IMF Downgrade Lowest Since GFC – What this means.

News

|

Posted 10/04/2019

|

4658

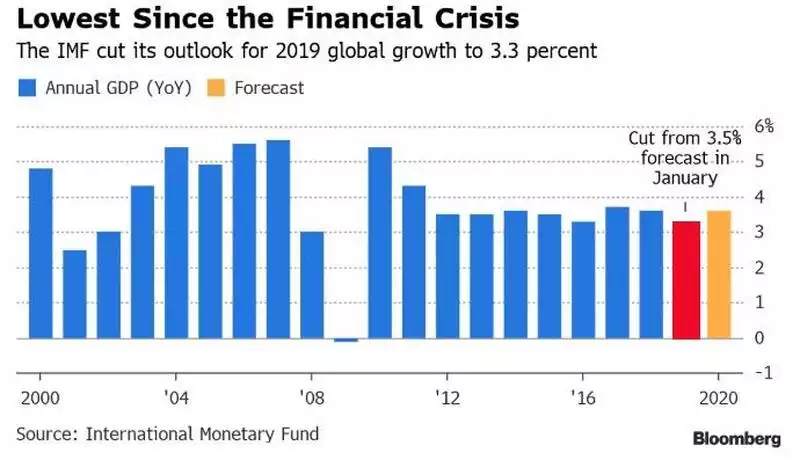

Wall Street had a bad night last night and gold rose, both largely off the back of yet another downgrade to global growth by the IMF, its 3rd downgrade in 6 months.

The IMF are now forecasting the worst global growth since the beginning of the GFC citing:

“Following a broad-based upswing in cyclical growth that lasted nearly two years, the global economic expansion decelerated in the second half of 2018……Activity softened amid an increase in trade tensions and tariff hikes between the United States and China, a decline in business confidence, a tightening of financial conditions, and higher policy uncertainty across many economies”

