Pal says “Time To Add” & Elon sees the green light

News

|

Posted 25/05/2021

|

6028

Late last week Raoul released a quick update titled “Time to Add” where he reflects on the crypto market after the massive sell off. During extreme market conditions, it helps to look towards experts to keep a level head. Here’s what he had to say;

“Well, that was an interesting few days in crypto!

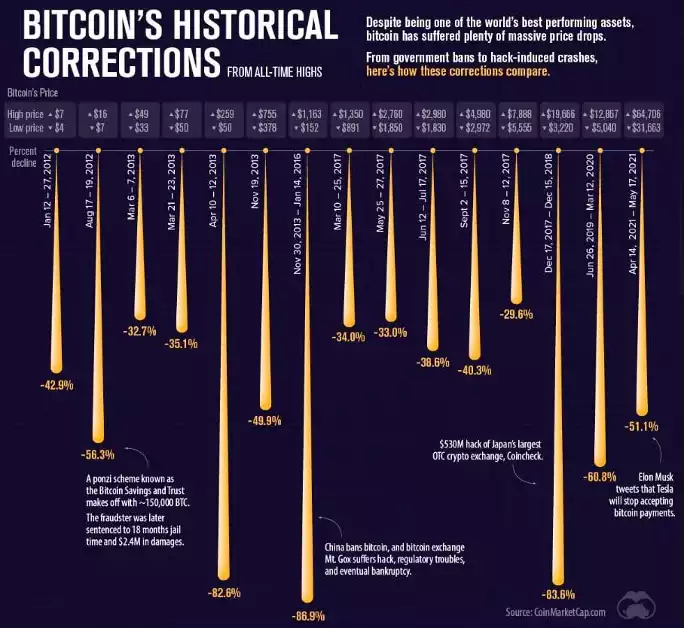

What do you expect in a 65% vol to 100% vol asset? As I have explained many times, 50% pullbacks are rare but expected, and 35% pullbacks are common. No one likes them when they come but, if you use them to your advantage and add to your trades if possible, then they become your friend.

If you do trade around your position (which I don’t – I just hold) then you should add into sell-offs and reduce into the sharp spikes higher. Oh, and please don’t use leverage... you really don’t need it in an asset that can go up 10x in a year.

However bad the bloodbath of selling got, ETH was still up 200% on the year and BTC was still up 20%. My guess is that they finish the year maybe 10x from here.

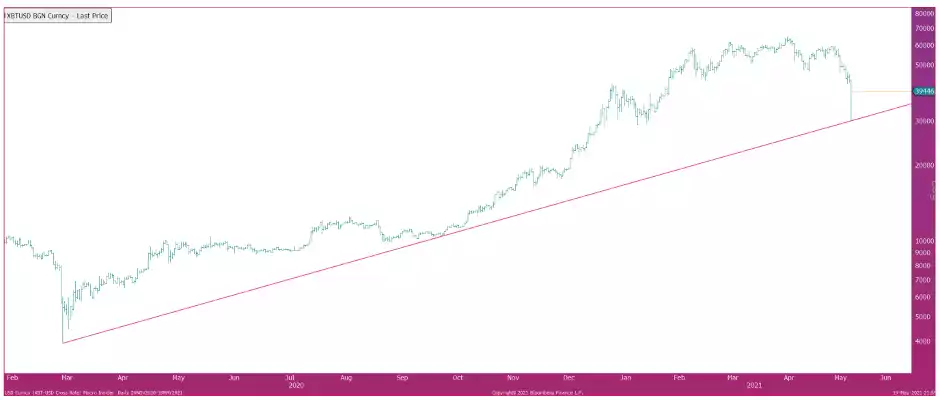

In other words, it’s all there to play for. I thought I’d show you a few charts to see where we are. I tend to use log charts for exponential assets. The log chart of BTC exactly hit the trend line.

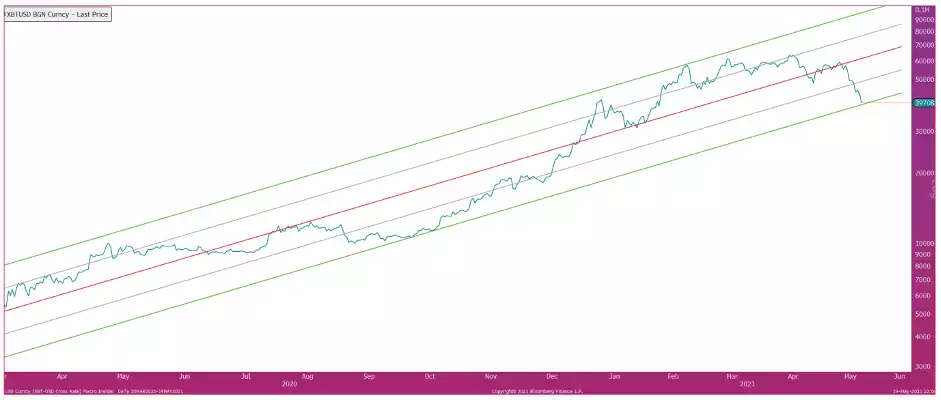

Using the regression channel, BTC is right on the two standard deviations oversold...

Again, this to me suggests this is the buy zone. Sure, it might take a month to digest all the selling, it might even retest the low or make margin new lows, but most of the pain for all of us is finished.

