Juerg Kiener: Gold ‘bargain of the century’ at current spot levels

News

|

Posted 27/04/2022

|

7309

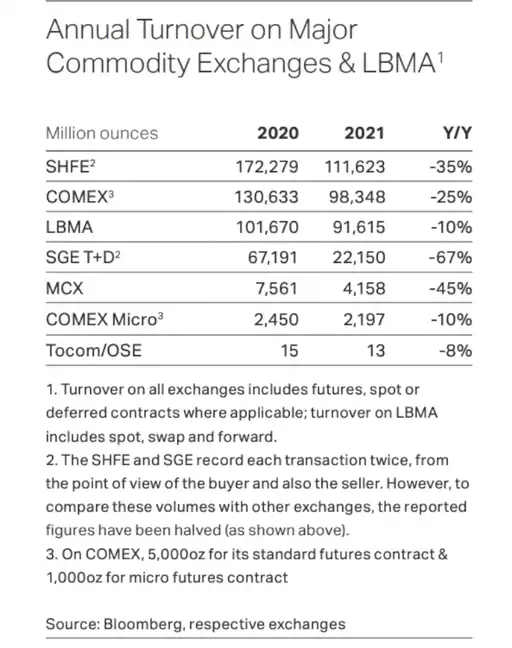

Speaking on Bloomberg Asia, Founding Partner at Swiss Asia Capital Singapore dropped a number of bombshells in the live interview. In a case of the ‘tail wagging the dog’, outsized silver futures and options leverage outnumber the physical metal more than 100:1!

The futures market was initially conceived as a way for users of the physical to hedge risk and maintain a consistent cost-basis. Keiner points out that the price of the actual physical is defined by movements in the derivatives market, as opposed to the actual physical trade ‘on the ground’. In his analysis of the supply demand fundamentals on the ground, supply levels haven’t been this low in 20 years. This is leading major industrials to seek out direct agreements with miners and refiners to guarantee their own supply, as opposed to purchasing on the open market. As we covered in the news last Friday, the supply deficit is the largest in 20 years.

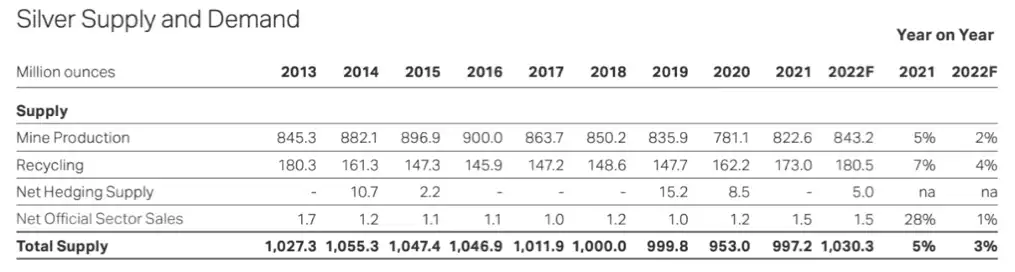

As per the Silver Institute’s supply and demand report, there were just over a billion troy ounces of silver mined in 2021 - 1,030,300,000 (see below).

In contrast, in 2021 there were more than 325 Billion ounces traded across the various derivative and options exchanges globally. That’s a rate of approximately 325:1 for all derivatives traded to the supply produced in 2021. Clearly price discovery is happening on the paper market.

Base metal inventories are quickly running out despite increasing global demand. Zinc in particular is seeing smelters shut down at a time when inventories are already low. The biggest byproduct of zinc is none-other than silver. Pure play silver mines outside of Latin America have already been shuttered, and now the byproduct supply is also being constrained. As silver is essential to strategic applications such as the energy grid, military hardware and green technologies, people are focusing increasingly on ‘physical’ silver, as opposed to the ‘paper’ metal. We may have seen a window into the future with the Nickel price blowing up on the LME (London Metal Exchange) and the LME announcing they will be exiting the precious metals futures market by July. The cracks are appearing…

Finally, of all the metals markets, gold at present spot prices is the bargain of the century, as $5-figure gold will be needed to stabilise global markets in a new currency realignment. Keiner argues that Putin has booked price support around the US$1920 level. If this really is the bottom, there is reduced risk for investors who want protection in a period where safe-haven demand is likely to continue to rise.

Silver and gold are both in backwardation, the rates charged for taking delivery from ETFs is rising, and when delivery does take place, the wait time for large quantities is ramping up. Speaking from Singapore, Kiener argues that very little gold is coming onto the market in physical form, as it goes straight into the treasuries of BRIC countries.

