Krugerrands: The Iconic Vanguard

News

|

Posted 09/04/2021

|

5407

Krugerrands produced by the South African Mint have a certain lustre amongst metals investors due their pervasiveness throughout the bull market of the 1970s. They were introduced in 1967 to promote gold exports from their burgeoning mining industry, and enable everyday South Africans to invest in gold apart from the British gold sovereigns.

The South African Mint introduced the Krugerrands in 1967 as a 1.09 troy ounce unit (33.93 g). To improve durability, the coins contained 8.33% copper whilst maintaining a full troy ounce (31.1035 g) worth of gold. This level of purity is the same as the British gold sovereigns, known as ‘crown gold’. The coin is legal tender in South Africa, which has exempted it from import taxes in many jurisdictions. The coin holds no face value, thus is traded based on the prevailing price of gold.

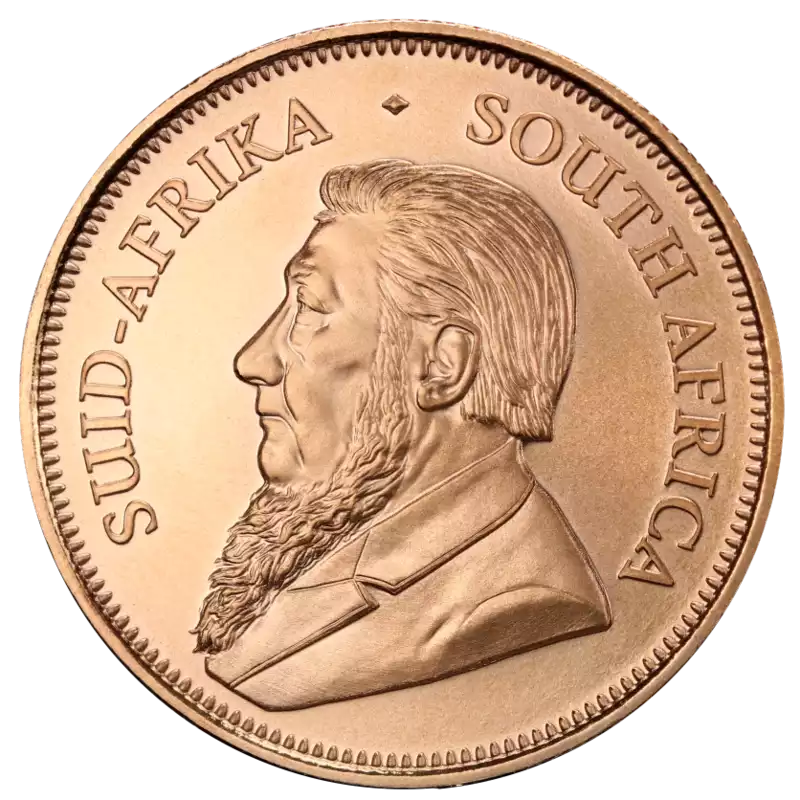

The obverse depicts Paul Kruger, the Boer statesman and former President of the South African Republic, and the reverse sports the Springbok, the national animal. The coin’s namesake is a blend of Kruger and the ‘rand’, the national currency of South Africa.

The recognisability and dependability of the coins made them an ideal investment vehicle for retail investors globally. They were so popular in fact, that by 1980 the Krugerrand was already the default choice for gold coins, representing approximately 90% of all trade. The introduction of the coins coincided with the 1971 closing of the gold window, and US citizens’ newly reinstated right to own gold in 1974. By 1984, over US$600 million worth of the iconic coin were being exported to the US.

The iconic Krugerrand was the first bullion coin produced by a national mint to introduce a distinctive national identity. The prominence of the coin the coin enjoys even today, is due in part to this first-mover advantage. Prior to 1967, coins struck by the South African Mint, and the other British descended mints produced gold sovereigns. In 1979 the Royal Canadian Mint introduced the Gold Maple Leaf, the first 24 carat gold bullion coin. This was followed by the American Eagles produced by the US Mint in 1986 and The Australian Nugget in 1987.

The alloy nature of the coin precludes it from being classified as investment grade bullion in Australia. As such it attracts GST for Australia purchasers. Shop for Krugerands online with us.