Moving From ‘Synthetic’ to Physical Gold Price

News

|

Posted 13/07/2015

|

4111

The Tocqueville Gold Strategy Investor Letter has a vast following and the 2nd Quarter 2015 one just came out and is posted HERE. It’s quite a brief one this quarter but topically given the epic set up of speculative shorts on COMEX at the moment and its effect on keeping the US spot price low amongst Greece and China, they had this to say:

“Gold is migrating to Asia in vast quantities. What this means is that that the power of synthetic gold trading on Comex and OTC transactions in NY and London to influence metal prices could be ebbing. Synthetic gold is traded by algorithmic and HFT strategies in which no gold actually changes hands, only paper derivatives connected notionally to physical bullion. The well documented disappearance of bullion from Western vaults means that credit required for transactions in synthetic may become increasingly difficult to obtain. China has built a market infrastructure in the form of the Shanghai gold exchange and will soon initiate gold fixes in renminbi that will be backed by physical gold, unlike Comex. We believe that the Chinese intend to use physical gold in partial settlement of cross border trade transactions to bypass the US dollar. These developments will eventually in our opinion make Western synthetic gold trade less influential in determining bullion prices.”

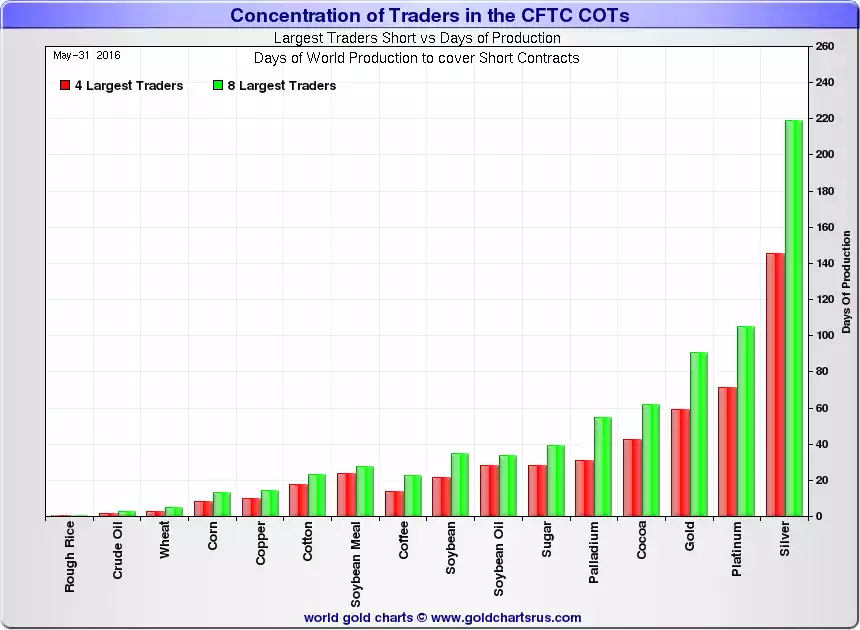

We recommend reading the article in full. Silver is arguably more ‘synthesized’ as captured beautifully in the following chart which puts the size of these futures short contracts against days of production for the ‘metal’ traded. The trades dwarf what is physically available – so if things deteriorate in markets and someone actually asks for metal the whole thing explodes. This graph puts that into perspective even more so. Do you have your real stuff?