IMF Global Financial Stability Warning

News

|

Posted 20/04/2017

|

5757

The IMF have just released their latest Global Financial Stability Report and it yet again screams warnings of the implications of all the additional debt accumulated since the GFC.

The main message of the report is that as interest rates inevitably rise the servicing cost of all that debt could bring the whole system down. Before we get into that at a corporate scale lets remind ourselves of the headlines in Australia just 2 days ago “This thing’s gonna blow’: Top economists’ interest rate warning” –

“Mr North's modelling shows 669,000 families (or 22 per cent of borrowing households) are in mortgage stress. That would rise to 1 million households, or one third of borrowers, if interest rates rose by 3 percentage points.

But the main factors in Mr North's reckoning are the static nature of wages and the rising tide of under-employment.

"This falling real income scenario is the thing that people haven't got their heads around," he told Fairfax Media.

"Unless we see incomes rising ahead of inflation and under-utilisation dropping, any increase in interest rates is going to have a severe impact on [people's] wallets and therefore in discretionary spending and therefore on growth.

"I have a feeling we are meandering our way, perhaps a little bit blindly, into a rather similar scenario to the US [referring earlier to this being like the US subprime market that caused the GFC]."”

But back to the IMF report…

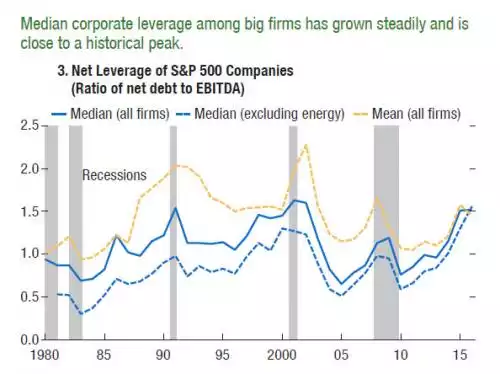

Here is a graph showing median corporate leverage (the ratio of net debt to earnings) has risen higher than the onset of any recession in the last 40 years.

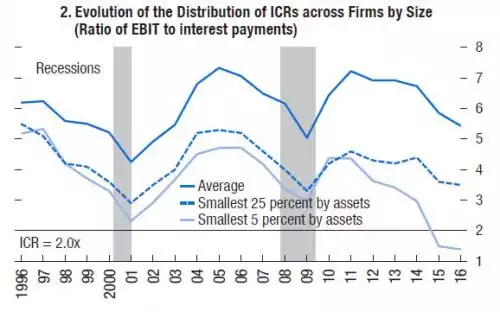

Now debt is no big deal if you can service AND repay it, but like the Australian housing warning, corporate America has a similar issue with the threat of rising rates and how to even service it. The following graph shows the Interest Cover Ratio (ICR – or the ability for current earnings to cover interest expenses) for the S&P500, and again we are well into territory previously only seen in recessions:

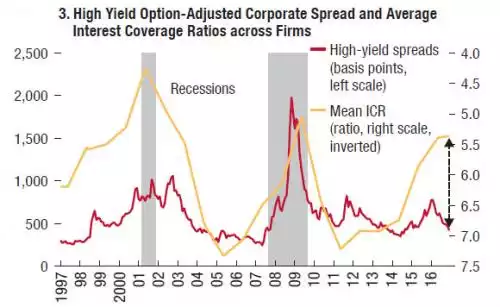

Their third chart then highlights the current phenomenon of “hope” driving markets in that in the past such a low ICR would see the market ‘pricing in’ (through widening corporate bond yield spreads) the clear and evident risk with corporate debt; but not this ‘everything’s awesome’ market….

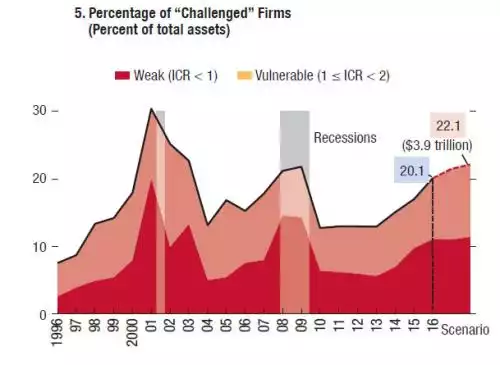

So where to from here? The IMF assesses that currently 10% of firms (measured evenly by assets) are what it calls “challenged” in that they appear unable to pay interest costs from current earnings. That is a high number but under an ‘adverse’ scenario of rising interest rates that jumps to a staggering 22% or $3.9 trillion. Such a mass default would dwarf that of the GFC’s subprime crisis which was ‘only’ around $1.5 trillion.