The ‘Fed Put’ & Where it May Lead

News

|

Posted 28/03/2019

|

6217

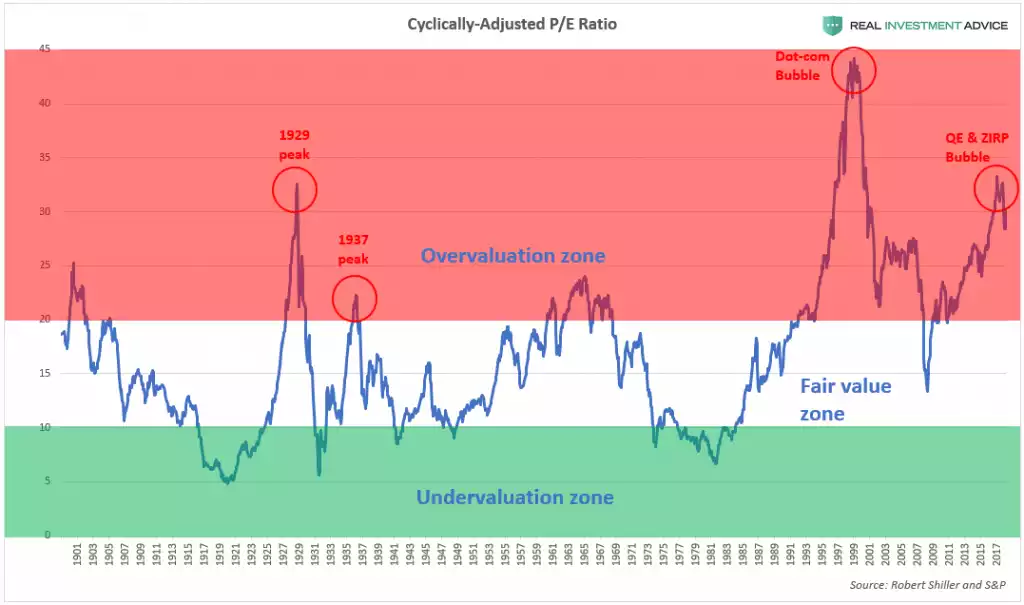

As concern grows more broadly now about the oncoming recession after the yield curve inversion received such wide spread media commentary, more people are looking to the US Fed asking ‘what are you going to do about this?’. They are asking this as the Fed has come to the rescue in each of the corrections since the GFC. It even has a name, the ‘Fed Put’. The graph below shows that with each attempt of the market to revert to fair value, the Fed has stormed in with more stimulus or more recently they have left it to the ECB, BoJ and PBOC to do it for them.

The problem going forward is the US Fed has pretty much tapped out the effectiveness of buying up US Treasuries and Mortgage Backed Securities, which is all it is currently allowed to buy to print money. They also have little room to lower rates. Their previous chair, Janet Yellen, said when she was still in charge in 2016 (courtesy of RealInvestmentaAdvice):

“The Federal Reserve might be able to help the U.S. economy in a future downturn if it could buy stocks and corporate bonds, Fed Chair Janet Yellen said on Thursday.

Speaking via video conference with bankers in Kansas City, Yellen said the issue was not a pressing one right now and pointed out the U.S. central bank is currently barred by law from buying corporate assets.

But the Fed’s current toolkit might be insufficient in a downturn if it were to “reach the limits in terms of purchasing safe assets like longer-term government bonds.”

“It could be useful to be able to intervene directly in assets where the prices have a more direct link to spending decisions,” she said, adding that buying equities and corporate bonds could have costs and benefits.”

Now we have written at length of the unprecedented size and increasingly poor quality of US corporate debt. Surely expanding that further is no longer on the table some 3 years later? Nope, Yellen just this week in Hong Kong said “global central banks don’t have adequate crisis tools.” and again called for the US Fed to be able to buy shares and corporate debt directly as she ventured in 2016. This is not new territory by the way. We have reported before that the Bank of Japan (BoJ) has been the biggest single holder of ETF’s on the Japanese sharemarket and holds nearly 50% of all bonds. The ECB too has been a massive buyer of corporate bonds in Europe. We also still have around $11 trillion of negative yielding bonds in the global system. So far the Fed has resisted changing its rules to be able to buy shares and corporate bonds and has not taken rates into negative territory. But they are clearly contemplating both when things get bad.

