Is Bitcoin A Bubble?

News

|

Posted 23/02/2021

|

5129

Yesterday BTC and ETH had short sharp corrections and bounced back. Topically last night our favourite macro investor Raoul Pal released a Macro Insiders In Focus report updating us on why the digital asset space is something that we simply can’t ignore. In his words, “It is literally the biggest thing that has ever happened.”

We believe that during these incredible times, especially when riding parabolic gains, its important to keep your head screwed on and we have found Raoul to be a fantastic point of reference. Here’s an excerpt from his latest report. Let’s hand it over to Raoul;

“Riding an exponential trend is literally the most psychologically difficult thing to do. Everyone you know – and trust – screams at you to take profit, don’t be an idiot and offers 57 reasons why it might all go wrong. It is so damned hard to filter out all of this and keep your conviction when you are in reality riddled with the insecurity of your thesis, as you should be, but still have maximum conviction.”

Raoul then goes on to put bubbles into perspective;

“Starting in the late 1990s, something entirely new began: a network that connected everyone on earth, something unlike anything we have ever seen before – the Internet.

The first phase of the Internet involved some people “getting it” and a load of people piling into momentum. We didn’t know how it was going to evolve but we kind of understood it was going to be big.

That led to a bubble that people still refer to today as a classic bubble. But was it?

The answer is yes, and no. Price did get ahead of the ability to predict the winners and losers, so the speculative nature of the initial rise was followed by a large collapse but then something happened that most people really didn’t get – the rise of the network effects businesses, driven by behavioural economics – Google, Facebook, Amazon etc.

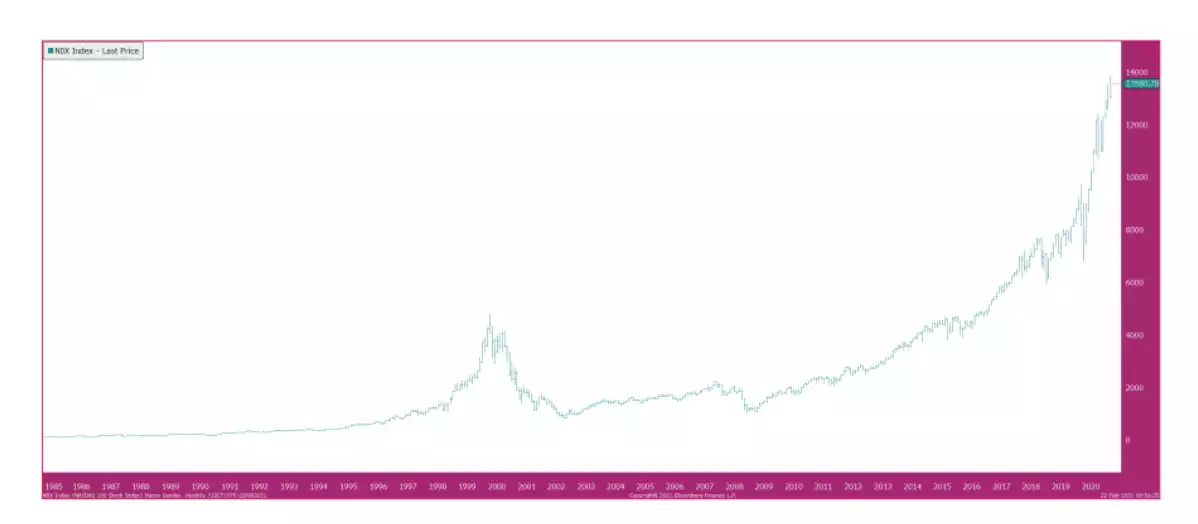

Looking back on the early Nasdaq bubble and collapse phase, it now seems like a distant memory in the chart...

Since 1995, if you’d just held onto the Nasdaq and didn’t sell, you’d be up 3122%, or 14.3% per annum.

But the Nasdaq is a mix of different companies, from software companies to hardware. These are not the same. When you tease out the network effect companies, an entirely different picture emerges... the exponential trend.

