Positive Signals – COMEX & Swiss Exports

News

|

Posted 24/10/2016

|

4351

Firstly, just a notice that our Future Proof Portfolio seminar sold out in just 4 days. Sorry if you missed out. We will try and hold another soon given the overwhelming demand.

We saw an interesting turn of events last week where gold rallied whilst the Managed Money (speculators) on COMEX sold down their long positions. The big Commercials look to have bought those long contracts and reduced their short positions (in both gold and silver), extending their recent run of doing so. This is seen as a bullish set up for the gold price by COMEX analysts.

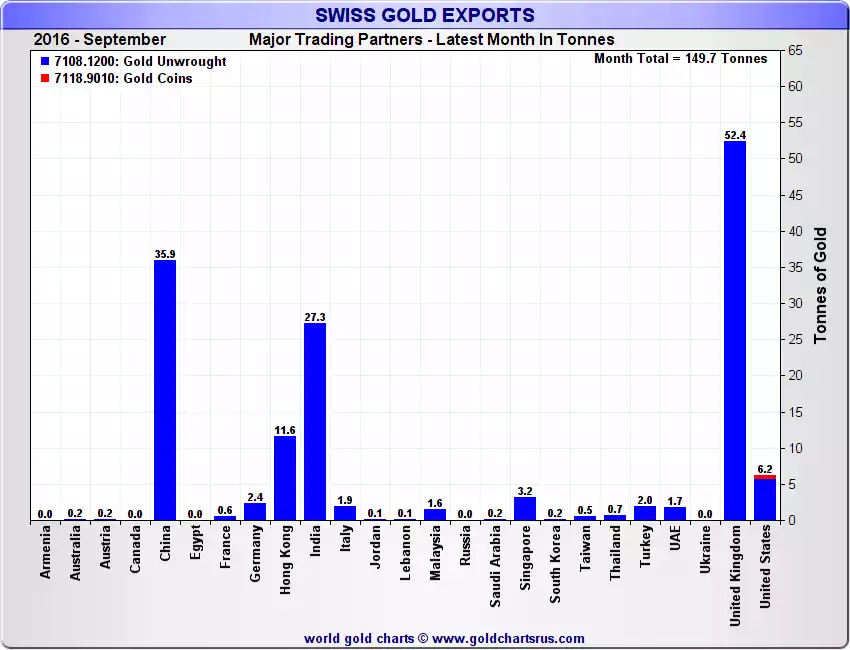

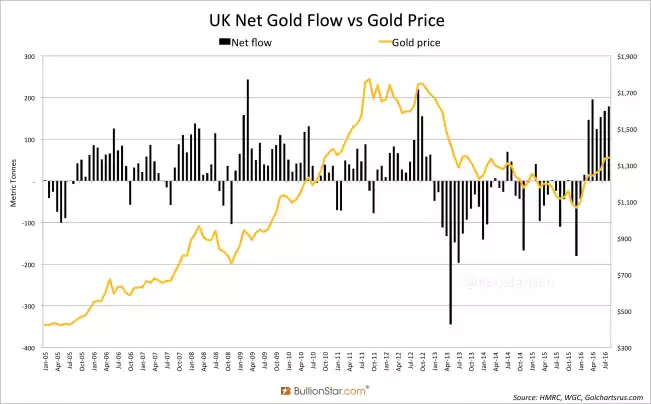

This coincided with some physical gold demand figures (for September) released showing an increase in demand from the East but importantly too London. The monthly Swiss import/export figures showed gold exports to China spiking to their highest since January (35.5 tonne, up 64% from August) and India up to 27.6 tonne (up 20% on August).