He said What!? Confusion reigns over Fed

News

|

Posted 01/08/2019

|

8204

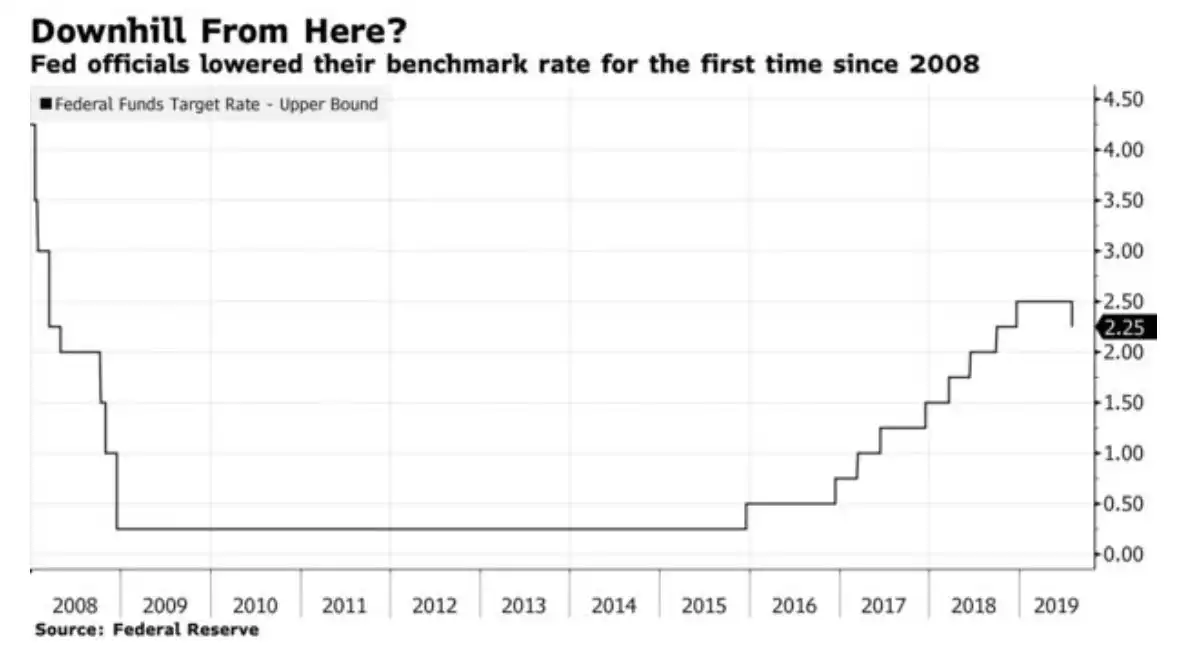

Wall Street fell over 1% last night across the board – shares AND precious metals - whilst the USD and UST yields strengthened off the back of the much anticipated July US Fed meeting seeing a 0.25% cut to 2.25%. That is the first rate cut since the onset of the GFC in 2008 when they quickly cut to near zero.

The question you may ask is, if this cut was so widely anticipated why the big reaction by the market and why from both risk-on shares and risk-off gold? Maybe not something you will hear often, but maybe Mr Trump said it best:

Now let’s dissect that a bit, including the large dose of irony within.

The lead up to last night was not so much about IF they would cut but rather would they cut by 25 or 50bp. They only delivered 25bp. That sees less sugar for shares and less deeply real interest rates for gold.

Hopes of this being the “beginning of a lengthy and aggressive rate-cutting cycle” were also dealt a blow with Chairman Powell stating in the press conference afterwards:

“We’re thinking of it as essentially in the nature of a mid-cycle adjustment to policy” and “It’s not the beginning of a long series of rate cuts,” and it was to “insure against downside risks”.

But he later left the door wide open by also saying “I didn’t say it’s just one” rate cut and the usual backstop of:

“As the committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.”

Of course the irony of Trump saying how awesome his economy is and simultaneously calling for “a lengthy and aggressive rate-cutting cycle” can’t be ignored….