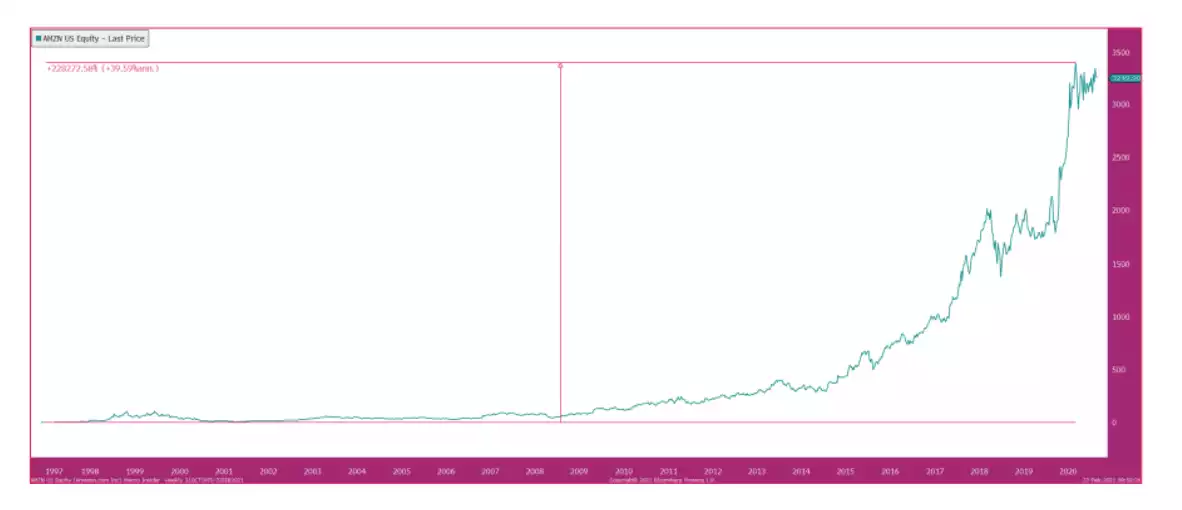

Here is Amazon – up 226,000% since going public and generating an unbelievable 37% returns per annum. Remember, this stock was always deemed to have a ridiculous valuation and was historically unprofitable and constantly referred to as a bubble as investors struggled to understand how network effects translate into exponential trends...

Google produced 26% returns per annum, Facebook 30% etc. And all of these stocks fell 50% or more numerous times, but they continue to rise as adoption increases.

In an exponential trend, the mean reversion is to the rising exponential moving average (the trend) and not to the price mean. Very, very different.

Humans are just not set up to think in exponential terms. It literally doesn’t compute for us. For example, 20 linear steps might take me 20 metres forwards while 20 exponential steps would roughly take me around the world three times.

Mind blown.

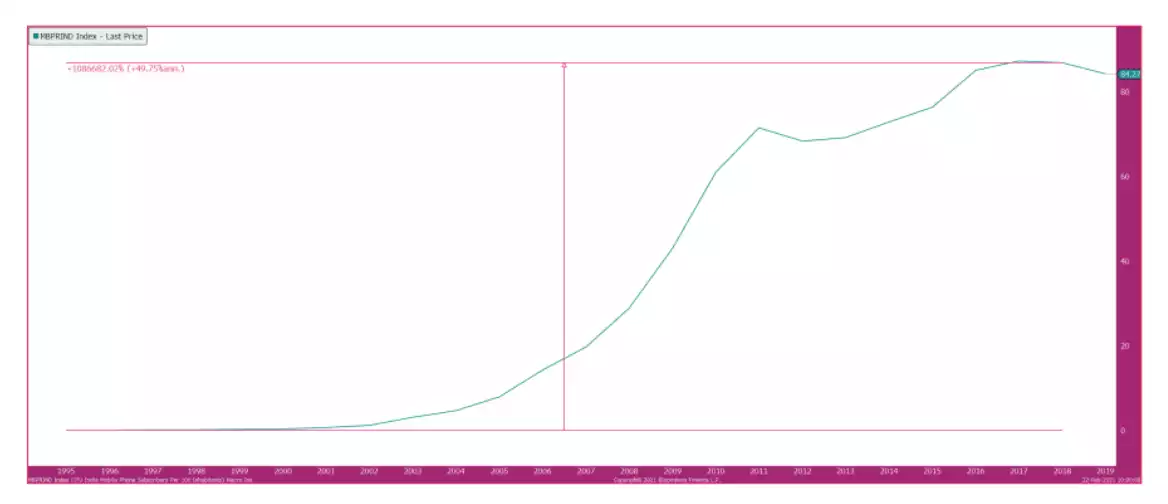

We have seen similar network effects in mobile phones too. For example, mobile phones per inhabitant in India have risen 1,000,000% since 1995...

But back in 2009, something new developed: bitcoin. Bitcoin was a monetary system in which at the very heart lay behavioural incentives and network effects. When you combine a big problem (fiat money debasement and a broken financial system bloated by excess debt) with a network based on value which increases as each new user is added, then truly spectacular things happen.

