More Falls Ahead for Housing and the Banks

News

|

Posted 10/07/2018

|

6817

One of Australia’s biggest banks has back-flipped on a previous prediction that housing prices were going to pick up. In a research note published recently, ANZ Bank has warned the steady decline in the country’s housing prices isn’t only going to continue, but the pace of the decline is going to pick up. ANZ senior economist Daniel Gradwell said the “weakness in Australia’s housing market has persisted longer than we expected, and the rate of decline in prices has recently accelerated”. Mr Gradwell attributed a number of things to the fall in housing prices, including the shift away from interest only loans and tightening on credit in the wake of the royal commission.

Those changes in customer behaviour suggest “the fall in house prices will be quite a bit larger than we previously expected, with recovery coming later,” Mr Gradwell said. In the past 10 months, nine of those have seen lower housing prices, according to CoreLogic data.

In the wake of the banking royal commission, where dozens of Australians spoke about being given loans they were not in any position to pay off, banks are expected to tighten their lending standards.

Mr Gradwell said it was the landmark royal commission, which has directly impacted the availability of credit, that was the “primary driver” behind the slowdown of housing prices. Australia’s home building boom also appears to be running out of steam, which is seen as a direct reaction to the nation’s housing price downturn. On an annual basis, housing prices are in reverse for the first time since 2012.

Although a lot of attention has been paid to the impact of the royal commission, in reality the home lending super cycle is coming to an end for multiple reasons, including:

• wage growth is historically slow

• interest rates have bottomed and households know it

• the prudential regulator APRA has increased the amount of capital required to be held against mortgages and constrained growth in investor and interest-only lending

• banks have less tolerance for high loan-to-valuation ratios

• banks are avoiding lending to owners in oversupplied postcodes

• banks are exercising more scrutiny of the expenses and other liabilities of mortgage applicants

• the house price boom in Sydney and Melbourne is over, deterring speculative investment.

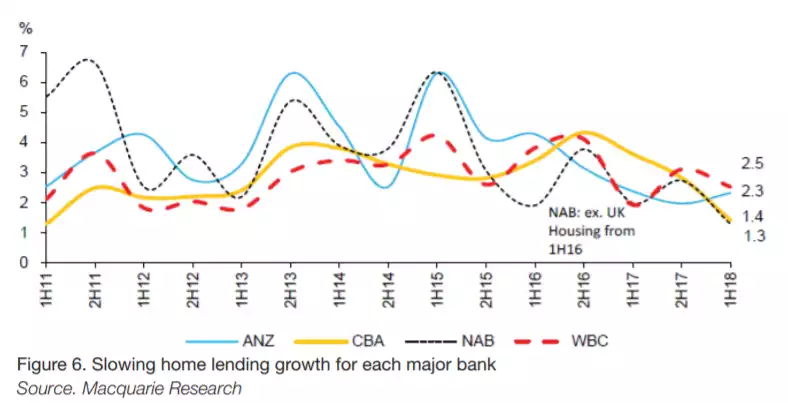

As recently as last month mortgage lending by the banks was growing as fast as 6% p.a. on a 12-month basis, but the banks themselves forecast a further slowdown to 4%. APRA, other financial regulators and the government do not want to completely stop growth in the supply of credit, but they do want to limit the build-up of further household leverage, as today’s record household gearing would force borrowers to cut spending heavily if an external shock were to hit the economy.

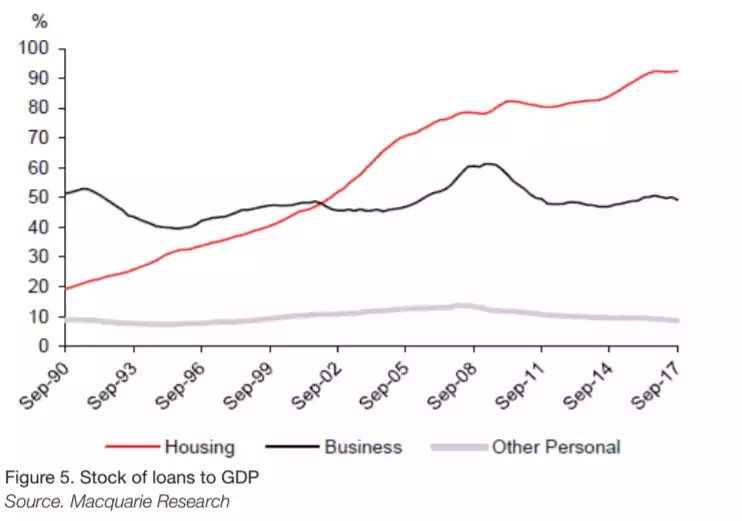

Over 27+ years, housing lending has trended higher to an extraordinary 90% of GDP, so this important revenue driver for the banks has far less growth potential than before.

The analysis presented paints a negative picture for the property market ahead, but also for the banks and their future profitability. If borrowers’ ability to access credit is reduced, and the longest sustained rise in history for housing prices is now over, then the time may have come to reposition portfolios away from the ending cycle and into an emerging one.

On that note, we leave you with one last chart that shows how gold may have only recently resumed it’s long term bull trend.