How Gold Performs

News

|

Posted 04/04/2022

|

7198

On Friday we shared the very solid year to date performance of gold this year (and every year since 2000) in a variety of currencies. What is particularly important to note is that the performance of gold this year has been achieved ostensibly with relatively limited ETF involvement as equities traders may have just pivoted from growth to value shares and not yet gold with gusto. We share more of the In Gold We Trust preview charts to illustrate.

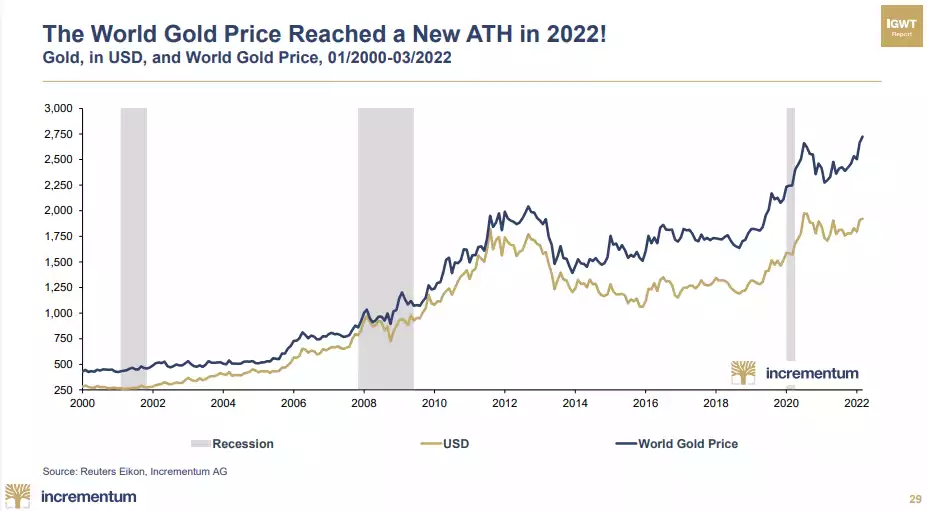

Consider that in a basket of global currencies, gold hit a new all time high this year:

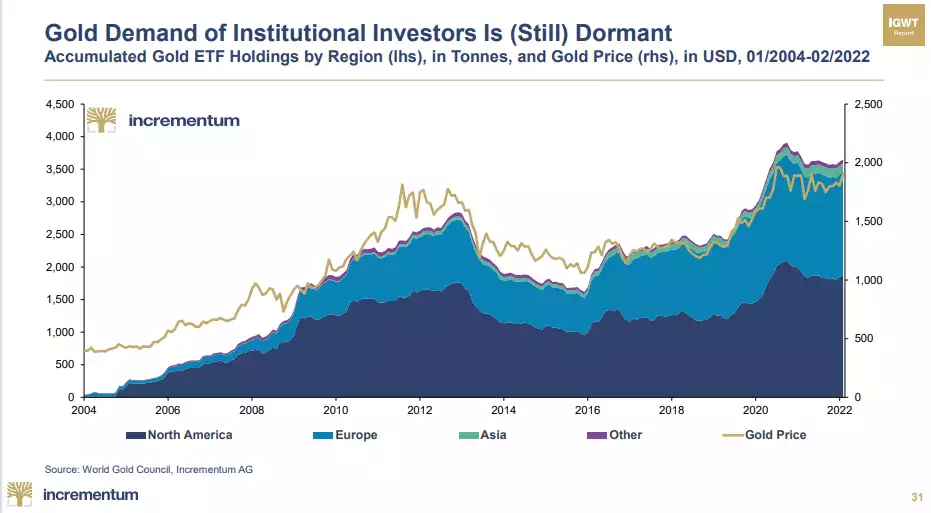

And yet that has not been driven by the funds that only deal in ETF’s..

However, and somewhat counterintuitively, looking at gold ETF holdings against the entire 5000 company Wilshire 5000 index, you can indeed see the sudden rotation into gold.

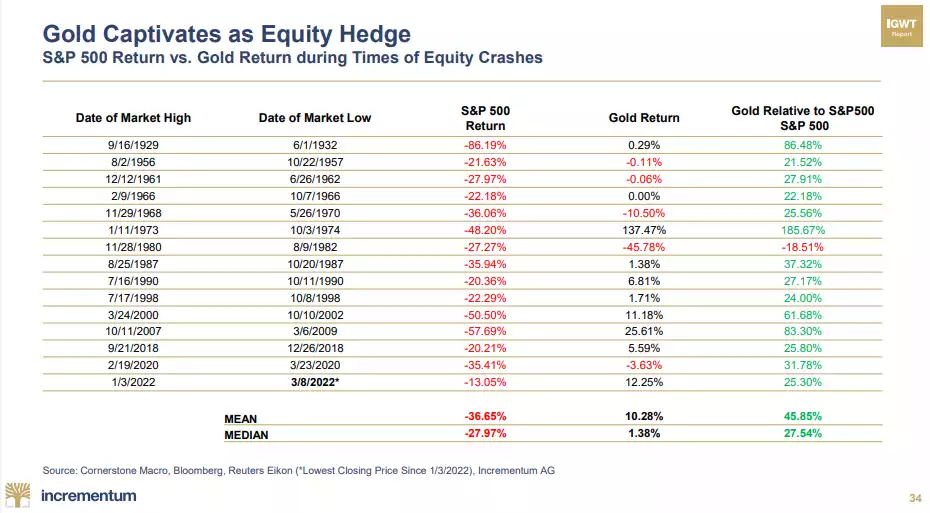

Why? Well history tells us that lack of correlation, and indeed negative correlation between shares and gold says it is one of the best places to be when markets crash…

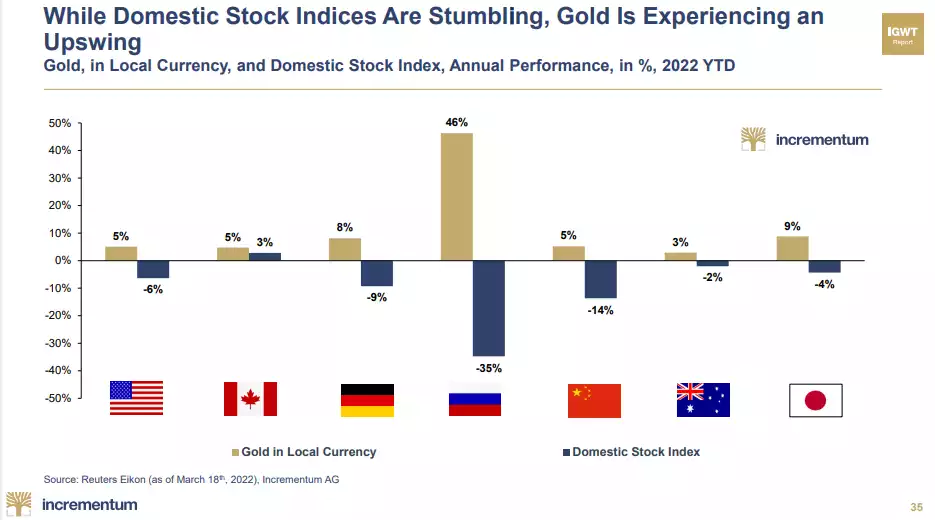

And that is playing out already around the world with gold in the positive and shares negative…

Last week we stepped through why a recession is now almost a certainty and the stagflationary environment we are likewise almost certainly in. The writing is on the wall, its only a matter of whether you prefer buying low and selling high or the other way around. That classic saying ‘better a year too early than a day too late’ should be front of mind….