HODLer Dominance Remains in Draw Down

News

|

Posted 12/04/2022

|

8277

A powerful set of tools for tracking the cyclical nature of Bitcoin cycles is onchain activity, broadly described as the utilisation of block-space via active network participants sending transactions and settling values. Metrics that describe this include active addresses/entities, transaction counts, mempool congestion, and fees paid.

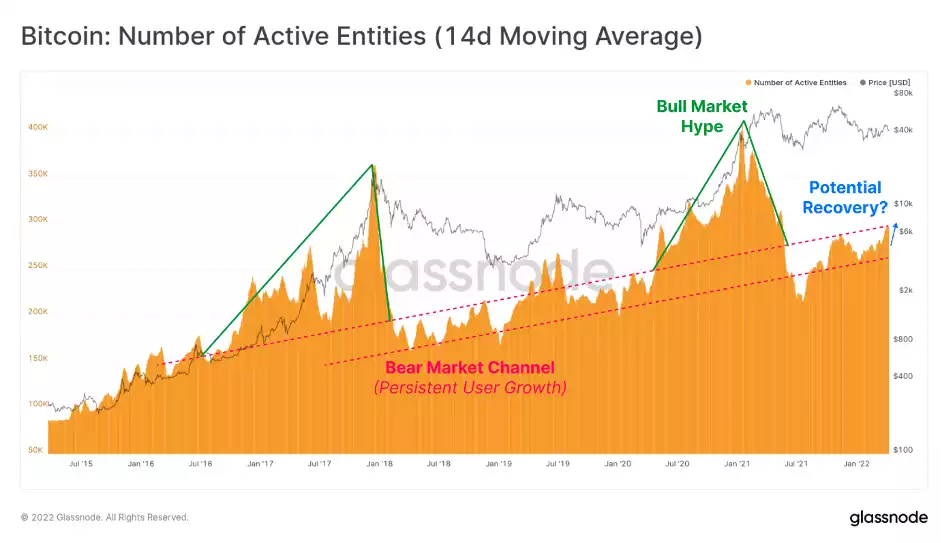

Across this suite of metrics, it is hard to find many observations that suggest the network user-base is recovering or growing strongly. The number of active entities (analogous to daily active users) remains within the bear market channel that has been established over the last six years. That said, the current active entity count of 296k/day is at the upper end of this channel, and a sustained expansion higher would be constructive.

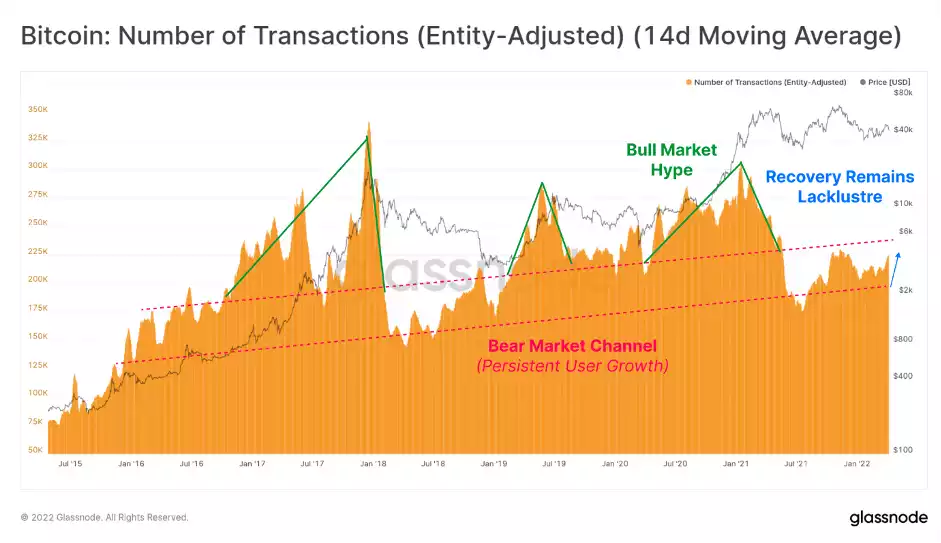

Transaction counts are also relatively lacklustre, currently at around 225k transactions per day, which is similar in magnitude to during the 2019 bear market. As with active entities, this metric has recovered from the lows of the collapse back in May-July 2021 but is a far cry from the hype cycle observed during bull markets (shown in green).