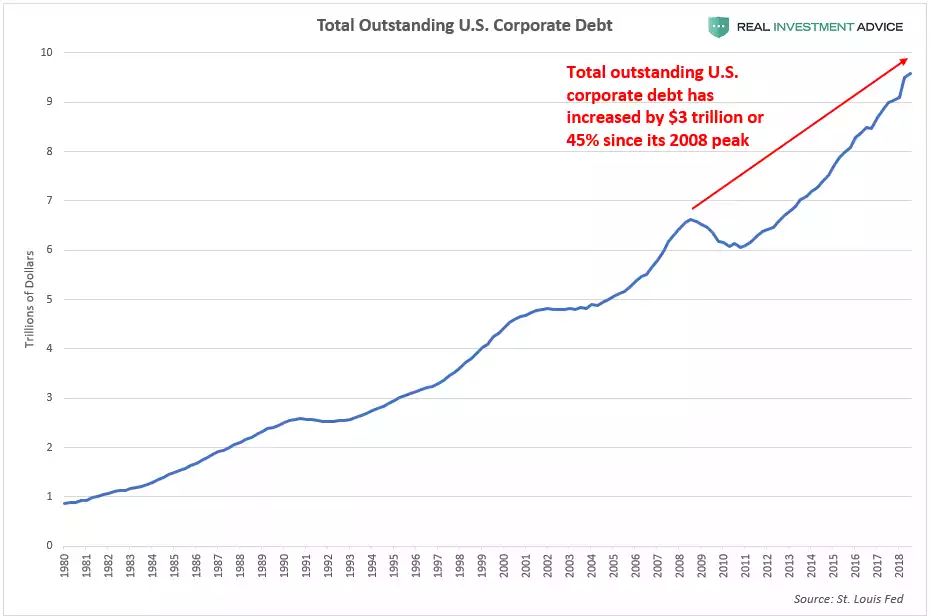

��������������������ÅÅÅÅÅÅÅOÅOOOÅÅÅÅÅÅÅÅÅOPer the linked article earlier, the US corporate debt market is already looking like one of the key potential triggers for a crash. It is already at unprecedented levels, deteriorating quality, and largely responsible for all the corporate buy backs that have artificially inflated sharemarkets. To unleash the Fed’s money printing presses onto it seems outright reckless. As a reminder, US corporate debt has increased 45% or $3 trillion since the GFC:

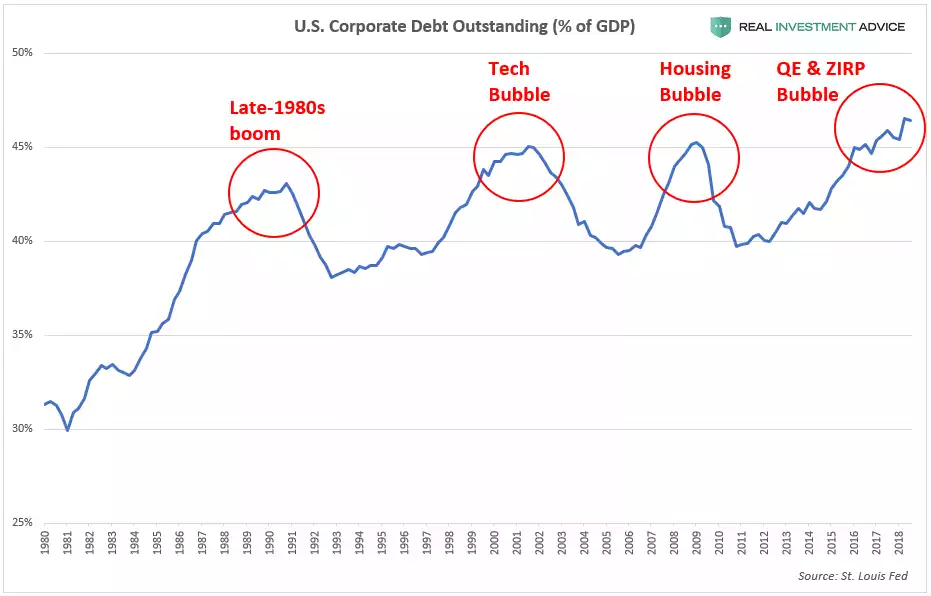

And in real terms, as a percentage of GDP, it is nearing half of all GDP at 46%:

Already we have US shares at valuations around those seen before the Great Depression in 1929. Record high valuations mean the price of shares is pushing all previous measures of value on fundamental measures. Unleash the Fed printing presses onto direct share purchases and funding corporate buybacks, and blind Freddy can see the outcome.