India Rate Cut Surprise & Gold

News

|

Posted 30/09/2015

|

4648

Yesterday, The Reserve Bank of India (RBI) cut its repo rate (the level at which the central bank lends to commercial banks) by 50 basis points from 7.25% to 6.75% with the market having priced in only a 25 basis point drop. Only 2% of forecasters predicted a cut of this size which represents the biggest drop since 2009 and as such lends support to our recent observations of repeated GFC record reads occurring for numerous metrics in recent weeks. Yesterday’s cut follows cuts in January, February and June that had already amounted to a 75 basis point drop.

In what could have been mistaken for the content of an RBA announcement, Governor Raghuram Rajan said “The weakening of global activity since our last review suggests that commodity prices will remain contained for a while” and indicated that "Monetary policy has to be accommodative to the extent possible". These statements represent somewhat of a policy divergence from those represented by the hawkish faction within the Federal Reserve.

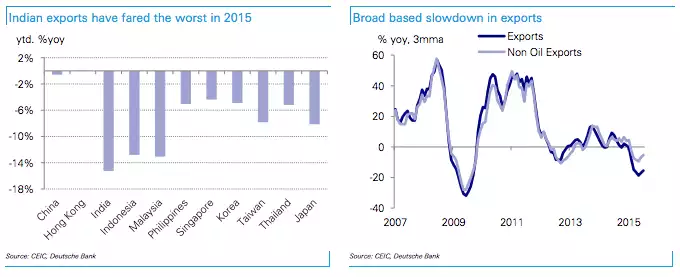

One can understand the importance of currency competitiveness given the fact that India’s exports have seen 8 consecutive months of decline with the July merchandise export figure falling by 10.3%yoy. The April-June quarter of this year saw Indian exports fall by 17%yoy which represents one of the steepest declines on record. The depressed oil price will have had an influence here with oil contributing 18% of India’s total exports. See the extent of India’s export problems in the chart below from Deutsche Bank. The RBI’s oil price projections have been subdued from the April range of $60-$63 down to $50/barrel currently.

In an all too familiar story, growth concerns seem to have heavily influenced the rate cut with India’s print falling from 7.5% to 7% in the April–June quarter. With a central bank target of 6% for 2016, India’s consumer inflation is also well below expectations.

At the announcement of the rate cut, Indian shares arrested their 1% falls for the day and closed flat. In last Friday’s weekly wrap we referenced ANZ research predicting that the RBA will need to cut our official cash rate to a record-low 1.5% next year and the RBI cut yesterday is likely to reinforce that analysis.

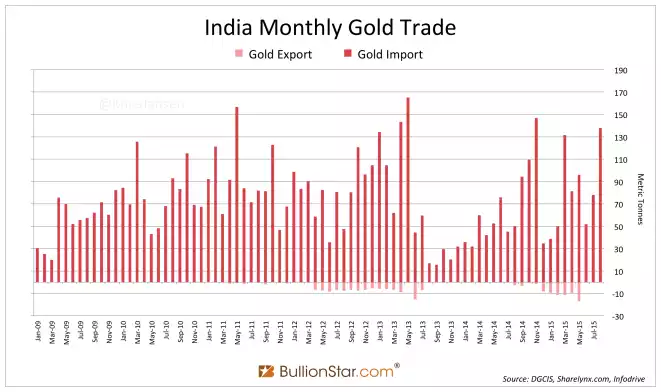

Whilst on the topic of India, let’s look at their August gold imports which jumped to 138 tonnes. At 5% of total annual gold production, this represents the highest monthly figure for this year and has been topped only once since 2013 as pictured below.

What’s interesting about this spike in Indian gold demand is that it is occurring within the context of a particularly week monsoon season which has the effect of reducing rural incomes. Note that the monsoon deficiency was referenced in the RBI’s statement of yesterday in the context of food inflation pressures.

A good analysis of this activity in gold was made recently by Hebba Investments who stated that “investors need to remember that much of Indian physical gold demand is coming from the rural economy which holds gold in lieu of rupees and bank accounts. So the fact that gold demand is surging in this sector despite lower incomes suggests that for the average Indian gold buyer, the price of gold is simply too low to resist.”