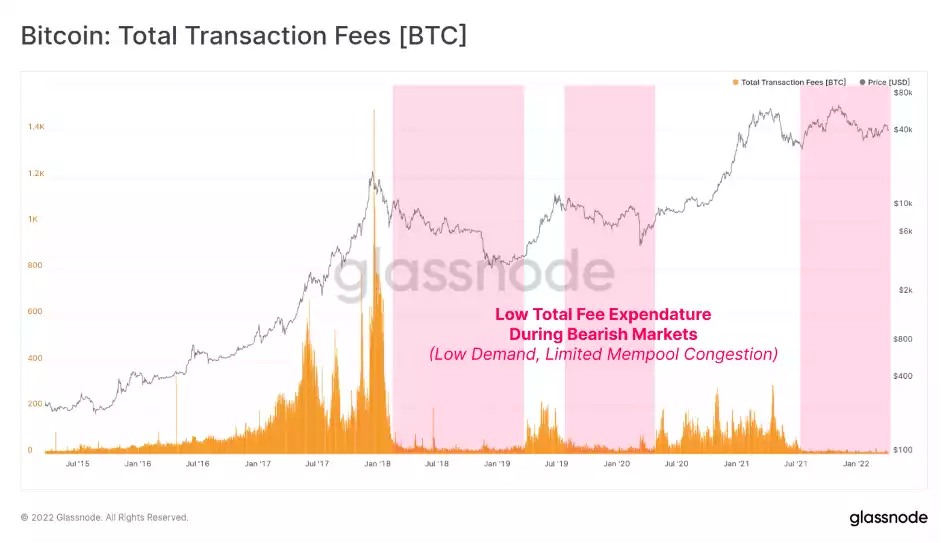

A result of this relatively low demand for Bitcoin block space is that there is little network congestion, and thus a low aggregate in transaction fees paid. Total transaction fees paid to Bitcoin miners have been languishing near all-time-lows since May, supporting the above observations that the recovery in onchain activity is lacklustre at best.

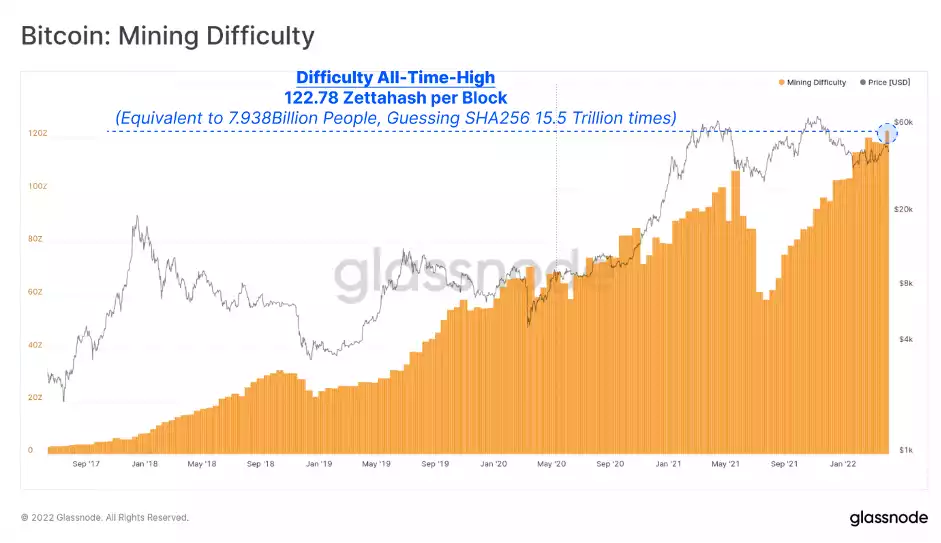

Despite network transaction fees being near all-time lows in (BTC denominated terms), the competition in the mining industry continues to set new all-time highs. The protocol mining difficulty has now reached a new ATH, with each Bitcoin block requiring 122.78 Zettahashes to solve.

