Irrational Exuberance

News

|

Posted 22/11/2016

|

5358

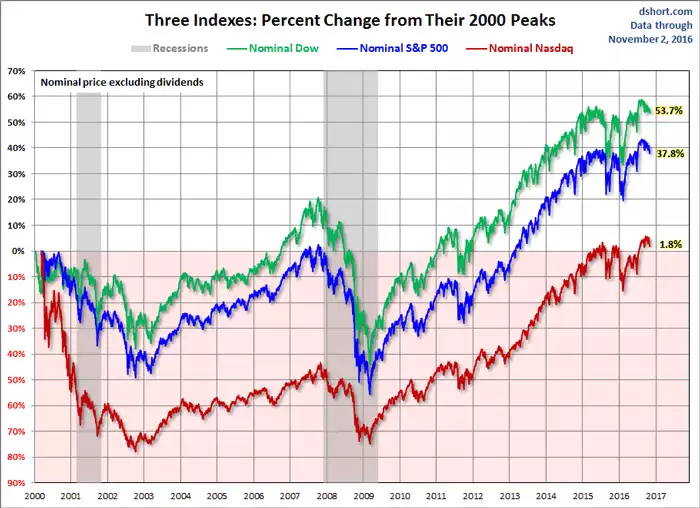

Last night the S&P500, Dow Jones and NASDAQ hit simultaneous all-time highs for the first time since 1999. Here’s a graph of what happened soon after last time:

There are a couple of takeaways from this graph. Firstly when you start to hear continued calls of new highs you can feel like you are missing out, especially as it coincides with falling precious metals prices. The temptation is to jump in to get that extra growth you are clearly missing out on. But it’s the second glaring takeaway from this graph that is too often missed. In chasing that extra few percent in a rallying market you risk losing 50% or more (the NASDAQ plummeted nearly 80%) of your wealth. In the ‘down the escalator, up the stairs’ playbook, you then need to make 100% on what’s left to get back to where you started and that can take many years.

Since the GFC the US sharemarket has pretty much mirrored the profile of monetary stimulus injections. US Fed prints money (QE), market goes up; US Fed stops, market goes down or sideways. Here’s a graph from tonight’s presentation showing exactly that.

So what is fuelling this current sharemarket rally? The PROMISE of more stimulus. This time however it is not the apolitical choice of the US Fed to print money and keep interest rates near zero (monetary stimulus), it’s the political promise of Mr Trump to unleash fiscal stimulus in the form of infrastructure spending and lower taxes. The key distinction here is the word political. The US Fed acts independent of political influence (in theory at least) whereas Trump has yet to get the very thing driving this market through Congress. As Reagan found out, that is not very easy. The thing is, Reagan didn’t have any of the massive fiscal roadblocks that Trump has to overcome. We will discuss that in more detail tomorrow.

The 2 charts above tell a tail of a market rally based on hope of stimulus and irrational exuberance ignoring valuation fundamentals and history. As Goldman Sachs pointed out yesterday:

"Donald Trump will take office next January in what will be the 91st month of the current expansion—the fourth longest in US history"

But it’s probably different this time yeah?