Liquidity “Danger Zone” v Gold

News

|

Posted 23/02/2017

|

5998

A clear indication of an overbought market is low liquidity levels in hedge funds. i.e. they are ‘all in’ with little cash in reserve to buy. The danger is simple. If there is a sharp market move to the downside (which is brought on by broad based selling) there is no one on the buy side because there is no liquidity to do that. That of course then leads very quickly to even bigger falls as there is no bid. To make things worse, hedge funds tend to buy a suite of the same shares as each other.

That is the scenario we currently find ourselves in per a Bloomberg report yesterday titled “Hedge Fund Liquidity Falls to Danger Zone in U.S. Stock Market”. Novus Partners Inc. calculate both factors at play, the liquidity ratio or index, and the amount of concentration in the same shares or ‘crowdedness’. From Bloomberg:

“ what if everyone bailed at the same time? To do this it [Novus] devised a hypothetical portfolio representing all hedge fund holdings and tried to quantify how much could be sold in 30 days.

Looking at equity funds with $2 trillion and limiting daily divestitures to 20 percent of a stock’s average volume, Novus calculated that the market could absorb only about 13 percent of the industry’s total holdings in a month right now. The measure, dubbed 30-day liquidity, has averaged 32 percent since it began tracking the data in 1999.”

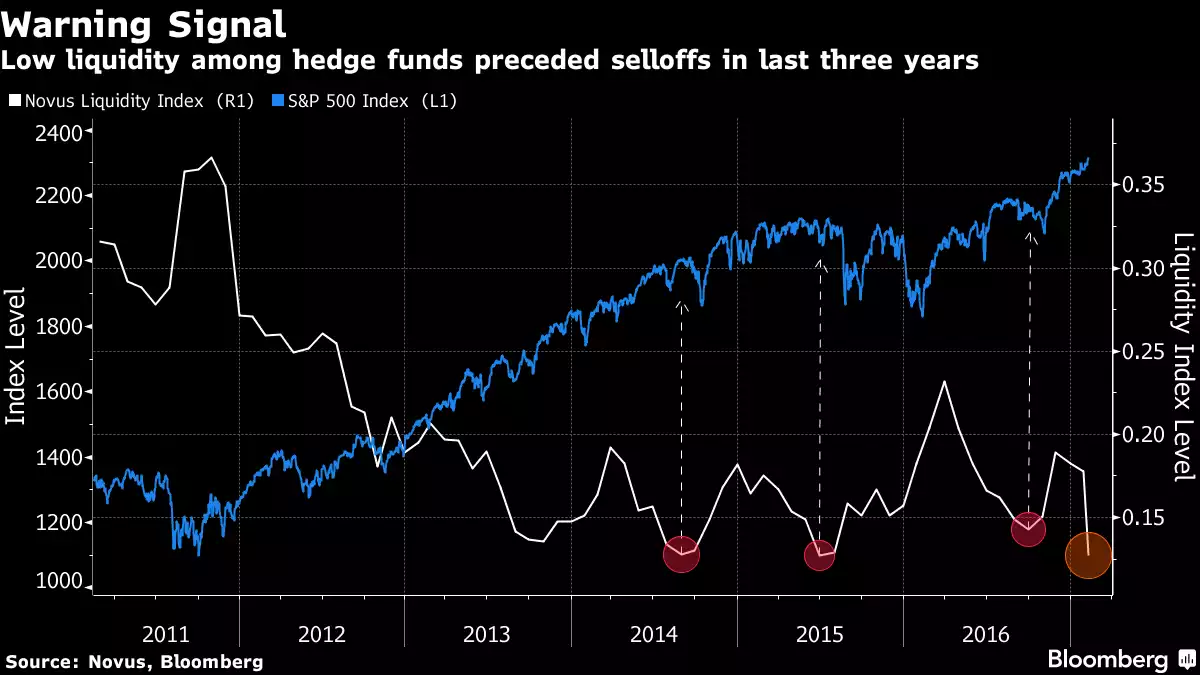

Per the graph below you can see it is at an historic low. You can also see quite clearly how each previous low over the last few years preceded a correction in the market by only a couple of months. Indeed the last time it got this low in July 2015, the S&P500 saw its biggest drop in 4 years just one month later.

To make things worse the following graph shows that the ‘crowdedness’ has reached an all-time record. So not only do they have very little liquidity, they are concentrated in the same shares like never before. That is a toxic mix. The previous cycle low in the liquidity index in mid 2007 preceded the GFC but was considerably less crowded….

As Novus said in the interview:

“When hedge funds get spooked about something and they all delever, there are going to be small pockets that get disproportionately hurt. Certain stocks are down 20, 40 percent with no apparent reason. Others catch the fear bug and start selling.”

It is worth ackowledging now that gold and silver can get caught up in such a broader liquidity squeeze too. That essentially happened in the GFC when everything that could be sold dropped en masse. Such financial market drops can trigger margin calls etc and people need to liquidate assets to pay up. Gold and silver are wonderfully liquid assets. But it was only fleeting and whilst shares halved over the course of the GFC, gold doubled. There are some out there suggesting cash is the only safe place to be. We’d argue they haven’t fully appreciated the implications of the G20 agreement on bail ins and possible capital controls if this gets really nasty. Sure you may be able to buy a ‘liquidity squeeze dip’ in gold and silver, but you may find it not so easy. As we often remind you, the size of the world’s financial markets is in the order of $300 trillion. The size of the ‘tradeable’ gold market is around $1.5 trillion. It takes but a small fraction of the former trying to get into the latter to see gold explode. How the physical market handles keeping up to that is the big question. Feeling lucky?