This would be equivalent to all 7.938 Billion people on earth each guessing a SHA256 hash 15.5 Trillion times, every 10mins to solve each Bitcoin block. Quite extraordinary.

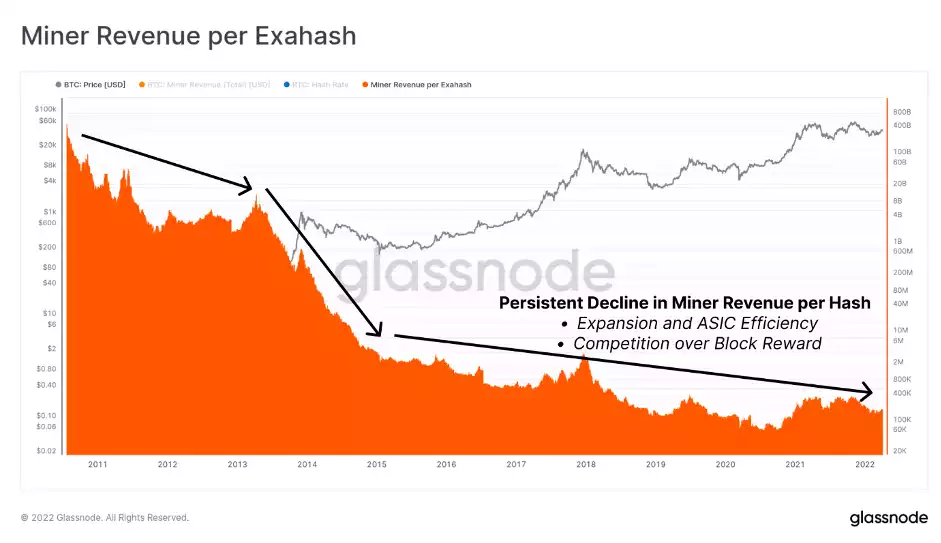

Competition in the mining industry is notoriously fierce, as miners seek to arbitrage the energy/BTC price ratio by finding the cheapest available sources of power and capital funding. As hash-rate competition expands, ASIC efficiency and rig counts increase, and the revenue earned per hash is driven ever lower over the long term. The chart below shows this long-term trend which illustrates, on a log scale, just how competitive the landscape for acquiring the ever-declining Bitcoin block reward is.

