In Gold We Trust Report 2020 – Intro

News

|

Posted 29/05/2020

|

31041

You can now listen to the article and all our daily news, via YouTube and Anchor

The eagerly anticipated annual “In Gold We Trust Report” by Incrementum is arguably the most widely respected publication relating to gold. This mammoth piece, 93 pages in the compact version or 356 pages in the extended version is certainly worth the read over the weekend if you have the time. Today however we will just present the Introduction as today’s article. Enjoy.

This year’s 14th edition of our In Gold We Trust report, titled “The Dawning of a Golden Decade”, is being published at the opening of a new decade. As the last decade draws to a close, gold has once again demonstrated its sensitive seventh sense and alerted the keen observer that the general situation in the financial markets is about to change fundamentally.Last year economic activity cooled off noticeably, and it was only a matter of time before the long overdue recessionary storm broke. In anticipation of the storm, the development in calendar year 2019 was superb on a US dollar basis, with a plus of 18.9%, and even more remarkable on a euro basis with 22.7%.

But even before the storm clouds could thunder and a “conventional recession” could occur, the world was confronted with the novel coronavirus and the dramatic reactions to it. The economic storm that we are now experiencing is indeed unprecedented. The pandemic became the trigger and accelerator of the following fundamental dynamics:

• Economic emergency braking

After a prolonged period of economic expansion, the global economy is experiencing the most severe recession in over 80 years. The IMF is forecasting a contraction in global GDP of 3% for the current year, and this figure is likely to have to be revised downwards. The real-time indicator of the Federal Reserve Bank of New York shows an unprecedented annualized contraction of US GDP of over 31% for the second quarter.

• Collapse on the financial markets

The economic slump led to a spectacular collapse in financial assets, which had already been valued ambitiously. March 2020 will go down as one of the worst months in stock market history. In the first quarter of this year, the market capitalization of the US stock markets, measured by the Wilshire 5000 Total Market Index, fell by USD 7trn. The “everything bubble”, which we have been pointing out for years, is now in acute danger of bursting. Central banks have since been trying to prevent further collapse with seemingly desperate stimulus measures

• Monetary U-turn

The normalization of monetary policy is off the table long before it could be completed. Quantitative easing is now (again) the norm because of the prevailing zero interest rate level. The dimensions of the new QE programs beggar the imagination. At the height of the financial market panic, the Federal Reserve dished out USD 1mn every single second, day and night, for two weeks. It should be noted that monetary policy had already turned around in the second half of 2019 in order to combat the looming recession early on.

• Fiscal policy crescendo

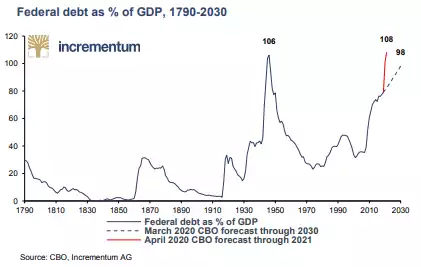

The renewed QE programs in the trillions are now being joined by a highly expansive fiscal policy. In 2020 the US is likely to triple last year’s already excessive budget deficit of 4.6%. Record debt growth is also expected in the eurozone. Italy, Greece, Spain and France, already economically depressed countries, will be hit particularly hard.

• The limits of debt sustainability

Many households, companies, emerging markets, and even industrial nations could reach the limits of their debt sustainability as a result of the devastating economic slump and the numerous government interventions. According to the latest estimate of the International Monetary Fund (IMF), the debt of the industrial nations will soar from 105% of GDP in the last year to over 122% in this calendar year alone.

• The end of central bank independence:

The dramatic debt developments are increasingly undermining the independence of central banks. The intertwining of fiscal and monetary policy is progressing steadily. For example, in April the very traditional Bank of England broke a fundamental taboo and is now financing the government deficit through direct government bond purchases. In the US, too, central bank circles are now openly considering the official interlinking of fiscal and monetary policy. All of these are steps that point further in the direction of implementing the controversial Modern Monetary Theory (MMT).

These developments have in some cases already built up over years and decades, but in the current crisis the situation is becoming exorbitantly worse. As unpleasant as the dynamics in general are, the conditions for gold could not be better, given massively overindebted economies, which as a last resort use the devaluation of their currencies to finance their deficits. For these and a number of other reasons, we take a broad view and foresee “The Dawning of a Golden Decade”.

But before we begin our analysis of this year’s topics, we would first like to take a step back to reflect on our past theses.

Looking back on the recent past of the In Gold We Trust report, we find that we became optimistic too soon after the gold price slump in 2013. By the time the US economy began to slow down in 2015, a recession was already in the air. Interest rates were still at a low level, even in the USA, and monetary policy normalization seemed light years away. Our expectation at the time was that, due to the prevailing low interest rate level, gold would experience a strong appreciation when the coming recession hit. The gold bulls were just beginning to trot when they were abruptly slowed down again at the end of 20.