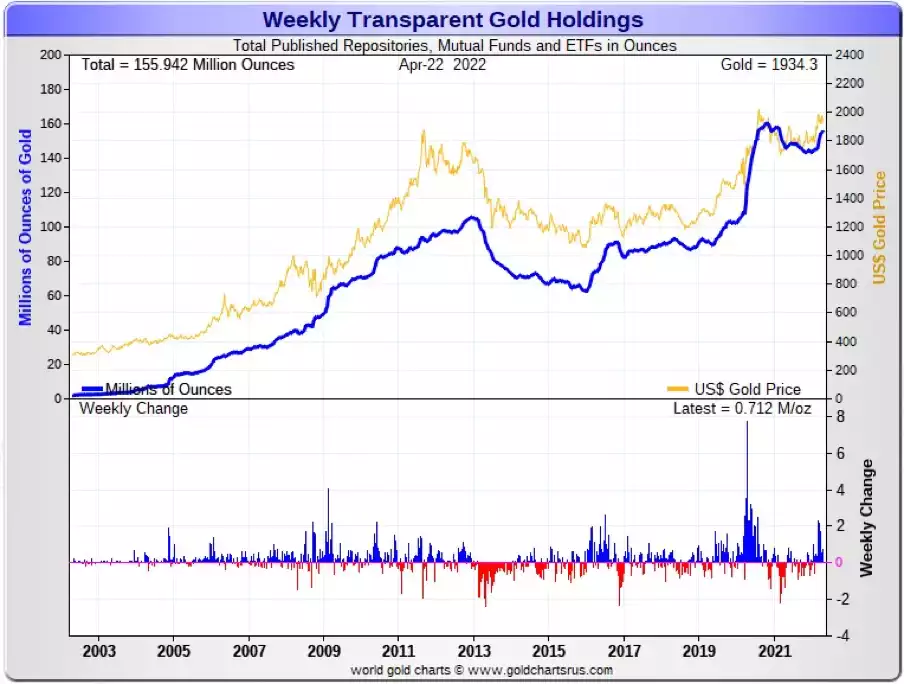

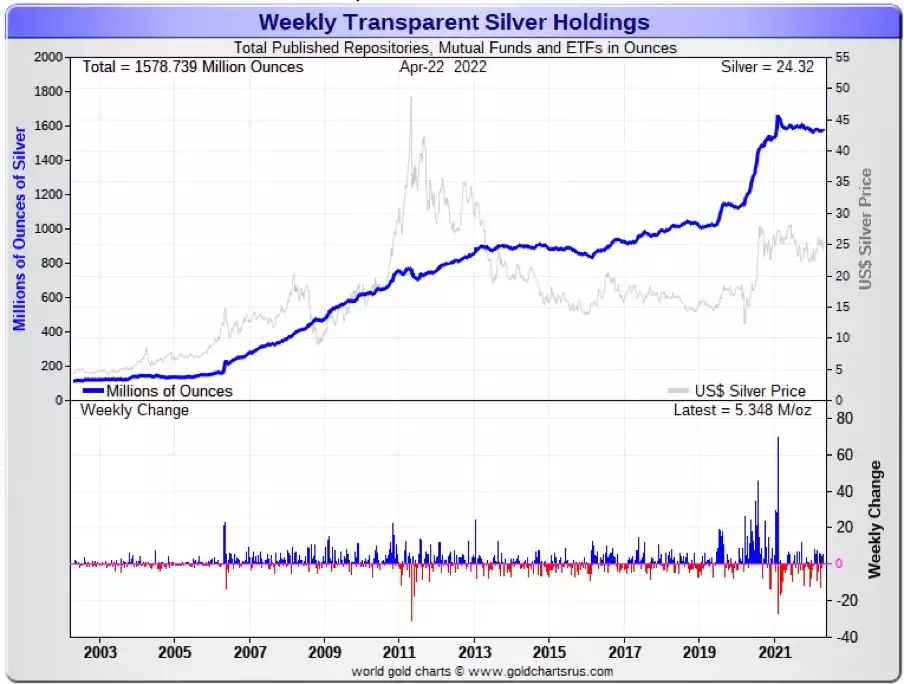

That said, the physical metal is still piling into investment depositories. In just the last week there was a net 712,000 troy ounces of gold a net 5,348,000 troy ounces of silver added to all known depositories, ETF’s and mutual funds..