You see, in the case of Amazon, the shareholders got the rewards while the platform user got the functionality, but in the case of bitcoin the platform user gets the economic rewards too. This is beyond powerful as a mechanism to create adoption.

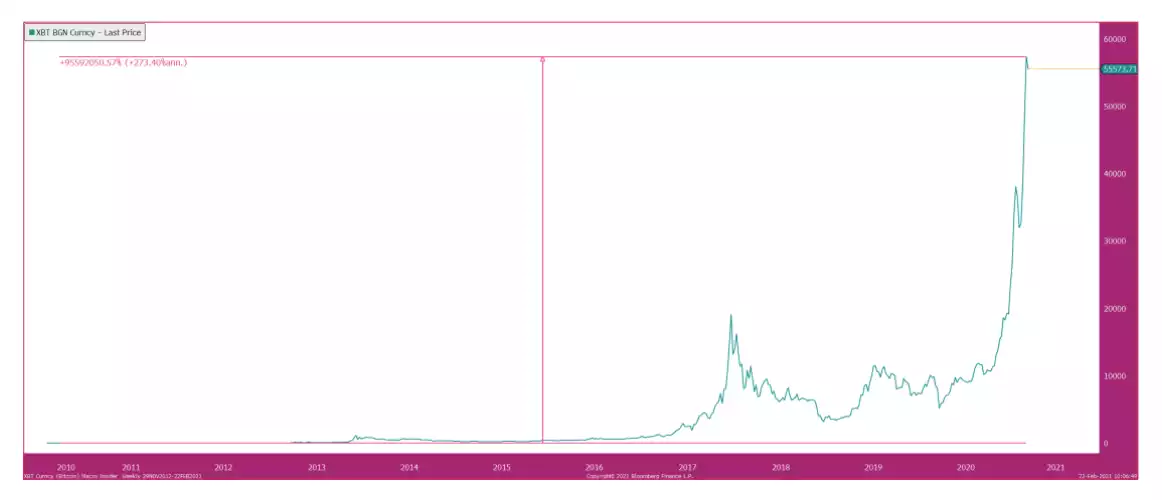

The case in point is that bitcoin is by far and away the best performing asset in the history of mankind.

Just take that in for a bit...

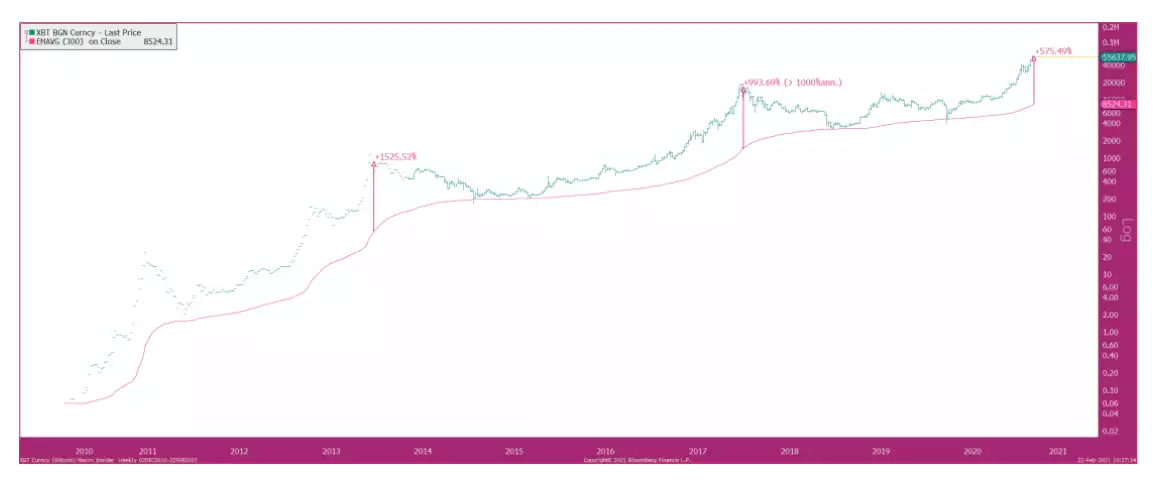

It has risen, as an asset class in its own right, 95,000,000% since 2010 or 273% per annum...

Surely it is a bubble? Yes, and no. Yes, it sometimes overshoots its exponential average by too much and corrects, but the exponential moving average is always rising.

I have written expansively how this is Metcalfe’s Law in full sight. Over time, these sell-offs are just mini S-curves but the overall trend is parabolic and will remain so for a long time to come.

