IMF’s “Bad Boom”

News

|

Posted 27/06/2018

|

6848

We have written previously of the record setting amount of corporate share buybacks happening this year (most recently here). Companies have been the biggest single buyers of shares this year, usually on dips, leading the broader market to believe that everything is indeed awesome and adding to complacency. When the US sharemarket had those decent drops in February this year a Bloomberg article at the time said:

“All that buying insulates the market against drops, which causes volatility to drop. Lower volatility causes humans to think stocks are safer than they are and computers to actually calculate that. Everyone piles into stocks, which lowers volatility further, until there's a big blow-off like last week. "Stock buybacks are in effect creating low volatility," says Christopher Cole, a hedge fund manager who has been warning that volatility has been artificially and dangerously depressed for a while. "Share buybacks are like a giant synthetic short-volatility position."”

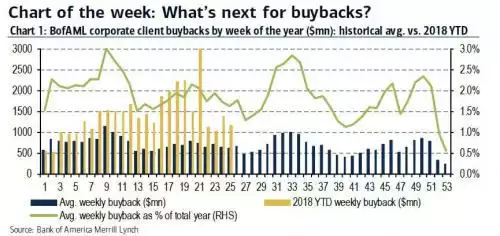

Fast forward to now and it is still going strong as illustrated in the below chart from Bank of America Merrill Lynch.

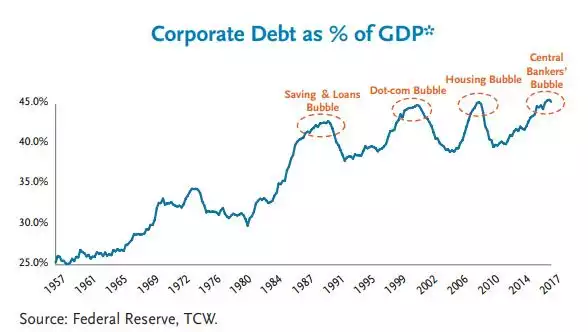

Many assume most of these buybacks are funded with surplus cash that would otherwise be reinvested into future proofing productivity investments rather than short term share price that may or may not be linked to bonus incentives of executives… However there is strong evidence that many corporates are still using (still) relatively cheap debt to fund these buybacks. That debt can often be via the issuance of corporate bonds. The following graph may therefore be a little instructive…

Whilst that graph alone may send shivers down your spine, it doesn’t differentiate between investment / high grade (IG / HG) and high yielding (HY or often called ‘junk’) corporate debt. Drilling down on those adds a new level of concern.

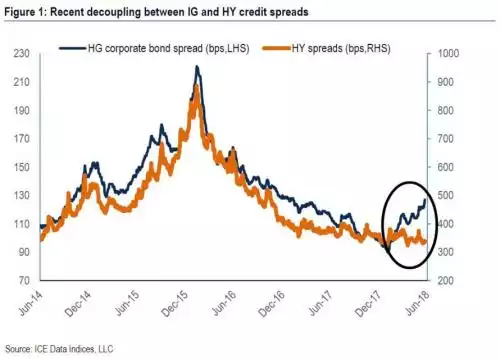

Firstly the chart following shows how the 2 are unusually diverging in terms of spreads (indicating stronger demand for junk than high grade)..

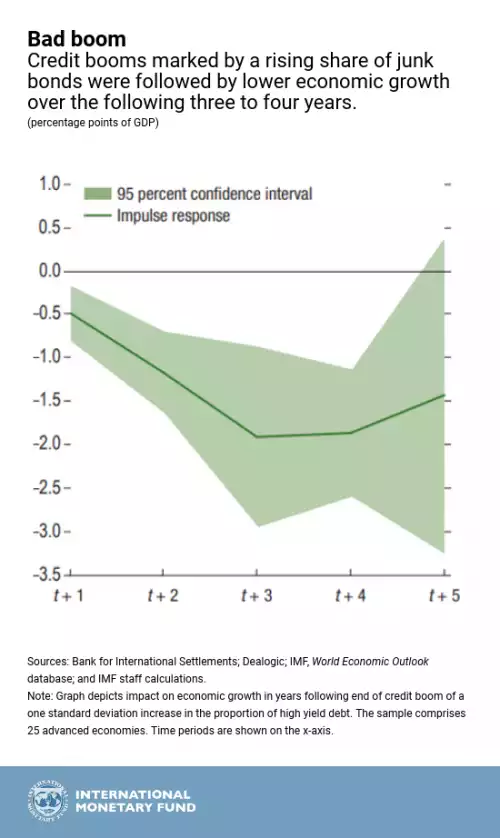

So is that cause for concern? The International Monetary Fund (IMF) think so. They are pointing to this growth in HY bonds as signs of what they call a ‘bad boom’.

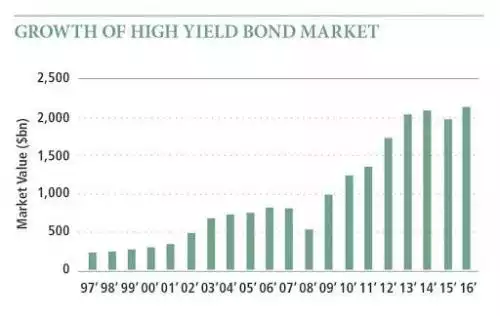

“Another method is to look at the bond market to see how much of the money companies and governments are borrowing consists of high-yield debt, also known as junk bonds. (These are bonds that offer higher yields to make up for the greater risk of default by the borrower.) The larger the proportion of high-yield debt, the higher the level of risk in the financial system.”

The amount of HY bonds has never been greater and the speed of growth quite phenomenal.

So what exactly is a bad boom?

And how do we get there? In the IMF’s words:

“it is fuelled by excessive optimism among investors. When the economy is doing well and everybody seems to be making money, some investors assume that the good times will never end. They take on more risk than they can reasonably expect to handle.”

The warning bells keep chiming…