One Year On – COVID Responses Come Home to Roost

News

|

Posted 26/02/2021

|

5399

One year ago we had the first big financial market sell off on the back of COVID hitting ‘the west’ and the realization this thing was big and so setting of an unprecedented year. Last night saw the worst equities & bonds rout since March. 113m cases, 2.5m deaths and much of the world in lock down at various times and we finally have a vaccine and ‘hope’ creeping back into the market, winding up the spring, albeit arguably prematurely. But could that ‘sprung coil’ be the undoing?

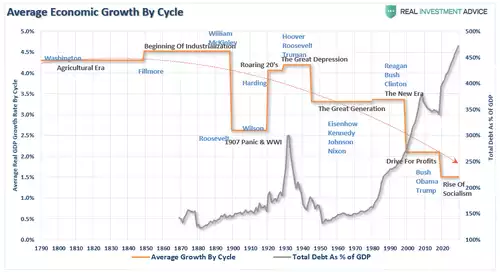

Part of what made this period so unprecedented was of course that tsunami of monetary stimuli being unleashed by central banks and governments around the world. The world’s two biggest western economies alone, the US and Eurozone, saw $6 trillion injected from those two central banks alone.

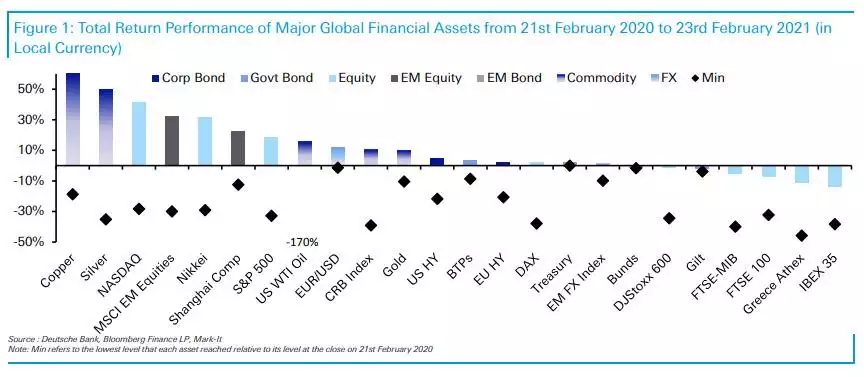

So where are we one year on? The chart below shows the total returns across a group of major financial assets over the year. You will note that silver was the 2nd best performer of the lot. Gold, given its gradual decline since August has moved from top performer to middle of the pack. Absent of course is Bitcoin, but mainly because a 396% gain doesn’t fit on the chart…

It is important to note the black diamonds, representing the minimums for each. You will see that gold had one of the best in the group, typical of a relatively stable safe haven asset. Most of silver’s gains have come in the back half of the year as well given it was late to the party.

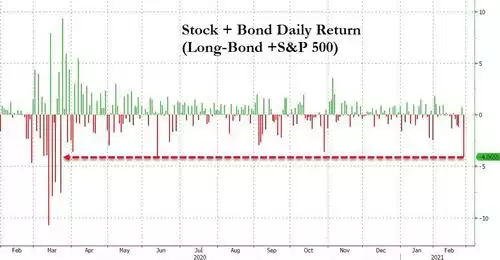

And here, one year later, we find ourselves at an incredibly important juncture in markets. Last night saw a bloodbath in both shares and bonds. Indeed it was, topically, the worst day for long traders in both since… March 2020 when things got particularly nasty on the COVID crash:

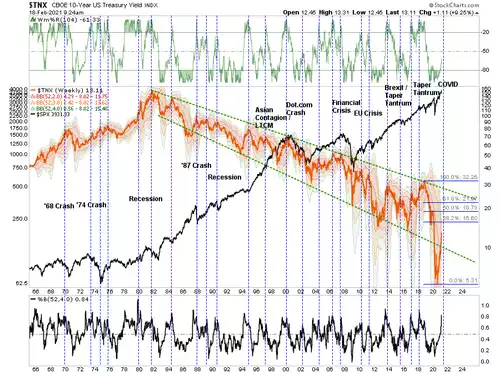

Part of what spooked markets last night was the worst 7yr US Treasury auction in 7 years, seeing prices plummet and yields spike to over 1.6% before ‘someone’ (Fed, cough cough) stepped in. This saw the all important 10 year yields spike, retrace but surge to hit that 1.5% mark some see as a line in the sand.

And so it would be no surprise that this all pushed gold lower and now below the USD1800 mark overnight as rising rates in the absence of equally rising inflation pushed real rates on the 10yr up, albeit still negative at -0.61%.

So should you be scared about gold? Well there are 2 rather sizeable elephants in the room that are very bullish for this being dip buying territory. First, the market is now getting very scared. The VIX, the Volatility Index, last night spiked higher to over 30. Gold loves a panic crash and the VIX is the canary in the mine.

Secondly, real rates are firming because inflation isn’t presenting YET. In an interview with The Telegraph, billionaire Pershing Square funds manager Bill Ackman, who called beautifully and made $2.6b in his credit market hedge trade before the March crash a year ago, is now placing a similar trade but this time in inflation instruments. From The Telegraph:

"We will see a spike in inflation as early as the middle of the year," Ackman said.

"It is already starting to happen. At some point if rates move enough than it becomes a market risk event."

"There is a finite amount of money we can lose which is not material to the fund and if we are right on rates then we make a lot of money," he added. "We want to protect ourselves against huge market-moving events. We look to buy insurance against disaster."

As we have been warning, the big driver is likely to be fiscal not central bank stimulus, namely Biden's $1.9 trillion stimulus package

“That is happening at a time when rates are zero, coupled with the psychological effects of being locked up for a year. That combination will lead to a lot of demand in the economy. Supply won't be able to meet that demand," he said.

He is particularly nervous about the high tech high growth shares that are so completely dominating the S&P500 now:

“In order to justify the high price of high-flying tech companies you need to have enormous continued growth and eventually have them generate profits," he said.

"The current level of interest rates mean that investors are willing to wait a long time for companies to generate lots of money. A move [higher] in interest rates is a big threat to growth companies."

Gold has long been a traditional hedge against inflation and the reason silver is currently shining already is that it brings that PLUS the impetus that comes with reflation expectations in such an environment combined with its specific industrial uses. This is a very bullish set up for silver in particular and at a time of various signs of tightness already existing in the physical silver market.

Financial markets have taken comfort to date that the Fed will somehow save the day. They are clearly starting to have doubts. Lance Roberts sums this all up beautifully:

“What should be clear is that if the rise in interest rates approaches 2% or higher, there are many problems embedded in an economy laden with nearly $85 trillion in debt.”

“The debt problem exposes the Fed’s most significant risk. Given economic growth remained elusive over the last decade, it is unlikely doubling the Fed’s balance sheet will improve future outcomes. The failure to recognize the impact of ongoing monetary policies, given a decade of experience of surging debt and deficits inhibiting organic growth, is problematic.”

“The US economy is literally on perpetual life support. Recent events show too clearly that unless fiscal and monetary stimulus continues, the economy will fail and, by extension, the stock market.

However, the Fed currently has no choice.

Such is the consequence, and problem, of getting caught in a “liquidity trap.”

What the average person fails to understand is that the next “financial crisis” will not just be a stock market crash, a housing bust, or a collapse in bond prices.

It could be the simultaneous implosion of all three.

Whatever causes that change in sentiment is unknown to me or anyone else.

I am not saying with certainty it will happen, as I hope sanity prevails and actions are taken to mitigate the consequences.

Unfortunately, history suggests such is unlikely to be the case.”