July’s Macro Insights for Gold

Insights

|

Posted 16/07/2018

|

6454

Eric Pomboy of Meridian Macro Research gave some interesting insight into Gold and why it currently stands poised for an upward breakout in his latest July update. A snapshot of his key charts and findings are highlighted below.

The long-term trend remains up

The first chart highlights that although gold has been down over recent months, key long term levels have no been broken, clearing the way for a continuation of the established trend higher.

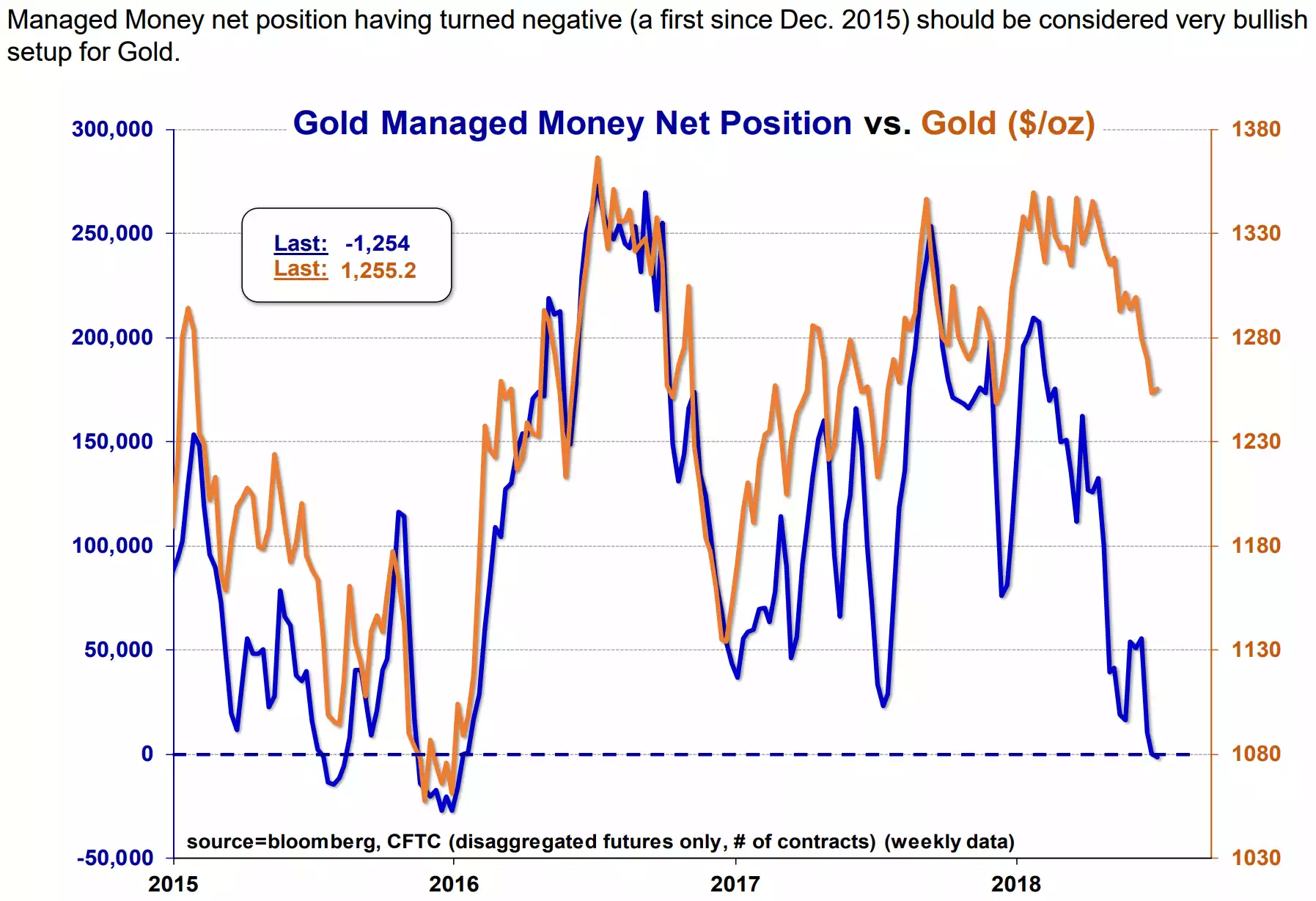

Gold managed money has turned net negative

The recent negative reading on the net position of managed money has been a reliable indicator of bottoming periods for gold in the past.

