Petroyuan v Petrodollar – The wider implications

News

|

Posted 27/03/2018

|

8354

Whether most people realise it or not, we are likely witnessing the early stages of an historic change in our global monetary system. In years to come we could well be telling our children or grandchildren that we noted when this all started. We are talking about the hegemony of the US and the USD. This is not a sensationalist ‘imminent crash of the USD’ story, rather the flagging of the early stages of a change to the world order, and one that history has seen repeated time and time again.

Let’s revisit the birth of the Petrodollar. In the early 1970’s the likes of Britain, Germany and France could see that the reckless abandon with which the US was spending its USD was undermining the gold backed reserve currency they all signed up to under the Bretton Woods system and starting demanding gold for their dollars. President Nixon could see where this was headed and ‘temporarily’ (still) ended the gold backed arrangement and made the USD completely Fiat (backed purely by the promise of the US Government).

Despite the hubris of Nixon, he knew this fundamentally undermined the reserve currency status of the USD and he needed more. And so he sent Henry Kissinger to Saudi Arabia to pitch the Petrodollar and hence replace dollars-for-gold with dollars-for-oil. The deal was simple, Saudi Arabia would deal exclusively in USD for all oil and spend profits on US debt securities (Treasury bonds). In return the US would offer military protection for Saudi Arabia’s oil fields, provide weapons, and guaranteed protection from Israel. The deal quickly spread to other OPEC nations and the USD was king again. The deal was ingenious as oil demand surged, it removed the constraints of the finite gold issue, and heralded the beginning of one of the biggest credit expansions in all history. The Petrodollar saw an immediate increase in demand for USD, increase demand for US debt securities and allowed the US to buy oil with a currency it could print at will, and did. All those US debt securities meant it could keep running deficits and pile on more debt, sold willingly to the world.

Back then, China was barely on the US’s radar as a threatening superpower. In the ensuing 40 years that has most certainly changed. China holds 3 topically key titles at present. It is the world’s 2nd biggest economy, has surpassed the US as the world’s biggest consumer of oil and is also the world’s biggest holder of US treasuries (debt securities).

Back in September last year we reported on the news that China was to launch a gold backed, yuan based oil contract. Read here for a recap. Yesterday it launched that Petroyuan, and it did so with very strong demand. The yuan-denominated crude oil futures launched in Shanghai with 62,500 contracts traded, or over 62 million barrels of oil changing hands for a notional volume around 27 billion yuan (over AU$5 billion).

Russia and Iran have both previously moved to yuan or gold for oil and pressure is mounting on Saudi Arabia. Throw in China’s massive ‘One Belt One Road’ or “Silk Road” initiative and the threats to the mighty USD are quickly growing. China always has the economic nuclear bomb of selling off all those US Treasuries at its disposal as well.

Moreover we are likely witnessing a direct threat to the supremacy of the US itself. Ray Dalio, head of the world’s biggest hedge fund and arguably the most respected person on Wall St authored an interesting ‘thought dump’ last night titled "Is Trade War Harbinger Of A Bigger Conflict?" He finishes it with the following:

“We are certainly in a period in which the world order is transitioning from being U.S.-dominated to being multipolar (so Thucydides’s Trap is worth considering), wealth gaps are large and rising, and populism, nationalism, and militarism also appear to be rising - and these factors will likely play larger roles in affecting economies and markets (e.g., populism in Mexico as manifest in the upcoming July election could have a bigger effect on Mexico’s economy and markets than anything else).

At such times, I believe that it is especially important to keep one’s portfolio liquid (to be flexible) and diversified (to not have concentrated risks).”

"Thucydides Trap" refers to when a rising power causes fear in an established power which escalates toward war.

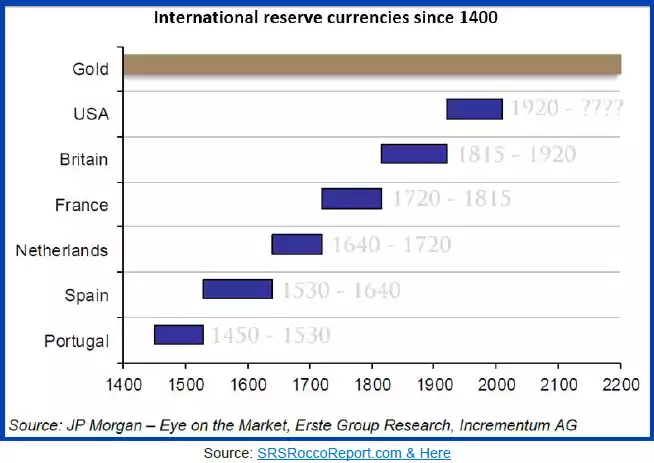

There is, quite simply, one clear winner in this whole set up and that is gold. Consider Exhibit A below: