New All Time High Portends Trouble Ahead

News

|

Posted 14/02/2018

|

7127

Yesterday we discussed the projected increases to the already record high $20.7 trillion US government debt. But it’s not just the government employing the “hope” strategy…

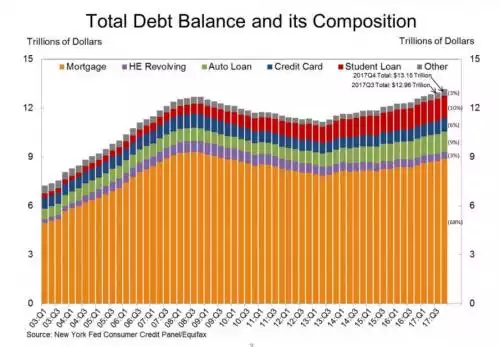

Yesterday, courtesy of the NY Fed, we saw personal debt in the US hit a new all-time high of $13.15 trillion after rising $193 billion in the last quarter of last year, or 1.5% in just one quarter!

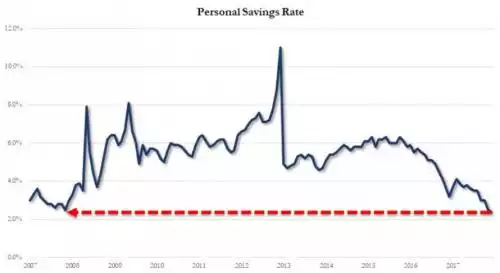

After the GFC people saw the dangers of debt and deleveraged and saved. Now that ‘everything is awesome’ again, they are back into the debt binge and savings have hit a near all time low. Savings haven’t been this low since, you guessed it, just before the GFC when everything was awesome too….

Now some of this may be voluntary (nothing can go wrong so let’s borrow and party and pay it back later with my bigger salary courtesy of tax cuts back to what my employer was actually paying anyway), and some may be involuntary (stagnant wage growth, rising real world inflation, I need to borrow to survive). Either way it is happening at a time when inflation (even the manipulated official figures) and interest rates are on the rise. In other words costs will go up and the cost of servicing the interest on all that debt will go up.

The thing is, history has a habit of repeating. The system can only handle so much debt. As more and more ‘pretend’ money inflates the system causing bubbles everywhere, it may be prudent to reassess how much real money you hold before the next ‘pop’. That’s REAL money, like for instance, gold and silver that has been around for 5,000 years and seen and survived these monotonous cycles time and time again.