Platinum – What makes it so special

News

|

Posted 20/09/2018

|

7934

Platinum is often the ‘overlooked’ precious metal. Today and tomorrow we are dedicating our time to help you understand this unique precious metal and why right now it is looking like a very undervalued asset.

Today we will look at what makes Platinum so special and tomorrow why it currently looks so undervalued.

So let’s get back to basics. Platinum (Pt) is not only a precious metal, it is a very rare metal being the 72nd rarest of the 92 naturally occurring elements in the earth’s crust. It is the parent to the group of PGM’s (Platinum Group Metals including Palladium and Rhodium) and was only discovered in 1735, many thousands of years after gold and silver.

Like silver, platinum wears two hats – precious metal monetary asset and industrial metal.

Demand for the metal stems from a number of unique properties.

- high melting point of 1,768c giving high demand in high quality glass production

- catalytic ability to speed up a chemical reaction without itself being changed in the process (hence heavy use in auto catalytic converters). Also more recently as a catalyst in revolutionary fuel cells (hydrogen/oxygen) to power cars cleanly

- very ductile and malleable, hence production of wiring and use in electronics

- increases storage density on hard discs for laptops and servers supporting cloud storage

- biocompatible giving demand for anti-cancer drugs, cardiac treatment implants such as pacemakers, prosthetics, and dental applications

- hard density and naturally white finish makes it perfect for jewellery.

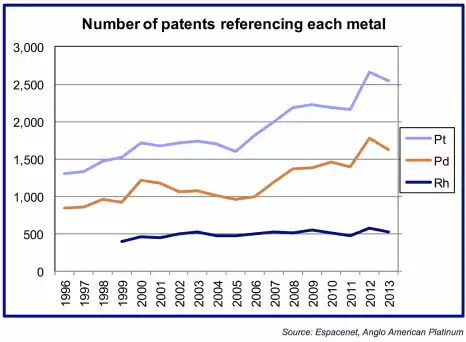

Importantly Platinum use is growing with new uses being discovered every day. The chart below shows this clearly:

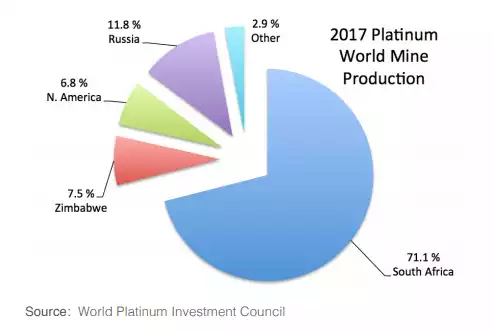

On the supply side of the equation, platinum is particularly unique. Platinum is very rarely found in its pure form in nature and geographically 80% of viable platinum reserves are found in the Northern part of South Africa. That is extraordinary concentration in an extraordinarily volatile human environment.

