Insiders & Funds Sell to Retail ‘Mums & Dads’

News

|

Posted 05/08/2022

|

7798

Markets were cautious last night with equities essentially flat after recent rallies on growing concerns that central banks will indeed keep hiking into what is becoming an increasing risk of recession around the world.

The Bank of England last night hiked rates for a 6th consecutive meeting by 50bps up to 1.75%, the biggest single hike in 27 years. BoE now expect inflation to hit an incredible 13% in Q4. But what really rattled markets was the BoE’s prediction that the UK will enter a recession in Q4 that will last for five quarters but with their stating they will continue to hike “forcefully” and undeterred.

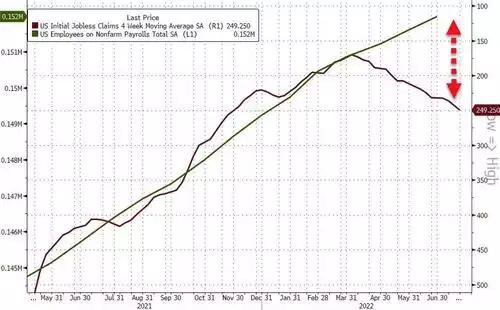

US markets also got a shake with Fed member Mester predicting they could raise rates over 4% in to mid next year, higher and longer than the consensus, and that they “could be more frontloaded" stating a 75pbs hike in September was not unreasonable. All eyes will be on the Non Farm Payrolls official employment figure released tonight our time. Should we see a stronger number than the expected 250,000 jobs and unchanged 3.6% unemployment rate that could well signal a 75bps hike in September and more market jitters (yes, good news is bad news…). However if we see a weaker outcome the market could well read that as a case for a softer approach from the Fed and perversely rally, and likely everything bar the USD again. We have certainly seen a sustained 4 month worsening of first time or “Initial” jobless benefit claims to their highest level in 8 months and the continuing claims rising up as well. Growing reports of more and more large scale layoffs certainly support the data.

So far the NFP numbers have largely (and curiously) ignored this as you can see below. This seems an unsustainable decoupling…

And so the $300 trillion question remains “are we going to have another leg down” in equities and risk assets as the central banks don’t blink and drive us deep into a recession. We ask this question just a month out from the historical ‘crash season’ of September and October…

Its often instructive to look at what the so called ‘smart money’ is doing. What we are seeing very clearly is the market is being heavily driven by retail investors. Cynically you could say the same ‘mum and dad’ investors that carried the can after the smart/ institutional money passed the whole collateralised debt obligation (CDO) toxic mess to them before the GFC. Right now we are seeing managed funds heavily in cash having lagely left the market and the so called ‘insiders’, those executives in the know, are now selling rather than buying their own company’s shares by a factor of 2.3, the most since the selloff began at the beginning of this year.

Gold, as always, is sniffing the trouble ahead and rallied last night to be one of the only markets in the green.

Lets see what happens with the NFP tonight…