It’s Official! – 2nd Longest US Expansion in History

News

|

Posted 02/05/2018

|

7185

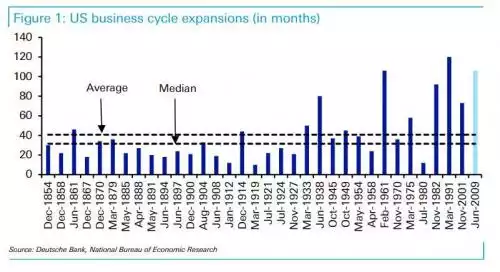

As we enter May we also enter the history books as the US is now in its second longest economic expansion in history. Over 164 years of data there have been 34 business cycles spanning between recessions.

The current cycle, since the GFC, is now 107 months old, beating only the 1990’s expansion that ended with the dot.com bust. Never before have any of the previous cycles seen such artificial monetary stimulus from central banks, so in a sense none previous have been so tenuous in their substance. That stimulus is coming to an end now.

You will note too the above chart from Deutsche Bank shows the last 4 expansions have averaged nearly double the historic median begging the question “is this era different”? Deutsche Bank explain their theory of why:

“The global labour force has naturally surged since 1980 with China deciding to integrate itself into the global economy at almost the same point. China thus dumped an additional billion of low paid labour on the world. This has helped structurally depress global wages for three and a half decades and meant that policy hasn’t needed to be tightened as early in the last four cycles as through most of history.”

However they believe that structural change to the global labour market has peaked and we will see a new phase of socio economic demographic challenges and ensuing wage and inflation pressures, leading to their closing conclusion..

"So the days of super long business cycles may be over so enjoy this one while it lasts."

Now one could either relax, enjoy, and employ the ‘hope’ strategy that this will be the longest expansion in all history or adopt the ‘better a year too early than a day too late’ strategy and prepare now. You may want to revisit our recent article here that outlines the CBO’s ‘hope’ strategy and our article Financial Maths 101 to revisit the implications of the ‘day too late’ scenario.

Topically Bloomberg yesterday reported that Egyptian billionaire Naguib Sawiris is employing the latter strategy investing half of his $5.7b net wealth into gold. From Bloomberg:

“He said in an interview Monday that he believes gold prices will rally further, reaching $1,800 per ounce from just above $1,300 now, while “overvalued” stock markets crash.”