Loosey Goose Trump Lays Golden Eggs

News

|

Posted 18/05/2017

|

6802

Love him or loath him, you have to admit Trump is a ‘loose goose’ or, maybe more aptly, a ‘loose cannon’. Either way, uncertainty and unease follow wherever he goes and whenever he speaks.

Last night US shares had their biggest fall since his election, the Dow down 373 points and the S&P500 down 44 points, the USD fell, bonds surged and so did gold (up the same 1.8% that shares fell). The falls were reflected all around the world and Australia will surely follow today. Why? Because the Democrats are calling for Trump’s impeachment after the (sacked) Comey memo alleging Trump was forcing him to drop the Russian investigation regarding the also sacked national security advisor Flynn.

Simplistically this just creates uncertainty, but more fundamentally it casts very serious doubt about Trump’s ability to get the key reforms of health care, tax cuts, infrastructure spend, etc etc through congress as even his own Republicans are starting to distance themselves. There is no shortage of irony in last night being the biggest fall since the election. What happened straight after the election of course was a massive hope fuelled rally, all based on his promises of stimulatory reform. We’ve written ad nauseum about this and you know NONE of it has happened.

Context is everything and the context of this uncertainty is that we have financial and property markets at crazy bubble-like highs all around the world. Bubbles, if you will, looking for a prick. Many Trump haters might take that as a pun….

The reality is Comey is due to testify this time next week and we will possibly learn the truth. Now the truth may not be as juicy as some would like, and we could see a reversal of last night. If he confirms worst expectations however, hold onto your hats.

But, and this is a big but, this goes way beyond the Russiagate issue. President Loose Goose/Cannon is yet to deal with a hostile congress on his key promises, North Korea, the looming Debt Limit and a possible government shutdown, the implications of his trade restrictions on global markets (3rd ranking below), and of course the unknown unknowns…

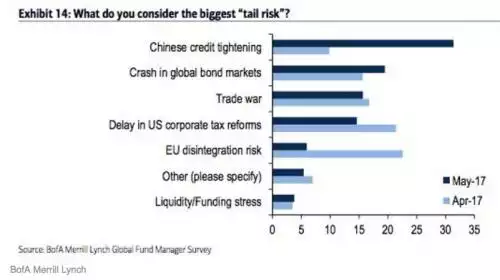

How a few days makes a difference too... Last week BofAML reported their Global Fund Managers worst fears (you will recall yesterday we shared their most overcrowded trades):

We’d like to see that survey done again now…. And that is the key point here. There are a host of uncertainties around now. Headlines change week to week but as we said, context is everything. Uncertainty in a stable environment is usually containable. Uncertainty (a myriad of ‘pricks’) flying around amongst so many over-inflated asset bubbles can only end one way. Bubbles go pop, you only know afterwards when that happens.

Check out Mike Maloney’s latest video “The Everything Bubble: CODE RED” that walks you through the abundantly clear warnings that this is close. Watch on our home page.