Japan on the precipice

News

|

Posted 15/06/2022

|

7504

The Japanese yen is down to 135 yen to the dollar from 127 earlier this month as the Yen is starting to crack. Against the US dollar, this is the weakest yen in 24 years. The Japanese central bank issued currency tumbled along with Japanese bonds and their stock market yesterday. This flies in the face of Kuroda’s usual talking points that a weaker Yen is good for the overall economy and stocks.

On Monday, a poll conducted by Kyodo News revealed rising discontent with 64.1% of respondents seeing the response to rising prices of food and other daily necessities as inadequate. A separate poll found that 77.3% of Jpaanese have had their daily lives affected by higher cost of living pressures and 71% said they’d take those costs into account when next voting. In response, BoJ Governor Kuroda asked consumers to become more “tolerant” of price hikes. He quickly retracted the statement but the damage appears to be done with now increasing calls for a new Governor to be elected in the coming months. A majority of public respondents (59%) see Kuroda as unfit to stay at the helm of the Japanese Central Bank.

The Bank of Japan (BoJ) announced in April that it had an unlimited bid for the 10-yr JGB (Japanese Government Bonds) at 0.25%. Their grip appeared to loosen yesterday as rates spiked to 0.31%. This was the highest rate on the 10 year since early 2016. Daiwa Securities chief market economist, Mari Iwashita, stated “The BOJ will now need to explain clearly what is the logic behind the 0.25% cap and whether that level is appropriate under the current environment”. The Bank of Japan may be able to maintain the yield curve, but they are increasingly sacrificing the purchasing power of the Asian power in the process.

BoJ Governor Haruhiko Kuroda has responded to the break out of the upper rate bound with an announcement of bond purchases worth 500 billion yen (US$3.71bn) to hold the rate in place. One wonders how high rates would jump if they weren’t being controlled by artificial fiat creation.

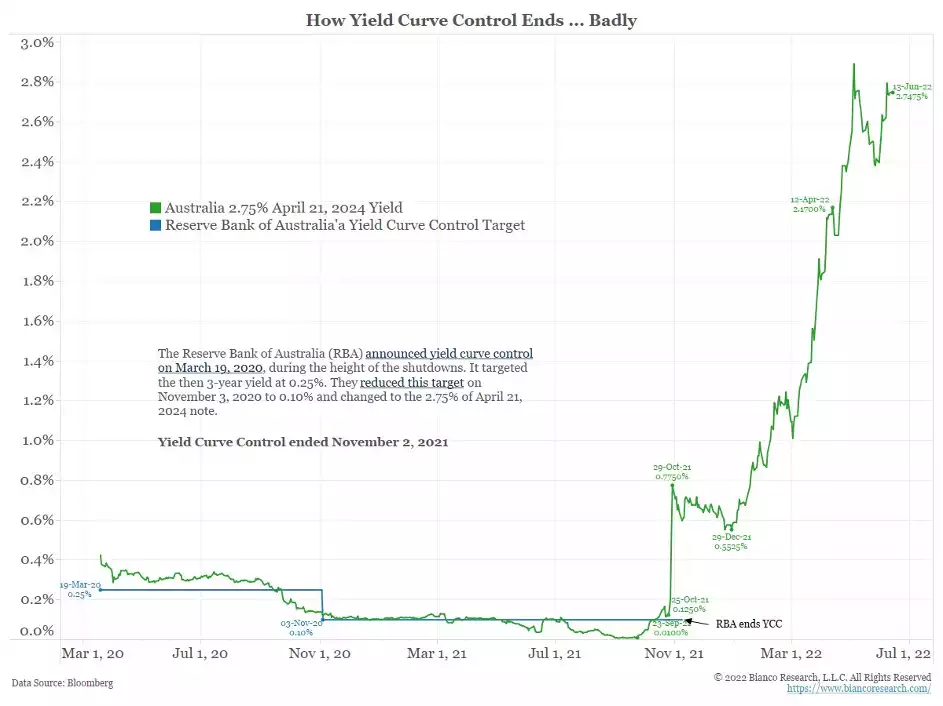

They are far from the first country to engage in yield curve control. Australia’s RBA higher bound limit of 0.125% on our 10 year bonds broke in late October of 2021.

Source: Bianco Research

In other news, European bonds are also spiking. The following chart shows the 10 year debt of Italy, Portugal, Spain, Ireland, France and Germany in 2022. As a reminder, rates going up show that investors perceive greater risk of default/devaluation and as a result need more return to justify the risk in lending. Incidentally, the primary buyers of most European bonds is the ECB. A bit like the left hand lending to the right hand.

As countries that have engaged in zero-interest rate policies (ZIRP) and even NIRP, QE and even purchasing stocks as Japan has, the Modern Monetary Theory endgame appears to be rapidly coming to a head.

Citizens across the globe are seeing the purchasing power of their salaries and savings evaporate as goods and services are limited. Fiat currencies are centrally controlled, gold and silver are stores of value outside of government control.