Is the gold leverage game nearly up?

News

|

Posted 26/11/2015

|

4565

Last week we reported on the epic set up in COMEX vaults (a must read, with its links, if you missed it). To give the full picture of this leverage game Money Metals Exchange had this to say on Tuesday:

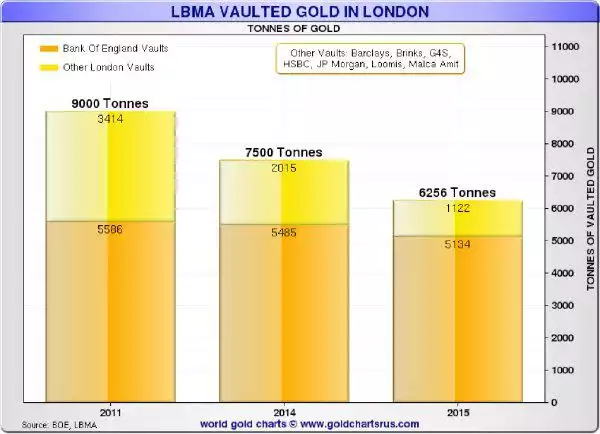

“The drop in physical inventory isn't limited to COMEX vaults. Trouble is brewing in London's LBMA market - the world's largest exchange - as well. Ronan Manly authored a report estimating that LBMA stocks outside the Bank of England vaults have fallen by 67% since 2011.

However, the report estimates that ETFs hold 1,116 of the 1,122 tonnes remaining, leaving only 6 tonnes - roughly 200,000 ounces - really in play for delivery.

Consider that LBMA banks often trade 1,000 times that amount - 200,000,000 ounces - in paper gold per day, and you find the same completely untenable scenario.

The price is falling because exchanges around the world are happy to let traders and banks sell more and more metal they don't have and almost certainly can't get. On the other side are folks busily buying the paper gold and ignoring the metastasizing counterparty risk. And behind-the-scenes inventories are vanishing as players with greater concern take delivery of bars and head for the exit.

There is no telling how this scenario will end. It could end if spot prices rise to the point that sellers with actual bars show up to sell. Or we may see exchanges engulfed and destroyed by a massive wave of delivery defaults. Who knows?

However, given the explosion in leverage over the past few months, the question of when it will end may be easier to answer. The reckoning for metals markets may not be far ahead.”