Many people, including concerned friends, have written to me or called me up and said, “Why don’t you take some off the table? Why don’t you take off your original stake?”.

This is a classic misunderstanding of exponentiality. Let’s say that when the Tether FUD began to reappear in December, I had decided to close my Bitcoin position. At the time, the price was around $24,000. Since then, it has risen 148%.

Even if the Tether story eventually comes out, let’s say in nine months’ time, Bitcoin will be at $300,000 or more. I always said it could cause a sharp 50% fall. That would bring me back to $150k. Well, that is a whole lot better than selling out in December 2020.

Unless something is a real, gigantic, existential threat RIGHT NOW, it is just noise, due to the price dynamics. We have upside price dislocations going on as the network effects spread to institutions while coins are being removed from exchanges in record numbers. This dynamic is not going to stop for a long time and in my view, from the discussions I have every day, it has only just begun.

In addition to all this stuff, there is another change that is so profound that most people haven’t yet got their heads around it. You get a higher yield than junk bonds by holding bitcoin and, if you switch to a stable coin like USDC, you get even higher yields. That means you are really not incentivised to sell and, even if you do, you are not incentivised to bring it back into the traditional system, unless you want to acquire some lifestyle chips.

That makes the entire system so absorbing that it is a Super Massive Black Hole, not just for bitcoin but the entire digital asset system (and that is just the start; I’ll elaborate how big this is going to become in due course).

But when I refer to it being THE macro trend – the only one that really matters – I am not being hyperbolic. You see, equities are the second-best performing asset after bitcoin, but when you look at what is really going on, things aren’t what they first appear.

So many people scream that inflation is coming but it is a near impossibility (outside of cyclical CPI rises) to generate goods or raw material inflation due to technology, globalisation, demographics and debt dynamics.

Although no one sees it, we DO have inflation. It is massive and it is insidious. It is the devaluation of fiat currency overall. This is what so many people have got wrong. They were looking to the 1970s and missed the bigger picture.

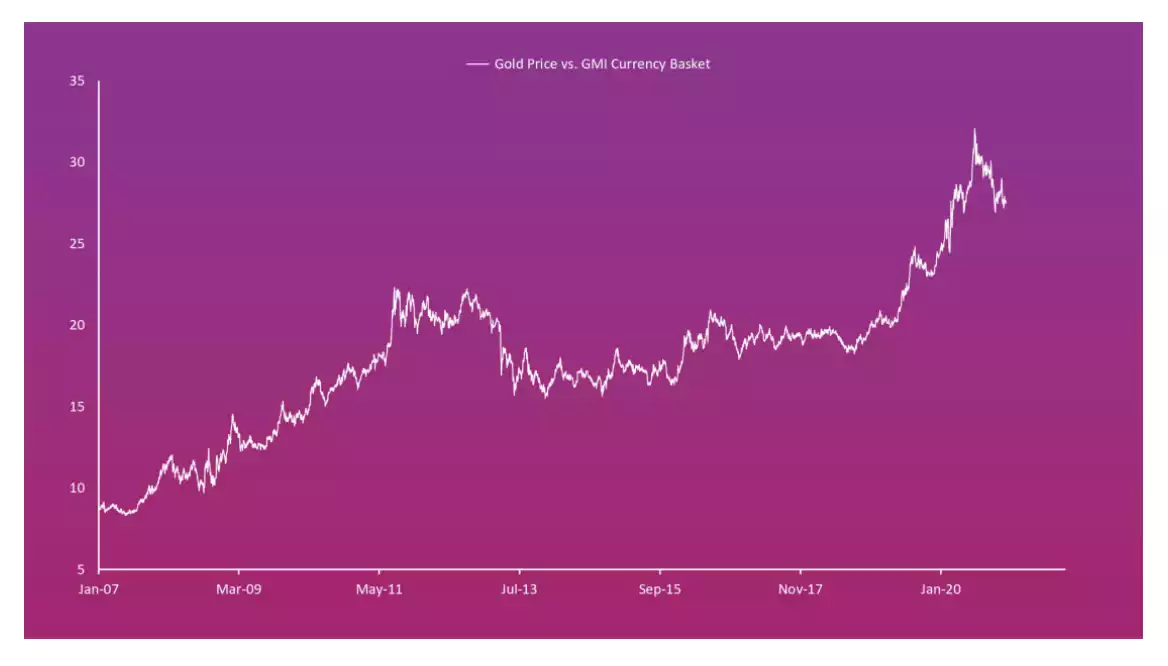

For years I have been tracking this by looking at a basket of 27 fiat currencies versus gold – the longest-standing measure of value we have...