Now to look at holder cohorts…

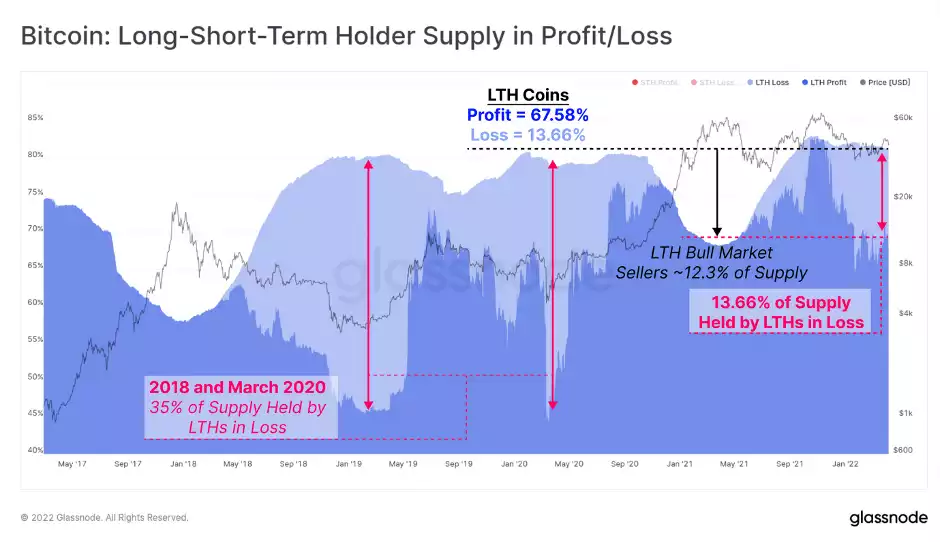

Bitcoin Long-term holders (LTHs) currently hold 13.66% of the supply that is at an unrealized loss, which is a sum approximately equal in magnitude to the amount of sell-side they applied in the 2020-21 bull market. LTH coins are the least likely to be spent and sold on a statistical basis, and it can be seen in 2018 and March 2020 that they have held through much deeper losses in the past.

The proportion of LTH coins held at a loss reached over 35% of supply in the depths of previous bear cycles, which is 2.5x more relative coin volume than we have in the current market.

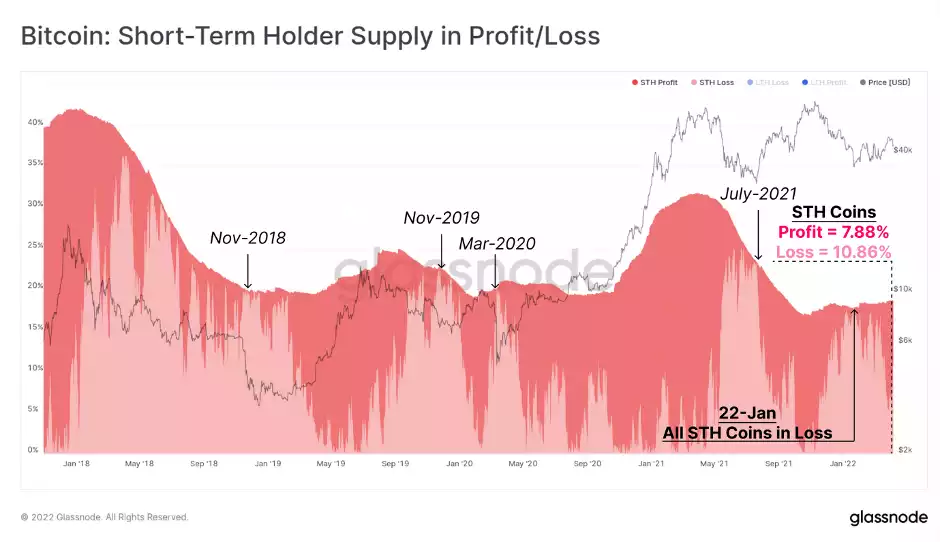

Short-Term holders (STHs) own far fewer coins compared to LTHs (18.74% of supply), however, this cohort has seen a marked jump in the profitability of late. As the market rallied out of the consolidation range, new accumulators (STHs) that acquired coins between $33k and $42k have returned to an unrealized profit, showing that investors saw value in that price range.

This is a positive development compared to the recent market lows on 22-Jan, where 100% of all STH coins were at a loss. Improving investor profitability, especially in this more price-sensitive STH cohort tends to lower the probability of panic-driven sell-side pressure.

The Bitcoin market has pulled back this week after a break-out from the multi-month consolidation range. Prices have thus far struggled to find much sustained upside momentum, and there are indications of a modest volume of profit-taking by investors. Especially across onchain activity metrics like transaction counts and active users, the recovery has thus far been relatively lacklustre and continues to suggest Bitcoin is a HODLer dominated market, with few new investors flowing in.

That said, network profitability has improved indicating significant re-accumulation took place since January. The aggregate profitability of the network remains in a far healthier position compared to prior bear cycles.