More Stagflation & Recession Signals

News

|

Posted 01/04/2022

|

7563

On Monday and Wednesday we stepped through the setup for stagflation in the US, the now ‘baked in’ recession to happen soon and how various assets perform in that environment. We shared preview charts from the highly anticipated In Gold We Trust annual. To address any view things may have changed, overnight we saw more new evidence emerge with the Fed’s preferred inflation measure being released and confirmation spending is dropping.

The Fed’s preferred measure of inflation is the so called Core PCE Deflator which was expected to rise from 5.2% to 5.4% in February. However the actual print was a whopping 6.4%. For context and per the chart below, that is easily the highest print since 1982 AND is before the effects of the Russian invasion! Until the GFC, the 1981-82 recession was the worst since WW2. In 1981 CPI hit 28.9%, from below you can see Core PCE hit nearly 12% and unemployment hit 11%. The Fed hiked rates right up to 20%. Today’s Fed response is 1/10th that…

Inflation normally means people buy stuff now in fear of it being more expensive later. Its why they hate deflation as it means people don’t buy now which means consumer spending, a massive part of GDP, falls and a recession ensues PLUS they can’t simply inflate away all the debt. But last night, and as discussed on Monday, more stagflation fears were reaffirmed with US spending dropping 0.4%. High inflation and poor growth (stagflation) is their worst nightmare.

Reality is starting to bite…

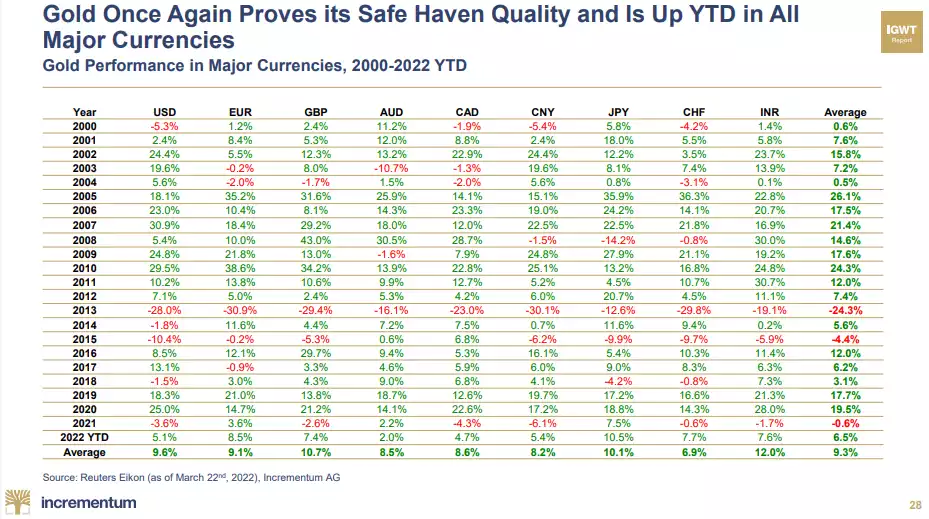

It is no wonder then that gold, despite this recent partial retracement from the mid March highs, is still performing admirably this year. The table below shows its performance in various currencies since the turn of the century.

There are essentially two camps for gold. Those that buy it as ‘insurance’ to balance their portfolio, and those that buy it expecting to make an outsized capital gains given the economic set up. Both are valid philosophies. What the table above reinforces is that, unlike traditional insurance, you are getting better annual returns than most assets as well!

You will note the AUD returns are one of the worst as our dollar has gone from 50c to $1 (in 2012/13) albeit now back to 75c against the USD. What hasn’t changed amid all that fiat currency FX fluctuation is the amount of gold you hold and a still fat capital gain dividend as you sleep well at night knowing real money, amid the biggest debt inducing currency debasement experiment in history, always prevails.