Gold is up 300% versus fiat currencies since 2008 or, put another way, the value of fiat has fallen 60%!!!

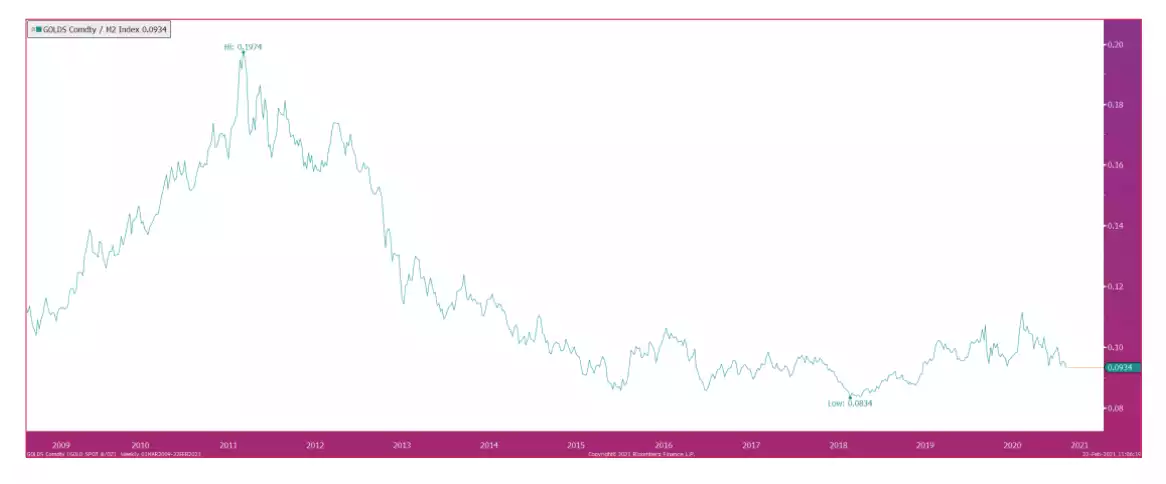

The rise in Gold is just a manifestation of the rise in M2. It has basically held its value over time...

But bitcoin, well, that is an entirely different game. It too has the store of value component, but on top it has the network adoption effects of an entirely new financial system coming into being. It has MASSIVELY outperformed M2 growth..

But eventually in this cycle, we will overextend versus the 300-week exponential moving average. We are currently 575% above it, but the last two bull markets hit 993% and 1525% above it, respectively...

Remember, the EXPMA [exponential moving average] is also now rising sharply too and the maths suggest it will continue to do so. This indicates that we probably have another 400% to 500% go to the upside for BTC before the next S-curve of gravity kicks in. Back in 2013, the market rose another 10x after it hit 620% above the EXPMA and in 2017 it rose another 450%.

Back in those previous bull markets, both had pretty decent corrections of 35% to 50% somewhere around this point. Seasonality suggests that a correction will come in March and will be short-lived before a much bigger run into June, when I think it reaches $100k and corrects for longer. Bull markets see another 10x from that deeper correction...

But, all the time, BTC is just catching up with its theoretical Metcalfe’s Law fair value of somewhere near $500k...

Even if we get another 35% pullback from, let’s say $60k, it still just brings us back to $42k (the power of an exponential trend).

We are under zero pressure to do anything. In fact, with such large upside available, we should just add more.

Elsewhere in macro-land, we can grub around for trades, capture a sharp move here and there etc., but there is really zero incentive to allocate risk budget to more traditional markets unless something truly epic sets up, like an equity crash, where we can hedge our crypto risk a bit.

Bitcoin is by far and away the world’s most dominant trade.

Traditional hedge funds will need to adapt or die. Same with asset managers. Same for all of us. We are already seeing the signs everywhere. This is not a parallel to the growth on the internet, it is the logical conclusion to it all. Software is eating money.

Then for a moment try to think about how big this could be for emerging markets, who will be freed of the dollar standard or of old technology infrastructure. Imagine how this wraps into the explosion 5G and 6G. Just dare to imagine what this is all going to be worth as a space...

• The global equity market cap is $100tn.

• The global debt market is $283tn.

• The global derivatives market is $1 quadrillion.

The entire digital asset space right now is worth $1.7tn. It is going up 100x or 200x over the next twenty years.

This is EVERYTHING that matters. You simply don’t have the choice to ignore it.

Everything else is a sideshow for amusement and a few trades.

Conclusion: This is the future of everything.”

Today we are offering BTC and ETH at just 2% over spot including our Ainslie Crypto Wallet for free.