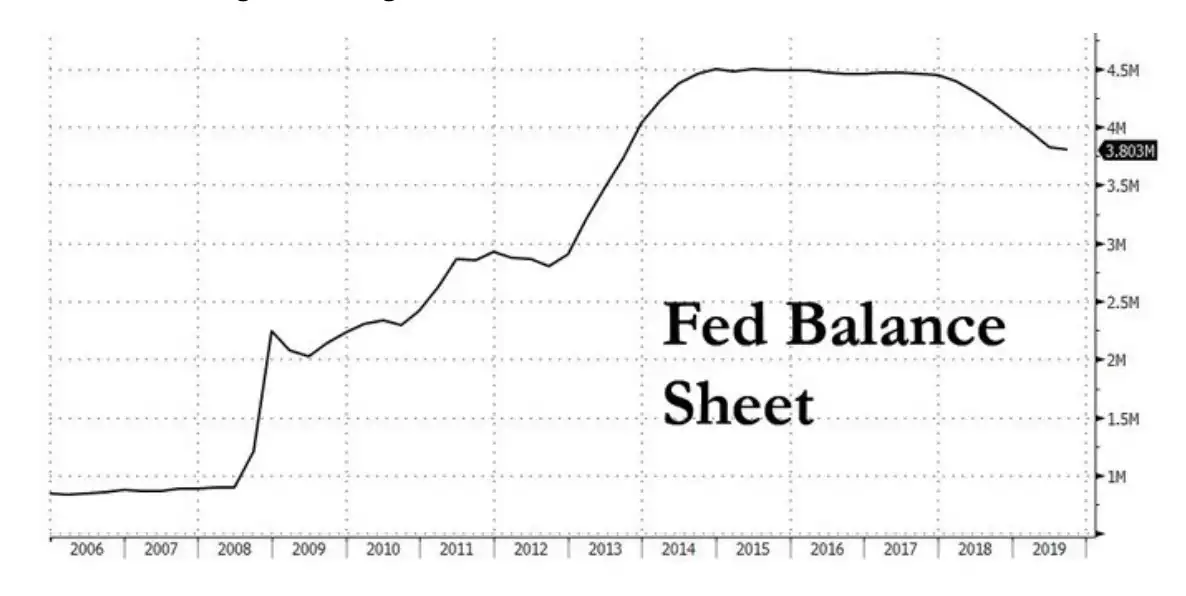

Trump’s reference to the Fed ending their Quantitative Tightening is the announcement that effective today, some 2 months earlier than forecast, the Fed will stop the monetary tightening of reducing it’s balance sheet. For newcomers, when the Fed employed Quantitative Easing (QE) after the GFC it bought bonds (debt) with freshly printed money and put those bonds (debt) on its balance sheet as assets. Some $4.5 trillion worth… As part of their tightening (abandoned in December from an interest rate perspective but continued with QT) they have been reducing this pile of “assets”. But they only got to $3.8 trillion before abandoning that as well. The Fed, to be clear and despite the jawboning from Powell, are now in easing mode again.

Take a good look at the chart above (the M’s should be T’s btw). See that $800 billion balance sheet in 2007? It took the Fed nearly 100 years (since 1913) to amass that much. They then proceeded to expand that by nearly that same amount on average each year for 6 years after the GFC. So, in context, a 700 billion reduction might seem a little underwhelming given how ‘awesome’ everything apparently is.

And so you may well see the conundrum before markets and hence the reaction overnight. The Fed is saying one thing (well 2 actually, just to make it more confusing) but the reality seems anything but.

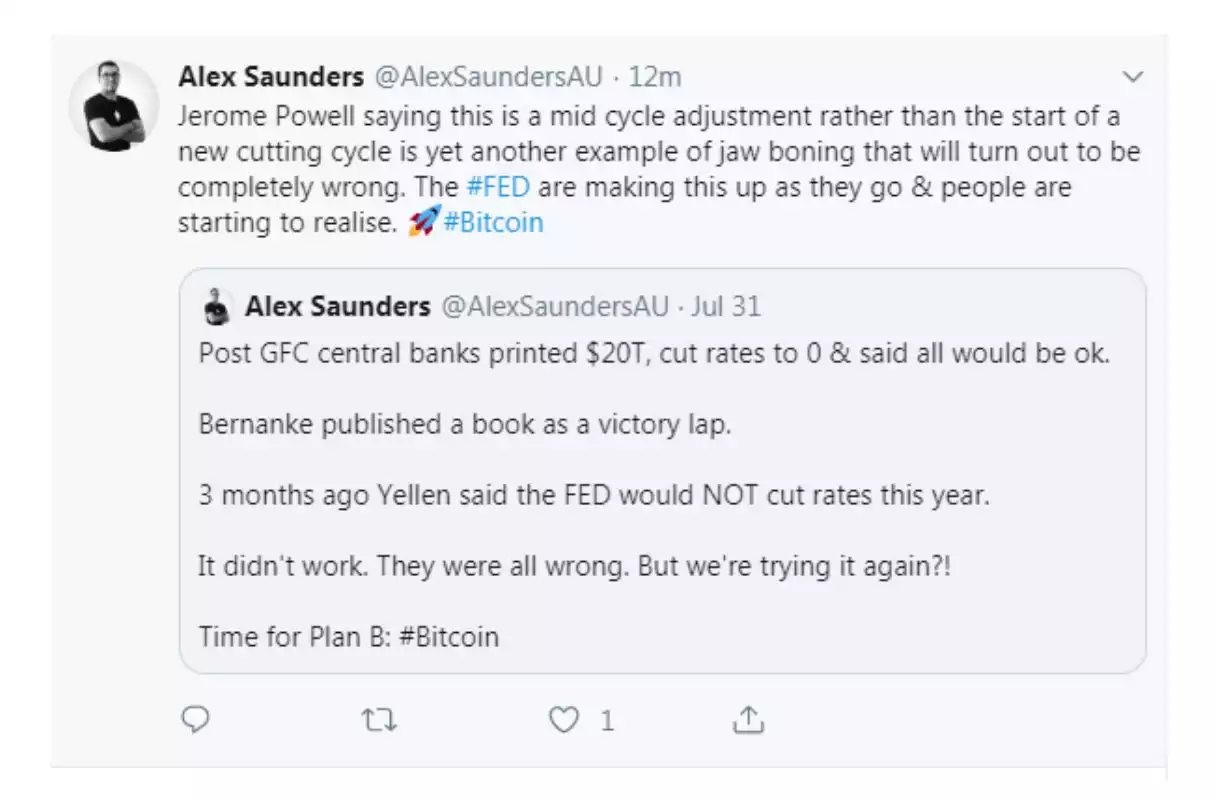

Nuggets News’ Alex Saunders tweeted succinctly this morning:

Speaking of Nugget, check out his interview with yours truly posted last night. It covers bullion storage, confiscation and bail ins. You can see it here.