Institutional Funds Line up for Crypto

News

|

Posted 23/02/2018

|

7435

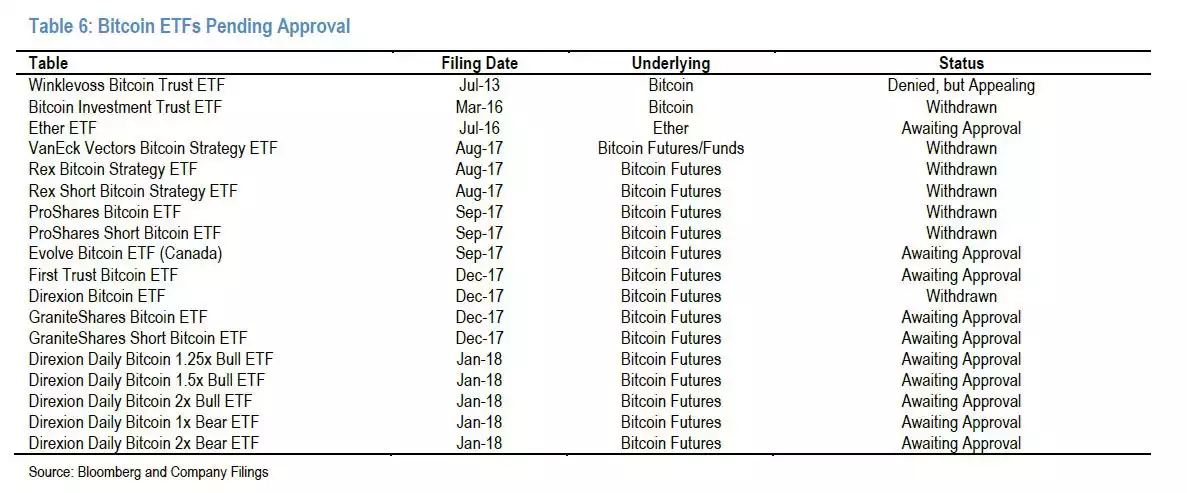

A lot of the anticipation of uber high Bitcoin and other crypto prices is around institutional take up, with 2018 touted as the year of major adoption. The table below lists the queue for ETF’s alone:

The SEC seems to be stalling with allowing the introduction of these crypto ETF’s with the concerns largely around liquidity.

ETF veteran Matt Hougan is (now) the former CEO of Inside ETF and ETF.com and has just joined Bitewise Asset Management as their vice president of research and development. In an interview with Bloomberg Hougan says, as ETF’s did when they started in the 1990’s and particularly into the noughties, crypto has "the potential to transform financial markets,". Bitwise launched its first fund last year, the HOLD 10 Private Index Fund, which invests across the top 10 cryptos by market cap. Hougan believes the potential for the still small crypto space, just approximately $450b which he compares to the “$3 trillion” gold market, is enormous. He believes that, like ETF’s in the 90’s, the institutions are cautiously hanging off whilst retail investors take the lead.

"Institutions are in learning mode…..That will translate into investing mode and we’ll see the early adopters as early as this year and really significant activity in 2019 and beyond."

This week also saw reports of two new entrants to the crypto space that will provide another onramp to the crypto market.

Newcomers, Bankorus and Xtrade are looking promising to being able to solve the challenges faced by High Net Worth Individuals (HNWIs) when they attempt to invest in crypto. It is estimated that the combined assets of HNWIs equals more than US$60 trillion, with only approximately $50 billion of that currently invested in the crypto market. More times than not, HNWI’s entrust their wealth management to financial institutions that operate outdated and centralised infrastructure. Further, as many early crypto adopters can relate to, HNWI’s encounter a range of problems when attempting to invest in crypto such as:

‘lack of access, persistent data-breach risks, a costly high-touch process, high compliance costs, and inconsistent reporting standards’. – Bankorous

In essence Bankorous is creating an AI and blockchain based marketplace aiming to build a platform which will allow HNWIs and their wealth managers to easily access crypto investments. The Bankorus protocol is an open-source API built on the NEM (XEM) blockchain.

The XTrade platform will allow institutions to have just one account across all the major exchanges. This one easy to use interface, will allow investors to view market data and trade executions for all crypto exchanges from the one account. XTrade also incorporates a liquidity management system along with instant access to liquidity.

To date the large majority of investment in the cryptocurrency markets has been made by retail investors and more recently through the introduction of futures contracts through CME and CBOE. The potential ‘game changer’ is platforms like these will act as a springboard for the institutional money to enter the crypto market. This year is shaping up to be another bumper year and with this $60 Trillion dollar opportunity more than ever within reach, the basics of supply and demand suggest that ‘little’ $450b may be short lived.