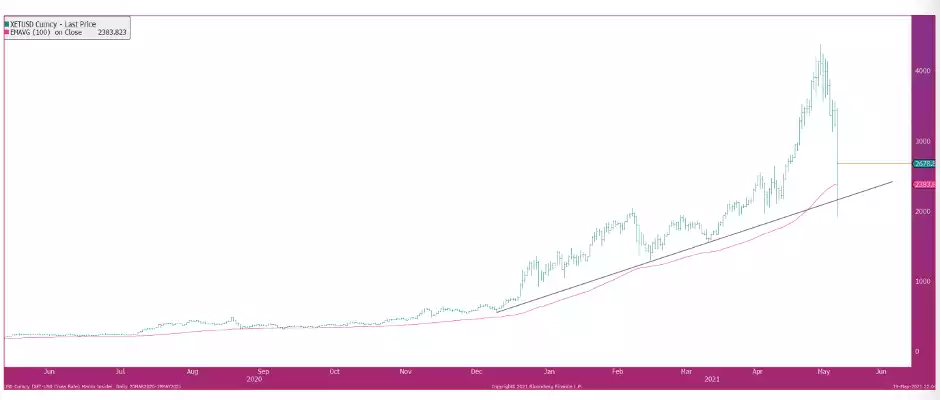

ETH is also super interesting. It too tested its major support and bounced hard...

... and got to one standard deviation oversold before bouncing...

But those aren’t the killer charts. These are…

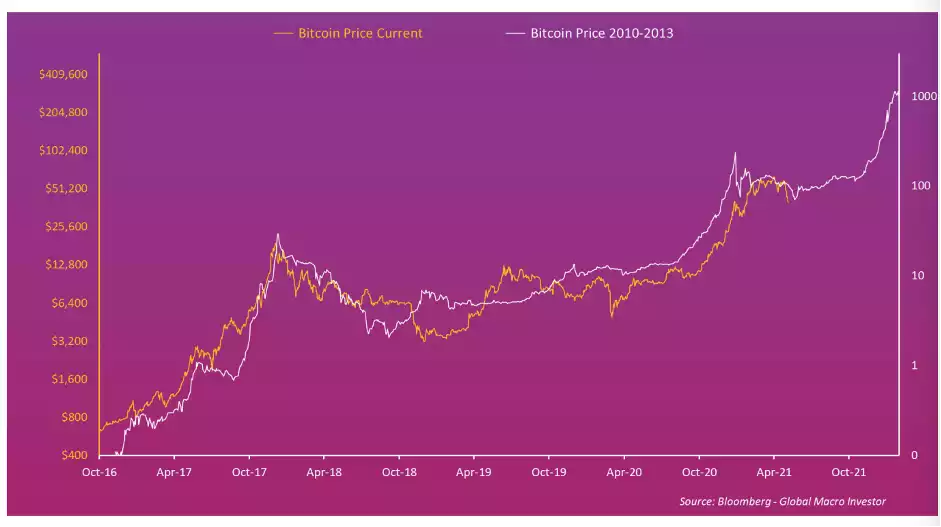

BTC is exactly mirroring the 2013 bull run....

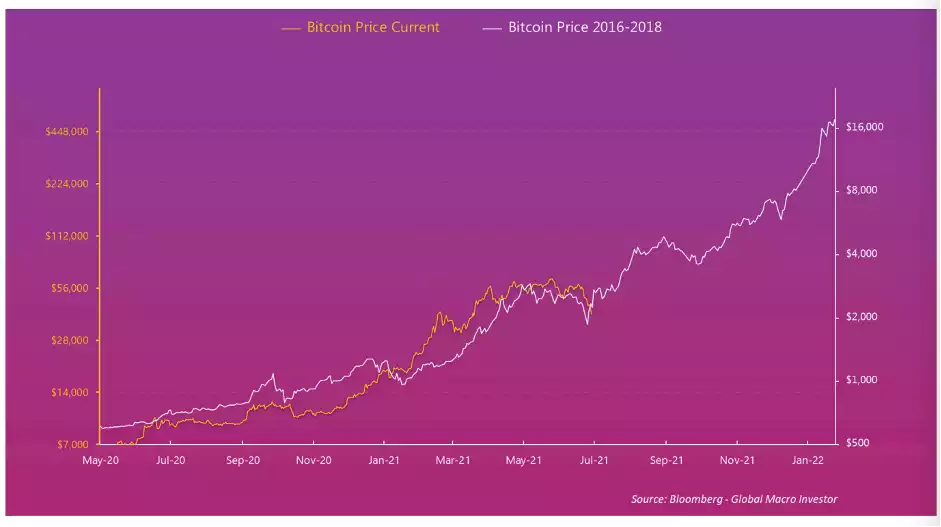

We can see the same pattern at play versus the 2017 cycle too. Both give the same upside at around $400k...

The mid-cycle correction is nearly over.

Keep calm and carry on.”

Bitcoin’s massive selling (which triggered the rest of the market to dump) was largely caused by a shift in sentiment after Elon Musk tweeting stating that Bitcoin would no longer be accept as payment for Tesla’s – citing the environmental harm that bitcoin mining causes.

This morning Michael Saylor of MicroStrategy tweeted the following;

This development has already had its effect on the market and Bitcoin is up roughly 14% in the last 24 hours. The positive sentiment was only amplified when American billionaire and head of the worlds largest hedge fund Ray Dalio stated yesterday that he holds Bitcoin and praised the cryptocurrency’s role as a better inflation hedge asset than bonds, implying a turnaround on his sceptic stance on the industry. All signs point to this latest pullback being a BTC mid-cycle correction better than most before it.