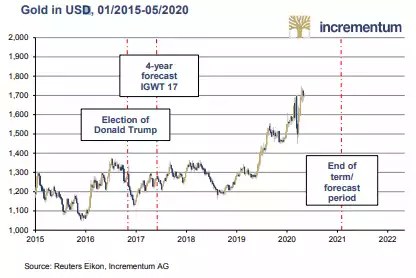

What had happened? Donald Trump was elected President of the United States, and with him a Republican majority in both houses of Congress. It was obvious to us that Trump would be a determining factor in the price of gold. This required a reevaluation of the situation. We therefore made a forecast for the gold price in the In Gold We Trust report 2017, which was timed to coincide with Donald Trump’s four-year term.

Our thesis was that the combination of deficit spending and the change of mood among previously disappointed sections of the US population would (finally) allow monetary policy to begin to normalize. The litmus test for us was whether a “normal” interest rate level could be reached or whether the reduction of the Federal Reserve’s balance sheet could be implemented without choking off the debt induced upswing.

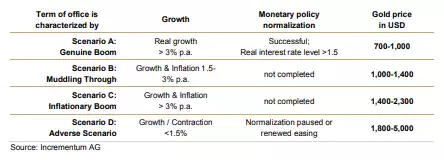

We worked out the following four scenarios for the gold price at that time, with a time horizon of January 2021:

With regard to the likelihood of a successful monetary policy normalization, we formulated the following position in the In Gold We Trust report 2017 and also advocated this position in the following two issues despite strong headwinds:

“From our perspective, one can essentially rule out that this [monetary policy normalization, note] can be done without triggering a recession.”

This year’s In Gold We Trust report marks the end of our nearly four year observation period. Today we know this: Monetary policy normalization has failed spectacularly, and the U-turn towards a loose monetary policy is finished. With regard to the scenarios we formulated, we can state that during Trump’s term of office the economy has largely been in muddling-through mode (scenario B). This term of office will probably end under the conditions of an adverse scenario (scenario D), which we have repeatedly classified since 2017 as the most probable scenario.

The gold price also behaved as we expected in the respective scenarios. In the event of a reversal of monetary policy, in 2017 we predicted gold prices of over USD 1,800 by the end of January 2021. This is still likely to be the case.

In retrospect, we are quite satisfied with our assessments of the past few years, because the central theses of our past In Gold We Trust reports have proved to be true.

Even more exciting than the review is the outlook. In line with this year’s leitmotif, “The Dawning of a Golden Decade”, we venture to offer a 10-year outlook for the gold price. First, however, we want to deal with the most burning issue at present.

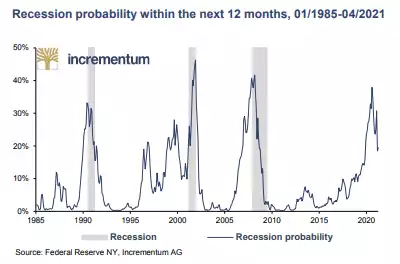

Covid-19 and the prospect of recession

The international reaction to Covid-19 is largely responsible for the extraordinarily severe recession we are facing. But would a recession have occurred even without the pandemic? An answer to this counterfactual question is very important for the assessment of future developments. We are convinced that even without a coronavirus pandemic in 2020, major economies would have slid into recession. What leads us to this view? Germany, Italy and Japan, for example, were already in recessions or quasi-recessions.

Most telling for us was the fact that world trade volume, which normally grows about 5% per annum or double the rate of the increase in GDP, last year declined by about 0.5%. This marked only the third decline since 1980. The other two declines happened during the deep recessions of 1982 and 2009. So it seems that we had already entered 2020 in a very weak condition, which leads us to think that the US would have entered a recession even without Covid-19. We would like to underpin this thesis at this point with some charts on the US economy.

An inversion of the yield curve has always been considered one of the most reliable leading indicators for recessions. As early as 2019, the proportion of yield curve inversions was already considerable, massively indicating an approaching recession. According to this indicator, a recession would not have been unlikely by mid-2020.