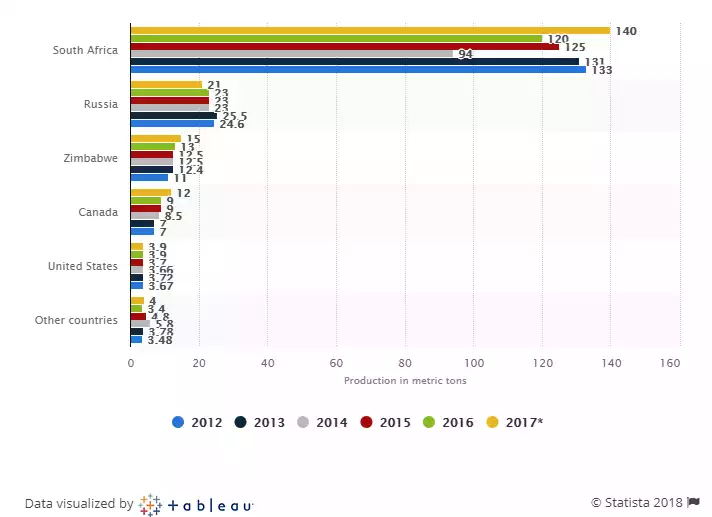

Long time readers will remember us reporting the protracted strikes in South Africa. Whilst ‘resolved’ it lead to a 7.3% increase in wages for 3 years from 2016. That delicate impasse expires next year. Platinum mining is hot, deep, dangerous work and South Africa continues to this day to see disruptions in the form of maintenance work, safety stoppages, and mine suspensions. The chart below shows the impact of the stoppages in 2016 on the world stage, begging the question ‘what happens next year’?

At the time of writing the platinum spot price is USD828. In 2016 the world average production cost was USD974!

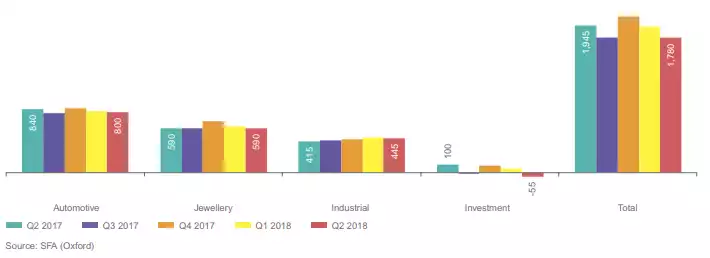

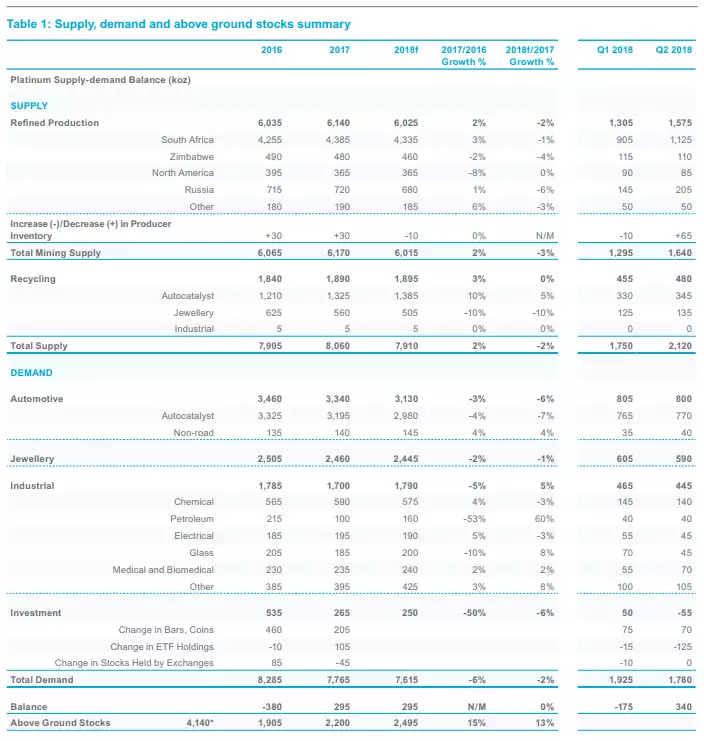

Up until 2017 platinum saw demand outstrip supply for 6 consecutive years. As you can see below it is currently slightly in excess due mainly, you guessed it, to a drop in investment demand just as we’ve seen in gold and silver. This of course is a bell sounding to contrarians.

As you can see platinum is highly susceptible to supply constraints with limited reserves and an almost unique concentration of supply from one, volatile region. Against growing uses and future demand that bodes well from a supply/demand price equation. But as with silver, that is only half the story and tomorrow we delve into the alluring price setup for this metal.

Ainslie sell 1oz and 10oz minted platinum bars from the LBMA London refiner Baird&Co and of course the classic Perth Mint platinum Platypus coin. Visit our webshop here to check them out.