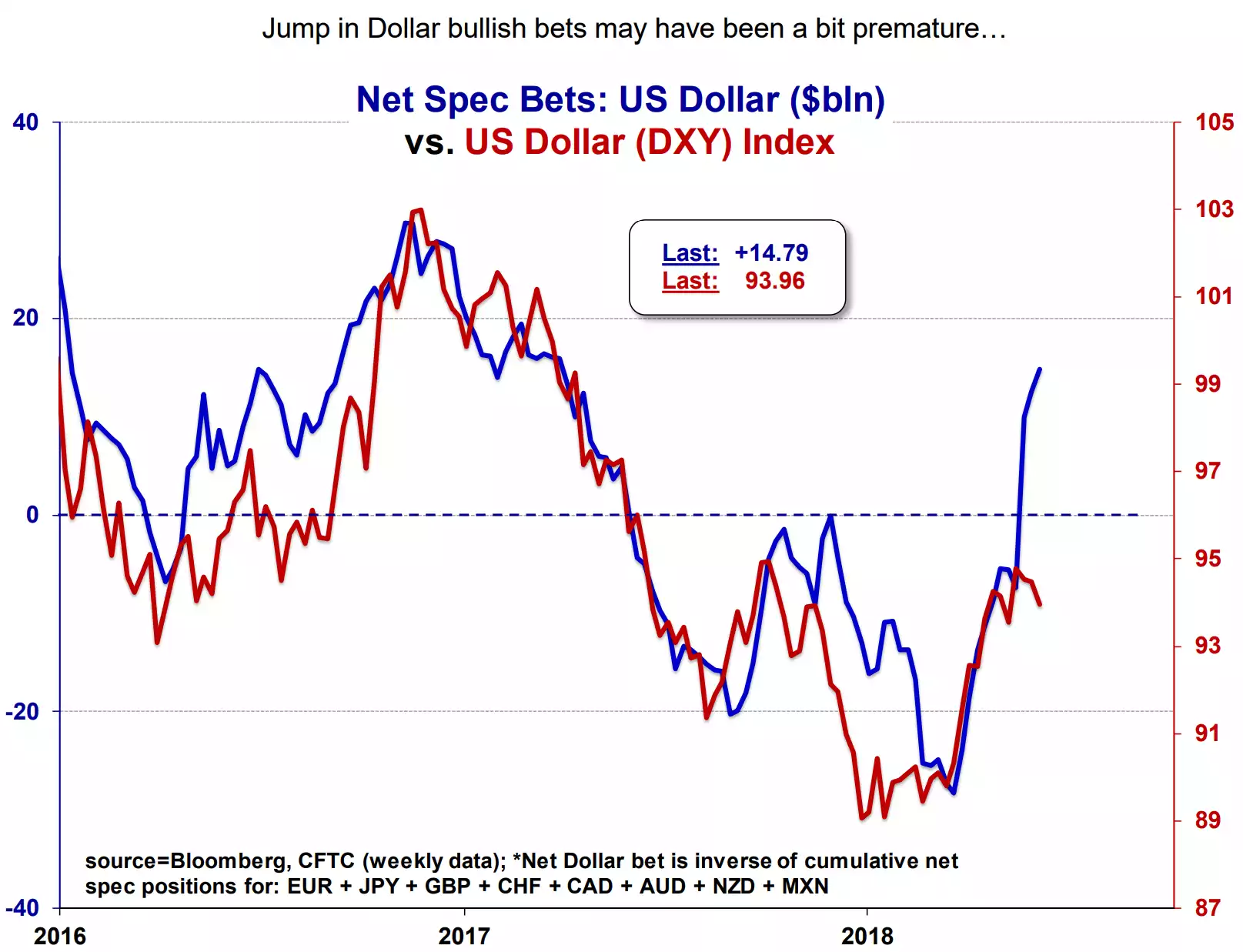

The USD bulls may have gotten ahead of themselves

The strength of the USD recently may be coming to an end and a weaker dollar would set the stage for gold’s next leg higher. If the dollar’s rise over the past few months has run its course then it would look to resume the downtrend which began in January 2017. Such strength in conviction by the long speculators is a strong contrarian indicator to expect weakness ahead.

