Is The Crash Close? ‘Smart Money’ is Leaving

News

|

Posted 19/08/2016

|

8320

A bit of a longer one today but we think these are extraordinary times.

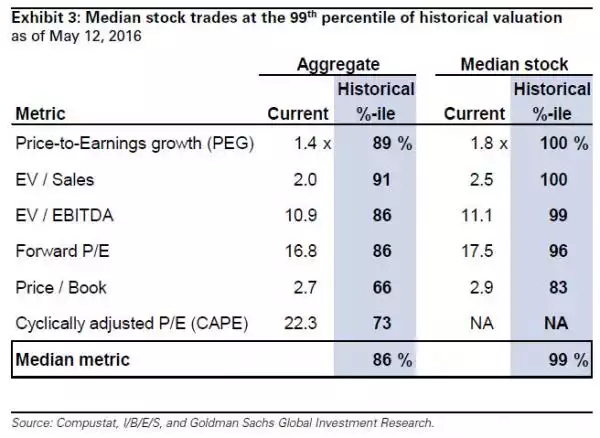

Gold and silver have consolidated, shares at new highs, and VIX/Volatility is in ‘complacent’ (everything is awesome, nothing to see here) territory. This is usually the set up before any crash. What also normally happens before a crash is irrationally and historically high valuations. The following is from Goldman Sachs showing various price earnings type metrics for the S&P500 in historical context and showing every one is sky high on the bell curve. (note this is from May 2016 and prices are higher now and more earnings results released showing declines as covered in today’s Weekly Wrap).

If this table alone doesn’t sound alarm bells, allow us to continue…

The human temptation when a market is running hot is to jump in because you feel like you are missing out. The smarter investor buys before things take off and sells to the fools coming in late. These poor fools are chasing that last 5 or 10% but forget they are risking, say, 50% (like the GFC) when it crashes. And remember if your investment goes down 50% you need to make 100% on that balance to get back to evens…

This is a market that is fuelled principally on cheap money, debt and monetary stimulus, not fundamentals. Businesses are spending on share buy backs not capital expenditure that ensures future growth. We learned last night that corporate debt in the US has doubled since the GFC to $6 trillion. This week multi-billionaire (one of the world’s 50 richest) hedge fund manager Carl Icahn said this in an interview:

“[The market] is way overvalued at 20 times the S&P and I'll tell you why: a lot of it is a result of zero interest rates….You have zero interest and a lot of buybacks. Money is not going into capital.

So think of it as a rich family that just decides "we're just going to have a lot of fun, we're going to sit around in the pool, and we'll keep printing up IOUs to the town, we've got a good name." You keep doing it until you go broke. And this is what's happening in our economy. Zero interest rates are building huge bubbles.” He also said “I am more hedged than ever” and warned “There's going to be a day of reckoning here”.

Taking Carl’s lead it is instructive to look at what the very managers of these companies are doing. From Bloomberg’s last week:

“The number of officers and directors of companies purchasing their own stock tumbled 44 percent from a year ago to 316 in July, the lowest monthly total ever, according to data compiled by The Washington Service and Bloomberg that goes back to 1988. With 1,399 executives unloading stock, sellers outnumbered buyers at a rate that was exceeded only two other times….. The lack of interest among executives may be a warning signal for investors who just saw analyst estimates for third-quarter profits turn negative even as equity valuations swell to levels not seen since the aftermath of the dot-com bubble.”

Apart from the table above we don’t know if there is a more damning indictment on the market than that piece from Bloomberg.

The GFC saw the big banks pass the debt risk of all the sub prime mortgages on to innocent investors just before the crash. (watch the movie “The Big Short” if you haven’t seen it yet). In a way these CEO’s and Directors are doing the same thing – set it up and pass it to the ‘fools’…. It’s not just in shares either. We just learned this week that globally Central Banks have offloaded a record $335 billion of US Treasury bonds in the last year. The buyers? “Private Investors”. All this whilst Central Banks continue to load up on physical gold at a cracking pace…

What of the implication of a financial crash?

