If it looks like a recession and feels like a recession….

News

|

Posted 05/12/2019

|

13485

Yesterday saw the latest GDP figures released for Australia. Not only were they moribund but they were even worse than consensus expectations. Q3 printed just 0.4% (against expectations of 0.5%) and year on year 1.7% which remains the weakest since the GFC. Per capita it remains essentially nil.

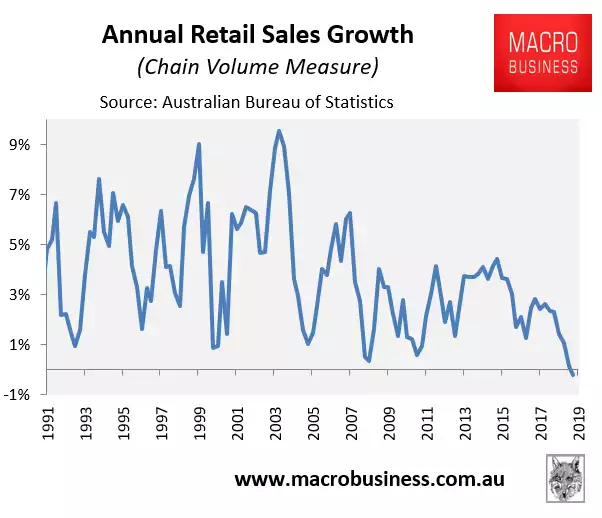

However looking behind the headline it quickly becomes apparent that government spending and exports are doing all the heavy lifting and indeed the private is actually in recession. We continually hear of the BBQ stories of everyone talking about how tough it is out there and this data confirms as much. The much discussed ‘retail recession’ continues to present in obvious ways like ‘Black Friday’ sales still going and large retailers talking of bringing Boxing Day sales forward of Christmas. Things are tough. The September quarter retail sales figures from the Australian Bureau of Statistics revealed that retail sales volumes declined for the first time since the early-1990s recession, falling by 0.2% year-on-year:

Often another bellwether for economic conditions, new car sales, also yesterday saw November numbers plunge 9.8% for the year (11.3% from March 18 peak), the 20th consecutive monthly drop.

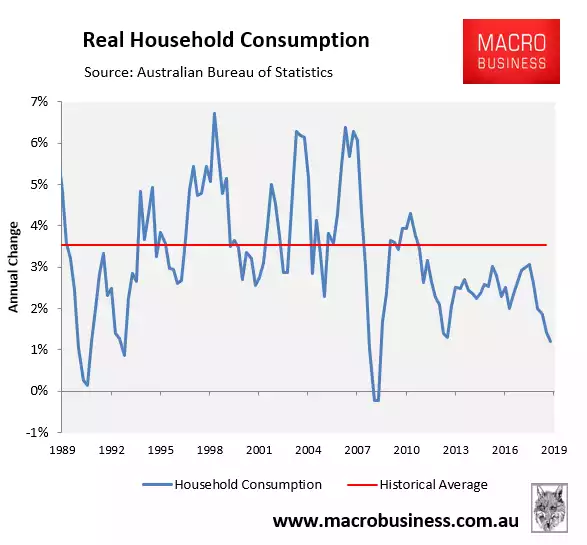

More broadly, household consumption crashed to its lowest since the GFC at just 1.2% compared to the historical average of 3.5%:

A large contributor is the toxic combination of Australia having the 2nd highest personal debt in the world against confirmation in yesterday’s national accounts that real average wages is 2.2% lower than the start of a continual downward trend since March 2012. That is not a formula for spending and hence private Australian consumption’s contribution to GDP, normally a large contributor, is so poor. That combination of Aussie debt and disposable income just keeps getting worse at a world record setting pace:

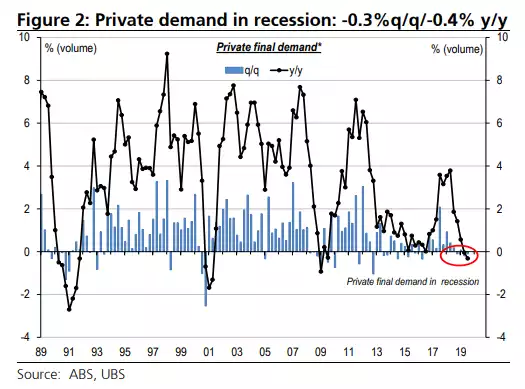

This is all reinforced from UBS’s summary of yesterday’s GDP print:

“Domestic demand weakened to 0.2% q/q & a 4-year low 0.9% y/y; despite booming public [government] demand (1.7%, 5.2%) adding a very large 0.4%pts & 1.2% y/y to GDP; as public consumption lifted (0.9%, 6.0%), & public investment rebounded sharply (5.4%, 2.1%). Worryingly, private demand fell into recession (-0.3%, -0.4%). Within this, business investment contracted again (-2.1%, -1.7%); as mining relapsed (-7.8%) but non-mining bounced (1.2%). Consumption (0.1%, 1.2%) slumped to the ~worst since the GFC. The housing downturn got worse (-1.7%, -9.6%). Elsewhere, inventories ~steadied (0.1%pts, -0.3%pts); but net exports added solidly (0.2%pts, 1.1%pts).”

The Aussie dollar shot up on the RBA holding rates steady on Tuesday as they remain backed into a corner with house prices rebounding against an otherwise poor economy. Cut rates and risk an exacerbation of the observations above about debt and wage growth. Keep rates (or monetary stimulus) as is and risk a more immediate AUD jump and broader recession.

On balance, UBS think expectations of a rebound are too high and there’s more cuts to come (as did Westpac as we reported last week here):

“Q3 real GDP remains soft, with little improvement so far from rate cuts & tax cuts, as households either save more or repay debt; seeing private demand fall into recession. We reiterate our below consensus GDP forecasts of 2.1% in 2020 (mkt: 2.4%, RBA 2¾%) & 2.5% in 2021 (RBA 3%). For the RBA, Q4 GDP needs to rise ~0.7% q/q to hit their 2.3% y/y forecast, albeit their Feb-20 SOMP may be ~unchanged. However, with weaker consumption, unemployment will remain too high & CPI below target. Overall, we remain more dovish than consensus, & still expect a 25bp rate cut in Feb-20 as likely (assuming no material fiscal stimulus in MYEFO), & then another 25bps cut to 0.25% by mid-2020; albeit the latter remains conditional on more global central bank easing.”

Gold and silver have seen a predictable pull back since they surged over 20% this year. As we wrote last week, analysts are predicting that buying opportunity may be about to end. The window for getting your wealth protected before this private recession turns into a broader recession at such prices may be about to close.