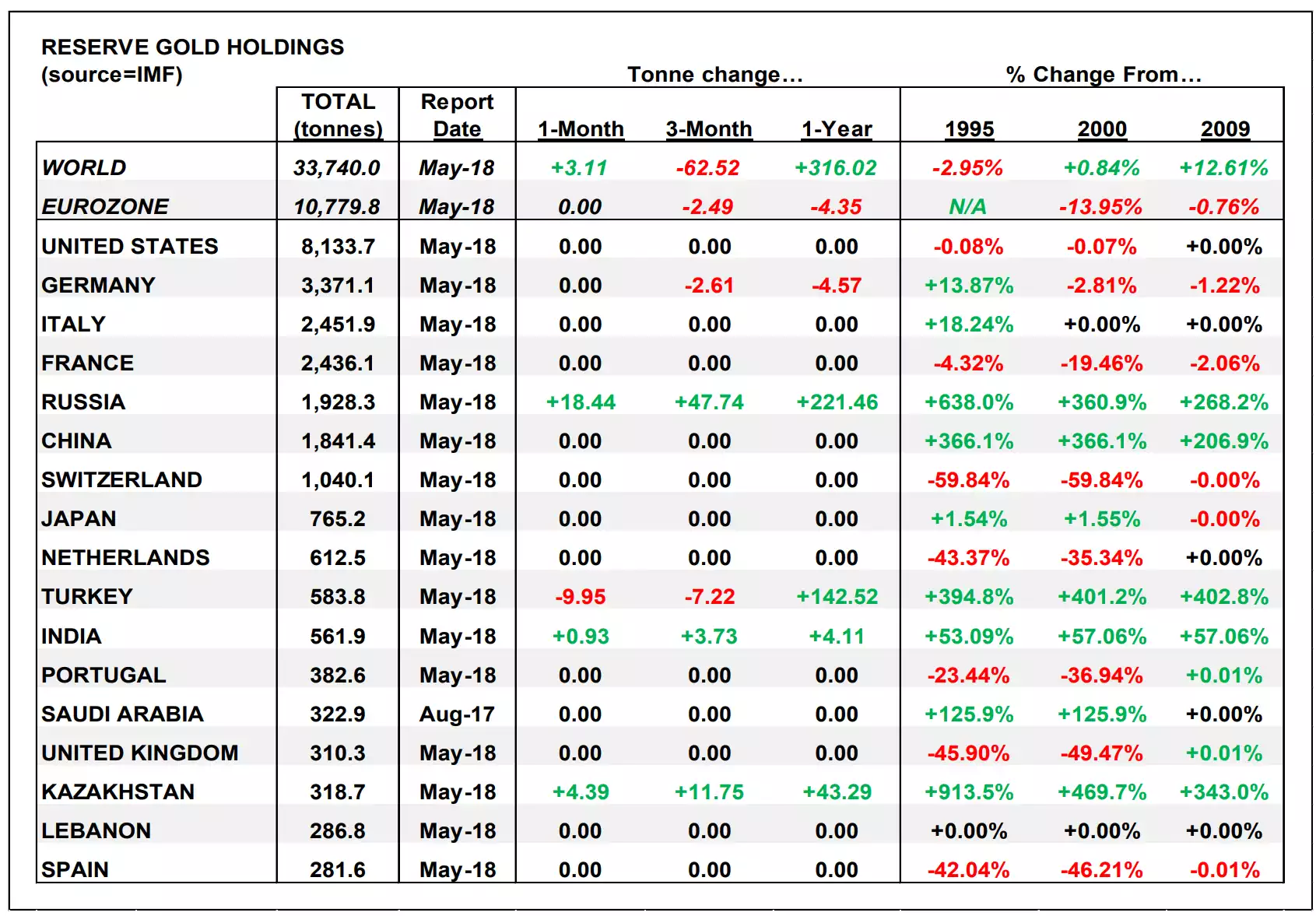

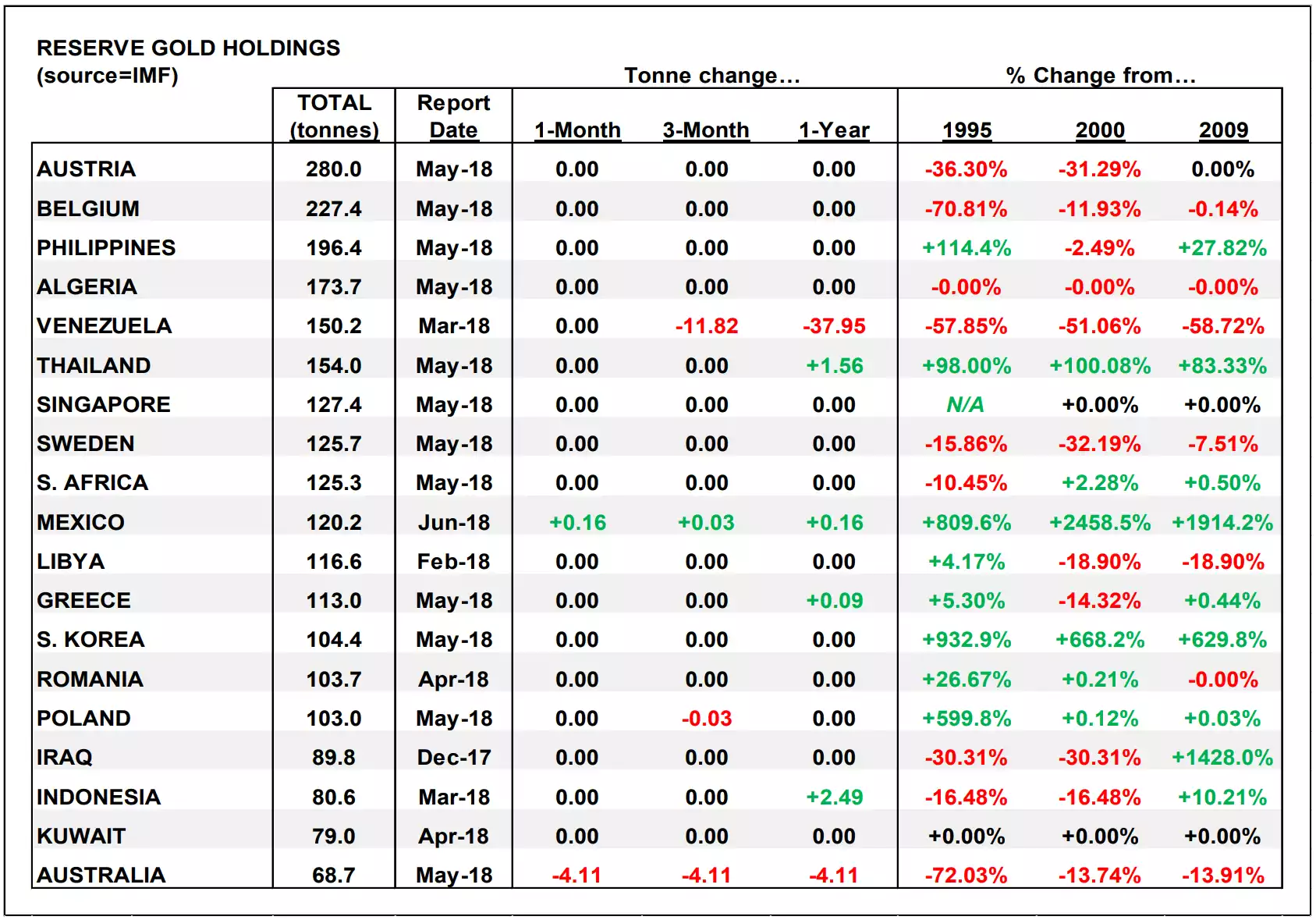

Global central bank accumulation of gold continues in key countries

Finally, the latest updates of reserve gold holdings paint an interesting picture of positioning by countries attempting to back themselves with the security of gold. Some substantial increases over the past decade (since 2009) as well as significant gains in the past 12 months are notable and worth a closer look.