retracement from a high only seen 3 times before in history.

Inverting that chart and adding some technical indicators, you can see the set up is indeed quite alluring for the yellow metal:

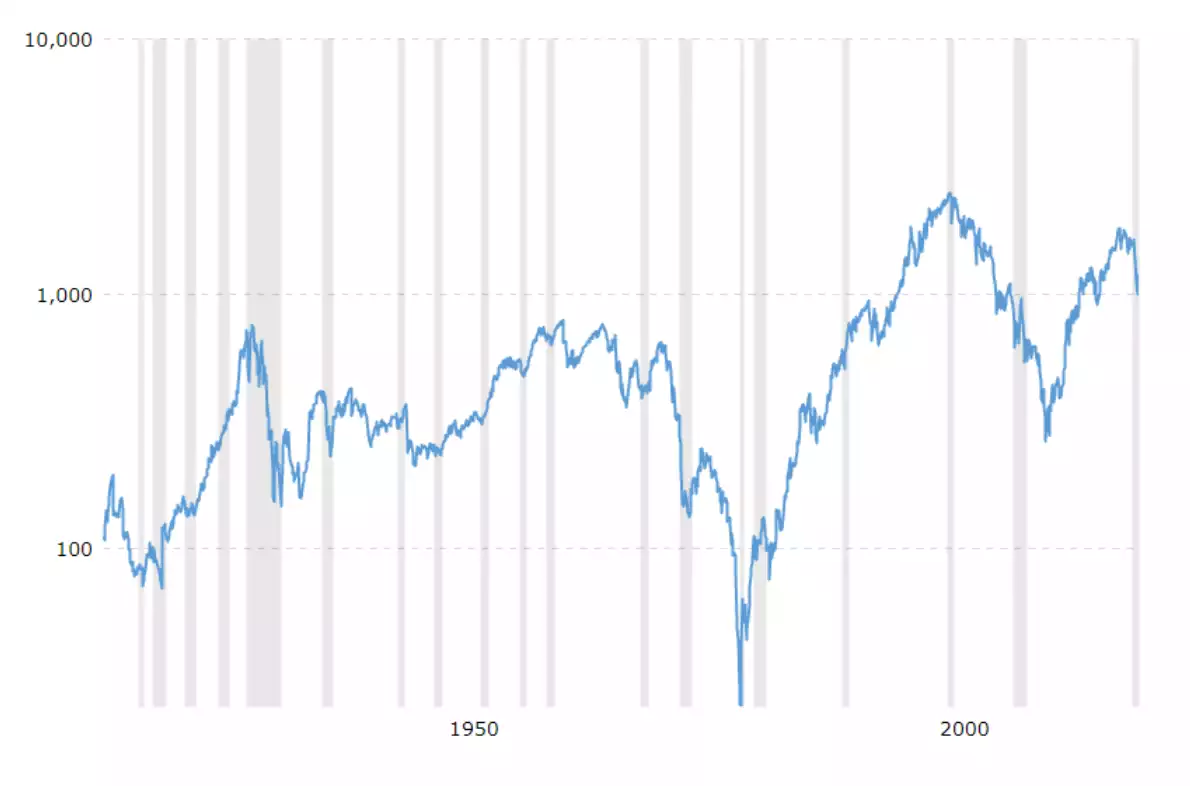

Silver too looks similar and that last big dip which was 2011 is still quite a long while off from the current position. Remember in 2011 we saw silver at $50…

h

h

Bitcoin doesn’t have the history to map out like the precious metals but it is forming a channel in its brief history against the Dow that is trending in a bullish direction for the digital currency and indicating it is poised for a pronounced bullish run against the Dow as it tests its upper range.

The Felder Report recently spoke to this set up for gold as well with the following being an excerpt from the paid PRO report:

“With the gold price up about 100% since it bottomed five years ago, some investors seem to believe that it has gotten overpriced. In addition to watching important drivers of the gold price, one way to look at its valuation is to simply compare it to popular alternatives. The gold price relative to the Dow Jones Industrial Average would seem to suggest it is not expensive at all. In fact, to match the valuation peak it reached about a decade ago, gold would need to double again from its current price. Of course, that would still leave it far below the peak seen four decades ago. So gold’s upside potential over the long run looks far from exhausted even after its terrific run over the past few years.”