In Gold We Trust Teaser – QE4 coming?

News

|

Posted 11/04/2019

|

8079

Incrementum’s annual “In Gold We Trust” report is probably the most anticipated annual in the gold community. They have released their “Preview Chartbook” and list 4 topics as their executive summary main points and over the next 6 days we will summarise each. They are:

- A turn of the tide in monetary policy (2 parts)

- A turn of the tide in the global monetary architecture

- Gold’s status quo

- Gold stocks

- Quo Vadis, Aurum? (Where to for Gold)

So let’s look at the first. On this topic their executive summary says:

“Events in Q4 clearly showed that a ‘monetary U-turn’ is currently on its way, which means that further large-scale experiments like MMT, GDP targeting, and negative rates might be expected in the course of the next severe downturn.

We might already be in a prerecession phase. Crisis-proof assets will probably be in greater demand again in coming months.”

We have covered much of that addressed here recently, so briefly recapping:

- The changing from QE (Quantitative Easing) to QT (Quantitative Tightening) and the impact on the markets and the subsequent reversal of central bank policy from tightening to neutral prematurely.

- Bond yield curves are giving very clear recessionary signals. Based on the probability of a US recession predicted by treasury spreads (12 months ahead), there’s a 25% chance of a recession within the next 12 months and since this level has been reached only four times in the last 30 years, 3 have been in a recession and we might already be in a prerecession phase.

- In the past 100 years, 16 out of 19 rate hike cycles were followed by recessions. The rate hike cycle just finished, are you betting against 84% odds? Is this time different?

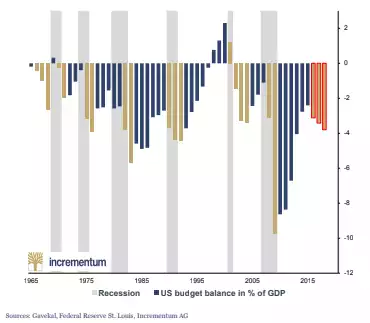

They, however, raise some new points not directly addressed by us recently. Firstly, and in the context of looking for ‘this time is different’ paradoxes, they produce a chart showing the correlation of 3 consecutive years of widening US budget deficits and recessions… Is this time different?

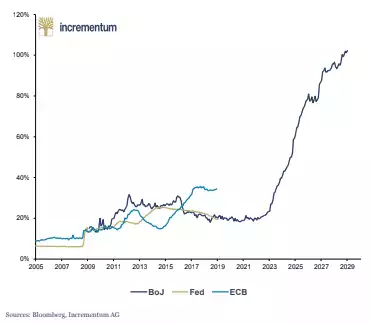

And in case you thought the Fed couldn’t possibly do more QE… context is everything. People talk of the Japanification of the US…. Their chart below shows that context, and as they say:

“The balance sheet of the Federal Reserve measured in % of US GDP is slowly decreasing due to QT. We could observe a similar process in Japan some years ago, before the monetary expansion took off and the balance sheet of the BoJ increased tremendously, actually reaching the GDP level of Japan! From our point of view it is unavoidable that sooner or later the Federal Reserve will implement another round of QE.”

Japan has clearly shown you can’t simply keep printing money and amassing debt. Why should the US be any different? In a sense they are, but not in a good way. Japan has a massive trade surplus. The US on the other hand runs a deteriorating trade deficit. As the world’s reserve currency, the US needs the world to maintain faith in the value and discipline of the USD, Japan doesn’t.

Even Trump last weekend weighed in, tweeting:

"I personally think the Fed should drop rates, I think they really slowed us down, there's no inflation, in terms of quantitative tightening, it should really be quantitative easing...you would see a rocket ship. Despite that, we're doing very well."

Whilst simplistically one might think more QE and more debt from the US will just inflate markets again and all will be fine. Tomorrow we will present another staggering insight into the debt trap the US has put itself in, and the correlation of this with the gold price.

On that note, and in stark contrast to the above tweet, the same Mr Trump, back in September 2011 tweeted:

“The Fed's reckless policies of low interest and flooding the market with dollars needs to be stopped or we will face record inflation.”