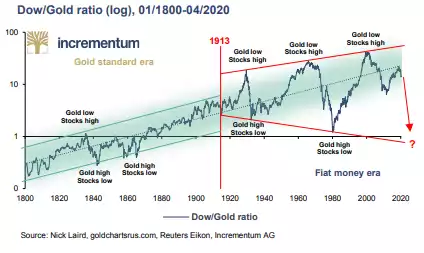

The Dow/gold ratio is also of great interest to us, as an unsustainable equity rally is sometimes sniffed out by a strongly rising gold price. According to the Dow/gold ratio, share prices had already peaked at the end of 2018. Since then, shares measured in gold have been on a clear downward trend. The long-term chart clearly shows the potential fall in share prices expressed in gold

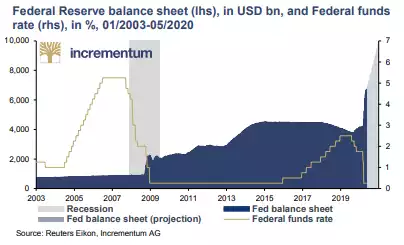

However, the most convincing evidence for the approaching recession is the U-turn in US monetary policy. In 2017/2018 the Federal Reserve continuously communicated its intention that monetary policy normalization would be carried out, come what may. As recently as December 2018, Jerome Powell said that the reduction in the Federal Reserve’s balance sheet was still “on autopilot”. Only a few days later, he rowed back this statement, in view of the massive correction in stock markets. For the first time since 2008, the Federal Reserve finally cut the key interest rate on July 31, 2019, with two further interest rate cuts to follow in 2019.

In autumn 2019, the quantitative tightening of the balance sheet was stopped. The Federal Reserve began to expand its balance sheet again, initially with the aim of keeping the rise in short-term interest rates in check. These measures were taken long before the outbreak of the coronavirus and testify to the fact that economic momentum had already weakened significantly by 2019.

Why is the question of whether the recession would have occurred even without the coronavirus so relevant? Ben Bernanke had always argued that the Federal Reserve’s bond purchases were not government financing through the printing press, as the increased bond holdings were to be held only temporarily by the Federal Reserve:

“The (FOMC) has often stated its intention to return the Fed balance sheet to normal, pre-crisis levels over time. Once that occurs, the Treasury will be left with just as much debt held by the public as before the Fed took any of these actions.’ When that happens, it will be clear that the Fed has not been using money creation as a permanent source for financing government spending.”

Between 2008 and 2015 the Federal Reserve’s balance sheet total increased from USD 0.9trn to 4.5trn. Only a fraction of this increase was repaid in the course of the economic cycle. After the first round of Federal Reserve measures to combat the catastrophic economic effects of Covid-19, the balance sheet total currently stands at a breathtaking USD 7trn. In reality, the exact opposite of Ben Bernanke’s statement is true: The balance sheet inflation is permanent and is therefore government financing through the printing press.

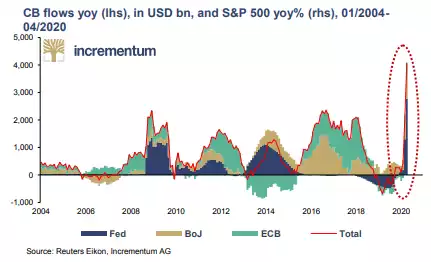

Have the industrial nations fallen prey to QE addiction?

In our view, the occurrence of another recession even before monetary policy normalization confirms that the “medicine” of unconventional monetary policy is at best paused but can no longer be stopped. QE is now conventional monetary policy, part of the new normal, and the (indirect) financing of the state budget via the electronic printing press is the new permanent state of affairs.

There is unanimity among governments and central banks on how to combat the economic consequences of the Covid-19 crisis: As many people as possible should be saved, whatever the cost. Après nous le déluge – the level of debt no longer matters. The combination of an unprecedented economic collapse and soaring debt levels is explosive. The debt is now threatening to get out of hand for good. After the Covid-19 crisis, a worsening debt crisis looms. It will probably no longer be possible to finance the debt, as global savings volumes are no longer sufficient to cover the financing requirements necessary to keep the electronic printing press up and running.

The central banks are not only playing along with the governments’ debt game, they are actively encouraging it. In the case of the eurozone, Madame Lagarde calls for a “common European fiscal response”, which should be “swift, sizeable and symmetrical”. Yet through their actions, central banks are putting the last remnants of their independence at risk. Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, recently answered the question of whether the Federal Reserve would simply print money on the TV show 60 Minutes:

“That’s literally what Congress has told us to do. That’s the authority that they have given us, to print money and provide liquidity into the financial system. And that’s how we do it. We create it electronically. And then we can also print it with the Treasury Department, print it so that you can get money outta your ATM.”

Money printer go Brrr

The realization that the central bank money supply will only know one direction will also affect the highest good of an uncovered fiat currency: confidence. In addition to system-critical gold bugs, an increasing number of fiat-money critics can also be found within the younger generation, most of whom reach this insight by studying cryptocurrencies. As the new QE programs are rolled out, these youthful citizens of the world are taking to social media to hold the overseers of monetary policy responsible. With the implementation of the new QE programs, memes, fun homepages, and YouTube videos have appeared online in the USA around the slogan “Money Printer Go Brrr”. Critics of the current monetary system are still in the minority. However, a world dominated by permanent money printing should increase the popularity of this critical view in the coming years. In addition, even more radical measures such as the implementation of MMT, helicopter money, increased financial repression measures such as cash restrictions, and low negative interest rates can be expected in the course of the next few years.

