NIRP & Great Monetary Inflation – Buy Gold & Bitcoin - Tudor Jones

News

|

Posted 08/05/2020

|

21180

Over the last 2 days we have taken a journey through time on economic empires and credit cycles. Fittingly last night delivered the perfect tail piece to a journey looking very much like a cyclical end being imminent.

NIRP & Great Monetary Inflation – Buy Gold & Bitcoin - Tudor Jones

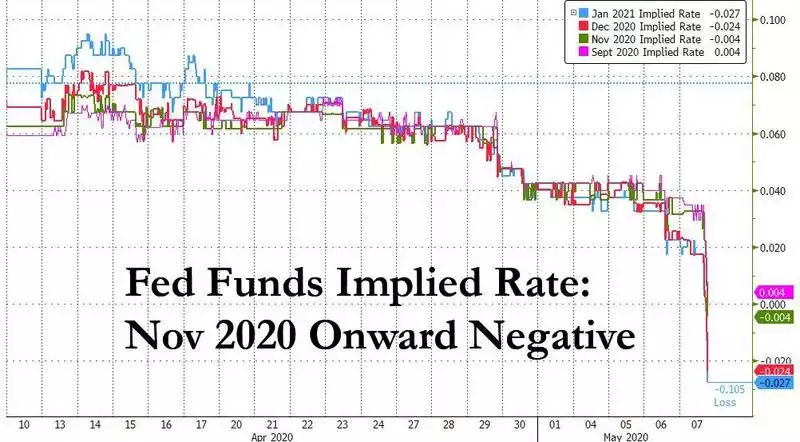

Having effectively gone to zero interest rates and printing more money, faster than ever before, the question of whether the Fed will takes rates negative hangs large. Last night Fed funds futures markets priced in negative interest rates in the US by November this year and on a trajectory to see even September contracts signal the same.

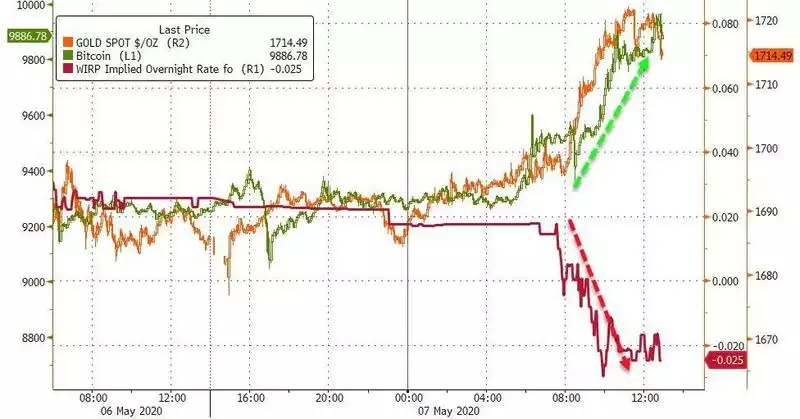

That sent the USD down and bonds, bullion and bitcoin surging as market participants see exactly the terminal signals that Ray Dalio talked to yesterday. Both 2 year and 5 year US Treasury yields hit their lowest level in all history (as the respective bond prices surged). Gold jumped $38 (2%) and silver 57c (3.8%) in USD but the stronger AUD reduced those gains locally to 0.5% and 2.2% respectively. Bitcoin jumped to just under $10,000 ($9954 at time of writing) up around 7% (4.4% in AUD). A picture paints a thousand words:

As Wall Street giants come, few are bigger than Dalio, but another highly respected player is billionaire Paul Tudor Jones who formed and manages the $38 billion hedge fund Tudor Investment Corp. So what does he think about the current situation? From Bloomberg last night:

“By his calculation, $3.9 trillion of money, the equivalent of 6.6% of global economic output, has been printed since February.

“It has happened globally with such speed that even a market veteran like myself was left speechless,” Jones, 65, wrote. “We are witnessing the Great Monetary Inflation -- an unprecedented expansion of every form of money unlike anything the developed world has ever seen.”

The question for a macro investor like Jones was how to hedge. He said he considered various bets on gold, Treasuries, certain types of stocks, currencies and commodities before recognizing a “growing role for Bitcoin.””

As Bloomberg points out, this makes Tudor Jones one of the “first big-name investors to embrace crypto”. He is putting his money where his mouth is too, revealing his Tudor BVI fund “may hold as much as a low single-digit percentage of its assets in Bitcoin”.

Whilst also backing gold and treasuries as a hedge against what he says is a similar set up to the 1970’s, he told his clients “Bitcoin reminds me of gold when I first got into the business in 1976,” and “The best profit-maximizing strategy is to own the fastest horse,” and “If I am forced to forecast, my bet is it will be Bitcoin.”

From Bloomberg:

“Jones first dabbled in Bitcoin in 2017, doubling his money before exiting the trade near its peak at almost $20,000. This time, he said he evaluated Bitcoin as a store of value and decided it passes the test based on four characteristics: purchasing power, trustworthiness, liquidity and portability.

“I am not a hard-money nor a crypto nut,” he wrote. “The most compelling argument for owning Bitcoin is the coming digitization of currency everywhere, accelerated by Covid-19.”

Tudor Jones is of course also bullish on gold which he predicts will rally to US$2,400 and US$6,700 “if we went back to the 1980 extremes.”

We are now only days away from the much anticipated Bitcoin halving. We explained the price mechanics here recently. To celebrate the halving we are offering Bitcoin today at just 2.5% above spot until 4pm AEST. Ainslie Wealth allows you to buy BTC in a uniquely easy and secure way. Our OTC (‘over the counter’) service allows you to deal with a human, lock in the price and then pay through simply paying your invoice via a bank transfer for the full amount. No depositing funds, waiting, and then operating an exchange, you can call us on 1800 987 648 and place your order or buy online and know exactly what you are getting ($2000 minimum). We then offer those who can attend our store, an unhackable Ainslie Crypto Wallet to store your BTC. Otherwise set up your own wallet and we simply transfer the BTC to your supplied wallet address or have a cold storage with Ainslie.

On the metals front, we have plenty of gold stock available now across all sizes. There are still a number of silver lines available for immediate delivery and most of those with ‘delayed delivery’ are arriving at the end of next week.

To learn more about BTC we were proud to support the release of this new film which gives a great unbiased journey through the Bitcoin story and has just qualified for the Academy Awards. Click here to watch this excellent production https://cryptopiafilm.com/