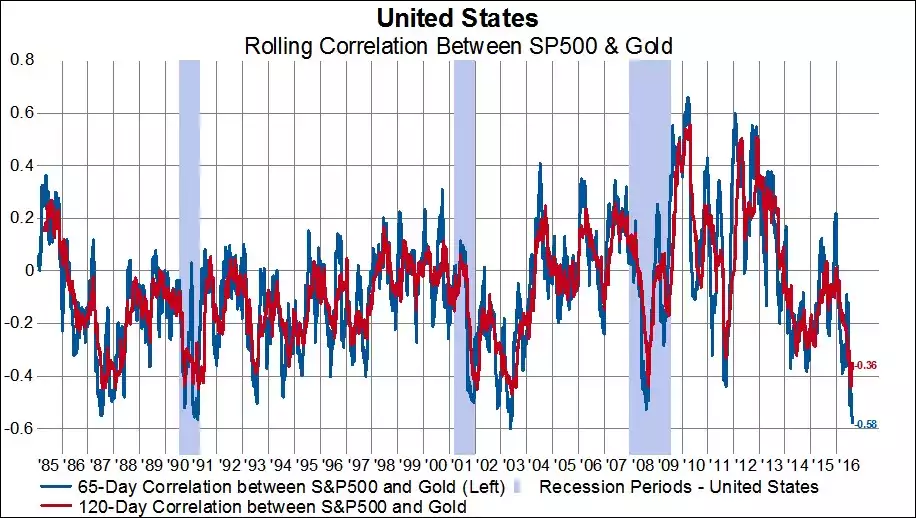

Shares and gold are notoriously uncorrelated (gold up when shares are down and vice versa), it is in large part why people buy gold. But it’s not perfect, there are times when they are correlated. That said if you check out the chart below you can see how incredibly ‘uncorrelated’ they have been of late as things are getting ‘interesting’. If you look at the 65 day correlation (the last few months) we are at a level not seen since the GFC

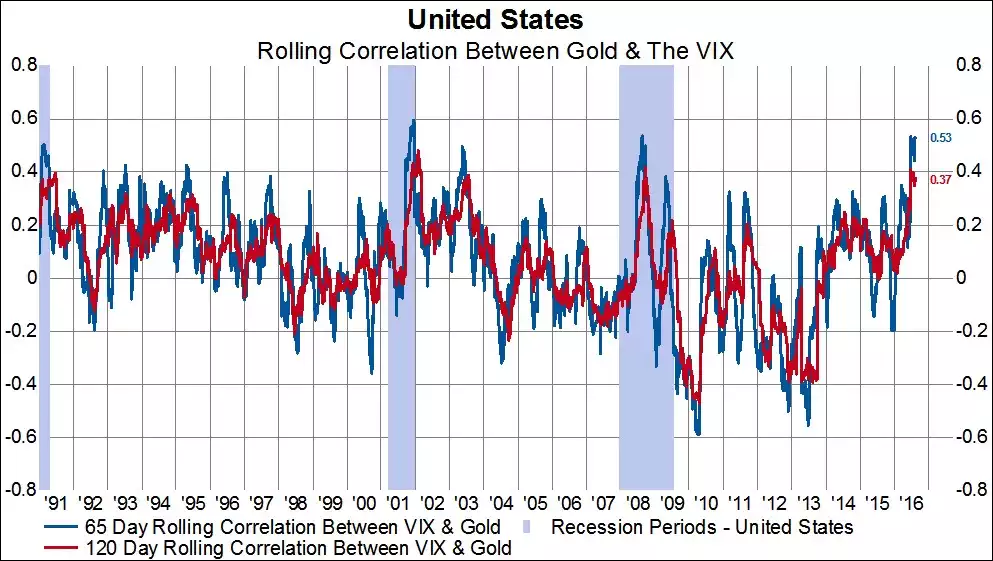

Likewise we mentioned VIX earlier at very low levels – i.e. high complacency. As you’d expect there is the opposite to shares where gold and VIX are highly correlated. Who needs gold if you are relaxed right?

And again we are seeing the last few months hit highs not seen since the last 2 crashes.

So we are seeing shares at very elevated valuations and volatility at very low levels, but all within a market based on no fundamentals of earnings, economic growth, or consumption. It makes no sense. Even those in control are bailing! Let us remind you what gold did versus shares in the 5 worst years on the ASX in the last 50 years:

Finally, speaking of those in control, few have such ‘pedigree’ as the Rothschild’s. So let us leave you with this…

Rothschild Investment Trust Chairman, Lord Jacob Rothschild, had this to say this week:

“The six months under review have seen central bankers continuing what is surely the greatest experiment in monetary policy in the history of the world. We are therefore in uncharted waters and it is impossible to predict the unintended consequences of very low interest rates, with some 30% of global government debt at negative yields, combined with quantitative easing on a massive scale.

To date, at least in stock market terms, the policy has been successful with markets near their highs, while volatility on the whole has remained low. Nearly all classes of investment have been boosted by the rising monetary tide. Meanwhile, growth remains anaemic, with weak demand and deflation in many parts of the developed world.

Many of the risks which I underlined in my 2015 statement remain; indeed the geo-political situation has deteriorated with the UK having voted to leave the European Union, the presidential election in the US in November is likely to be unusually fraught, while the situation in China remains opaque and the slowing down of economic growth will surely lead to problems. Conflict in the Middle East continues and is unlikely to be resolved for many years. We have already felt the consequences of this in France, Germany and the USA in terrorist attacks.”

“… we have reduced our [equities] exposure from 55% to 44%. Our Sterling exposure was significantly reduced over the period to 34%, and currently stands at approximately 25%. We increased gold and precious metals to 8% by the end of June."