The Great Monetary Inflation

The extent of the central bank measures is not only of concern to a critical minority of consumers. Assorted investment legends have also been unable to hide their concerns about the ginormous QE programs. For example, hedge fund luminary Paul Tudor Jones has drawn attention in his latest report, entitled “The Great Monetary Inflation”. He states that he is extremely critical of monetary policy and therefore bullish on gold:

“The depth and magnitude of the economic drop-off took modern monetary theory – or the direct monetization of massive fiscal spending – from the theoretical to practice without any debate. It has happened globally with such speed that even a market veteran like myself was left speechless.”

In addition, Jones has expressed a positive view of Bitcoin as a hedge against the incoming monetary tsunami, as he sees a high convexity here. The topic of Bitcoin is also close to our hearts, which is why we regularly report on it in our In Gold We Trust reports, as we did again this year. Recently, we also started offering a fund strategy for professional investors that invests in both physical gold and Bitcoin.

Where does the money flow to?

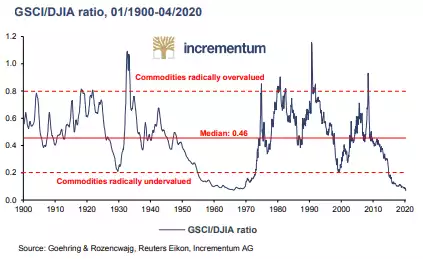

It is very possible that experimental monetary policy will trigger a renaissance of hard assets. If that thesis is correct, the battered commodity sector should also offer opportunities to courageous contrarian investors. Relative to the Dow Jones index, commodities are currently trading at the lowest valuation level since the mid-1960s. Compared to equities, commodities were undervalued to a similar extent only before Black Thursday on October 24, 1929 and during the exaggerations of the dotcom bubble.

Let us take a closer look at the two phases in which commodities were so favorably valued compared to equities, at the onset of commodity bull markets. What both phases have in common is that they were preceded by massive monetary inflation.

The parallels of the decade changes around 1970 and 2000 to the current situation are astonishing. Each time before, an expansive monetary policy had fed a period of bullish stock markets. What the Nifty Fifty were in the 1960s, the dotcoms were in the 1990s and the FAANG stocks are now. Could history now repeat itself? After 1970 and 2000, a decade of commodities began in each case. In the past 10 years we have experienced the most expansive and experimental monetary policy in history, but it has only peripherally reached the commodity markets.

Fiat system goes critical

With the dawn of the new decade, the world will become increasingly interventionist. In keeping with the motto “Once your worldly reputation is in tatters, the opinion of others hardly matters”, all the barriers to new debt are now being breached. Debt no longer plays a role, and zero interest rates and money supply expansion remain the order of the day as far as the eye can see.

The mixed situation at the beginning of this decade holds the possibility that the world monetary order that has existed for almost half a century may be fundamentally unhinged. This is the conclusion reached by an increasing number of analysts working for traditional banks. Deutsche Bank, for example, writes in its outlook for the year 2030 that our monetary system could start to totter before the end of the decade:

“The forces that have held the current fiat system together now look fragile, and they could unravel in the 2020s. If so, that will start to lead to a backlash against fiat money, and demand for alternative currencies such as gold or crypto could soar.”

Savers and investors will find it increasingly difficult to navigate their assets safely through the coming times. While the world is threatened by a flood of fiat currencies, safe havens are scarce. Gold could also increasingly compete with bonds in an era of negative interest rates. The conditions for investing in gold could not be better. While we do not know what the level of debt or the money supply will be at the end of the decade, in the case of gold or even Bitcoin, it is quite likely that there will be a relative shortage.

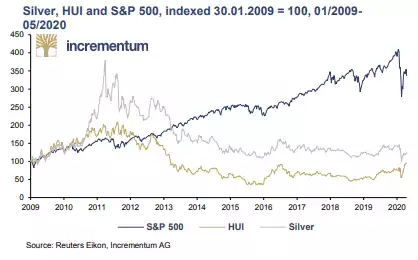

Historically, permanent central bank-financed debt has always led to rising inflation rates. In addition, silver and mining stocks are good investments for inflationary scenarios. Both assets have been rather shunned by traditional investors in recent years and are still relatively cheap. Therefore, we are devoting a chapter to silver and silver mining stocks in this year’s In Gold We Trust report.