Make America “Broke” Again

News

|

Posted 18/04/2017

|

5778

So Trump was going to cut spending and make it all “great again”…

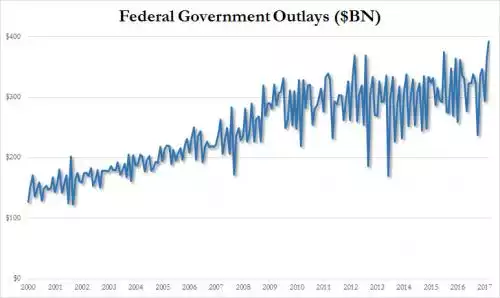

Just a couple of months into his presidency and the March monthly budget statement saw a record amount of outlays, some $393 billion in one month. Now that wouldn’t necessarily be a problem if all that “greatness” saw incomes outstripping that record expenditure. But alas incomes actually plummeted in March, at only $216 billion and equating to a $167 billion deficit in just one month. The official deficit for the US fiscal year to 31 March stood at $527b, up considerably on last year’s $459b.

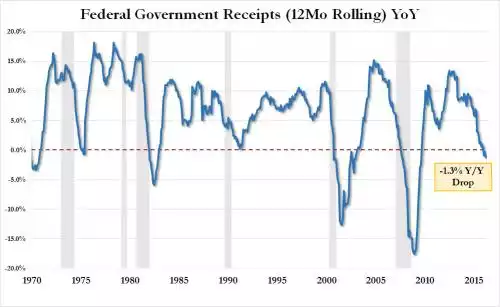

But the real concern is the rolling 12 month total of receipts which not only just saw its 4th consecutive monthly decline but the biggest drop since the GFC. Indeed if you look at the chart below you can see the shaded areas of recession have seen that same phenomenon.

Our Facebook followers saw a report via the Wall Street Journal over the weekend that points out the staggering scale of the interest on all their debt now, BEFORE interest rates really take off. For those who missed it, here is the link. In a nutshell however net interest payments rose $7b or 30% on last March.

Here’s a break up of that $393b

- Defense: $58 billion

- Social Security: 79 billion

- Medicare: $75 billion

- Interest on debt: $30 billion

- Other: $151 billion

You can see that interest is already a very big percentage. From WSJ:

“If that seems small, consider that interest payments rose $28 billion for the six months of fiscal 2017 to $152 billion. That’s a 22.2% increase, among the biggest in any single spending item highlighted by CBO. The increases reflect the growing debt but in particular the Federal Reserve’s decision to raise interest rates after years of near-zero rates.”, and

“This not-so-free Fed lunch is starting to end. CBO estimates that $160 billion more spending will be required each year over the next decade if interest rates are merely one percentage point higher than in its current projections. As interest rates rise, the Fed will also have to pay banks more to keep excess reserves parked at the central bank. After its latest rate increase in March, the Fed now pays banks 1% on reserve balances or about $20 billion a year, and that will go up.”

The other takeaway from the breakup above is the scale of social welfare and medicare, accounting for nearly 40% of outgoings. The Congressional Budget Office warn this is set to continue to increase as a percentage. We have often written of the fact that the US’s staggering $20trillion debt figure doesn’t include future commitments such as these as liabilities, as if they are just somehow going to go away. The trajectory of the expenditure depicted below speaks volumes of the Ponzi scheme that is the US debt situation, and indeed most western countries where politicians keep spending up to get votes at the expense of future generations. So far Trump is no different.