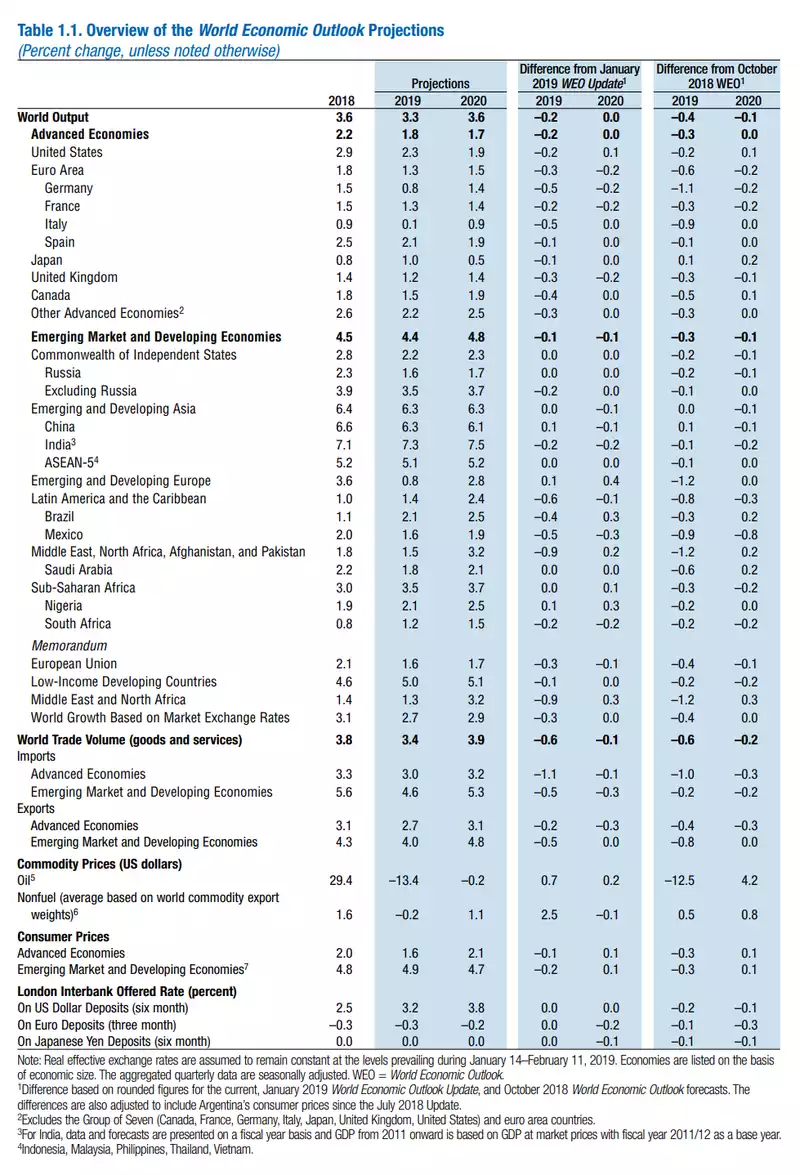

Whilst 3.3% may look healthy, that number is heavily boosted by fickle Emerging Markets, with Advanced Economies now down to 1.8% this year, declining to 1.7% next and 1.6% in 2024, i.e. no rebound and no acknowledgement of a recession in the next 5 years! Again, a reminder, the trend is constant downgrades as it continually gets worse than they anticipate.

By country, you can see every single country except Nigeria was cut and whilst they are ‘buying’ the better news out of China last week, they don’t see it as structural, decreasing China again next year.

"In the face of significant financial vulnerabilities associated with large private and public sector debt in several countries, there could be a rapid change in financial conditions owing to, for example, a risk-off episode or a no-deal Brexit"

And so the market will look to the central banks to come to the rescue. On this the IMF sound a clear warning:

“Amid waning global growth momentum and limited policy space to combat downturns, avoiding policy missteps that could harm economic activity needs to be the main priority,”

This really should not be news to equities markets despite the ‘surprise’ dip last night. Earnings forecasts are currently flagging this loud and clear. Morgan Stanley produced the graph below showing the worst plunge in EPS (earnings per share) growth since the GFC

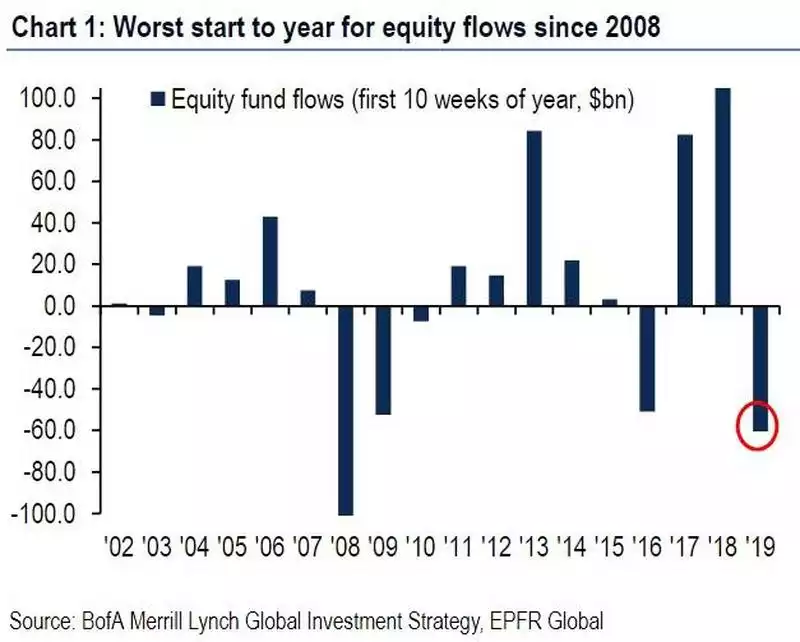

And so it should not be a surprise that Morgan Stanley point out that “More than 100% of the rally in stocks this year has come from multiple expansion”. So who is buying and propping up the price over earnings fundamentals? The following chart shows it’s clearly not equities funds, who are bailing out at the fastest pace since 2008. We know that corporate share buybacks are up 30% on last year and of course, just like the GFC when the smart money bailed just in time, offloading it to the retail mum and dad investors to take the fall again. Will that be you? How many warnings do you need to hear?