Margin Debt – Early Warning Sign

News

|

Posted 19/02/2016

|

5374

Yesterday we wrote about how history indicates spiking junk bond yields are an early warning sign of a financial crash. Well another early sign is when margin debt on shares comes off new highs.

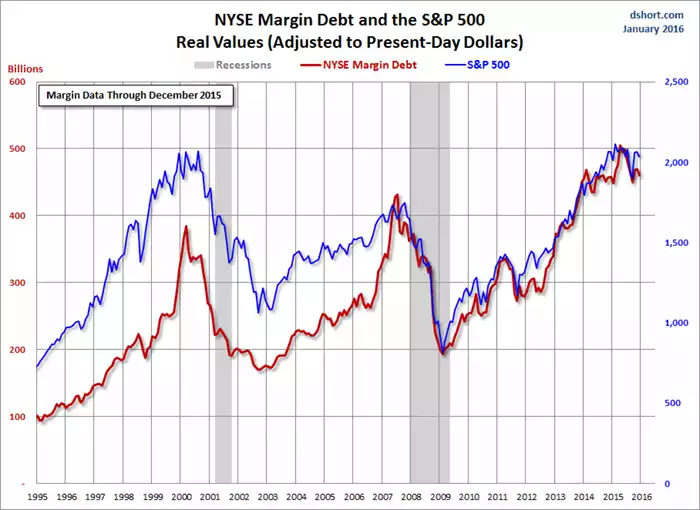

Just as zero interest rates fed speculation into junk bonds so has it fuelled margin lending into shares. Indeed as can be seen in the graphs below, despite the very apparent lack of fundamentals and various over valued metrics, margin lending into shares is at an all time high.

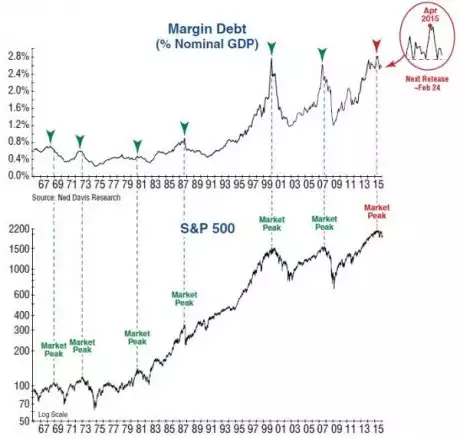

The next chart shows it as a percentage of GDP and zooms back to show the incredible correlation before every market crash and that time when margin debt falls quickly after peaking to a new high. The chart doesn’t capture February but check out the zoom in on February below.