Great Liquidity Crisis – JP Morgan’s Warning

News

|

Posted 10/09/2018

|

10065

Many people theorise what will cause the next financial crisis and what will it look like? JPMorgan's global head of quantitative and derivatives strategy, Marko Kolanovic says the dominance of passive, quant, and ETF funds on shares at the moment will lead to what he calls the Great Liquidity Crisis. Here’s what he said just last week:

“What will the next crisis look like?

This year marks the 10th anniversary of the 2008 Global Financial Crisis (GFC) and also the 50th anniversary of the 1968 global protests. Currently, there are financial and social parallels to both of these events. Leading into the 2008 GFC, some financial institutions underwrote products with excessive leverage in real estate investments. The collapse of liquidity in these products impaired balance sheets, and governments backstopped the crisis. Soon enough governments themselves were propped by extraordinary monetary stimulus from central banks. Central banks purchased ~US$10 trillion of financial assets, mostly government obligations. This accommodation is now expected to reverse, starting meaningfully in 2019. Such outflows (or lack of new inflows) could lead to asset declines and liquidity disruptions, and potentially cause a financial crisis.

We will call this hypothetical crisis the “Great Liquidity Crisis” (GLC). The timing will largely be determined by the pace of central bank normalization, business cycle dynamics, and various idiosyncratic events such as escalation of trade war waged by the current U.S. administration. However, timing of this potential crisis is uncertain. This is similar to the 2008 GFC, when those that accurately predicted the nature of the GFC started doing so around 2006. We think the main attribute of the next crisis will be severe liquidity disruptions resulting from these market developments since the last crisis:

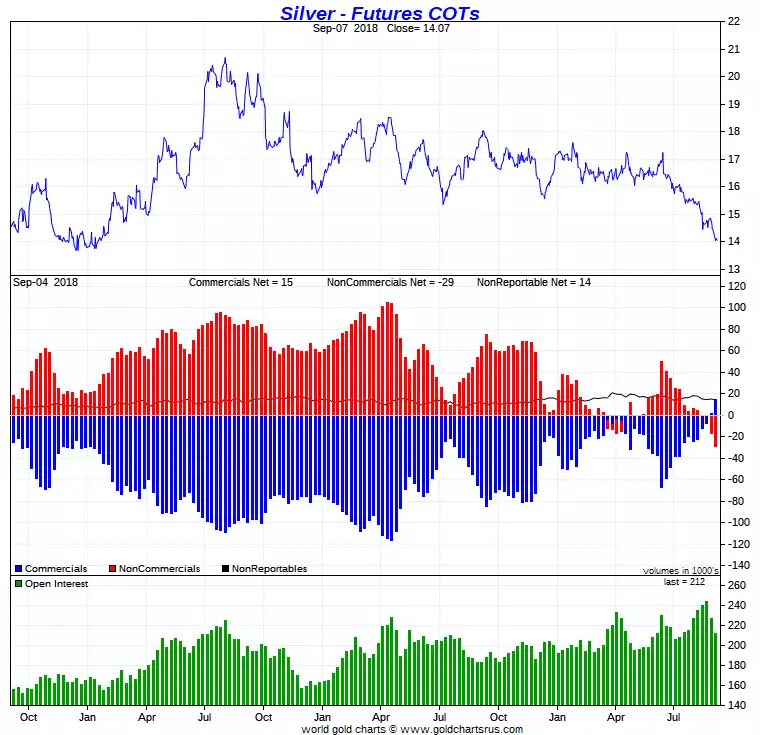

Shift from Active to Passive Investment. We have highlighted the growth in passive investment through ETFs, indexation, swaps, and quant funds over the past decade, transforming equity market structure and trading volumes. For instance, as of May 2018, total ETF assets under management (AUM) reached US$5.0 trillion globally, up from US$0.8 trillion in 2008. We estimate that Indexed funds now account for 35-45% of equity AUM globally, while Quant Funds comprise an additional 15-20% of equity AUM. With active management declining to only one-third of equity AUM, we estimate that active single-name trading accounts for only ~10% of trading volume. We estimate ~90% of trading volume comes from Quant, Index, ETFs, and Options. The shift from active to passive asset management, and specifically the decline of active value investors, reduces the ability of the market to prevent and recover from large drawdowns. Figure 1 illustrates the trend in passive assets, showing the growth of passive equity fund AUM as a % of total equity fund assets since 2005.”

90% is quite an extraordinary number on ‘auto pilot’. For Kolanovic, the head of JP Morgan’s quant funds, to be highlighting the danger of that very product is as disturbing as it is telling.

Quant Funds are funds that invest in shares using advanced quantitative analysis software programs meaning investment decisions are determined by numerical methods rather than by human judgment.

This is topical as this week we have some very exciting news to share around this space. Many of the trading ‘bots’ out there use similar quantitative analysis or Artificial Intelligence methods. Markets are driven by human behaviour and quants often ignore that dynamic. That’s great when upward momentum devoid of fundamentals is at play. Kolanovic warns above of the danger of that approach when things turn. Imagine an Artificial Intelligence platform that looked deeper, learned deeper, and analysed a full spectrum of parameters including human sentiment and other qualitative, not purely quantitative, factors to determine ‘what’s next’?

Imagine too, if you had access to that platform?

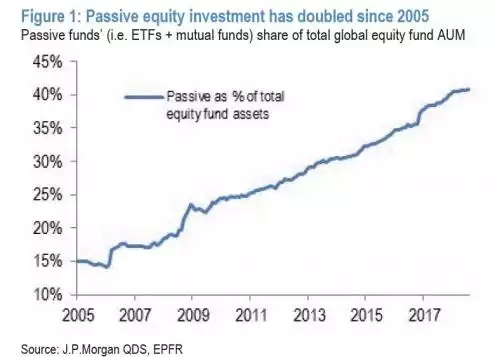

Is it any coincidence that the very same J P Morgan is now long silver and sitting on the world’s biggest physical hoard. Just check out the COMEX setup on silver now…. Wow, just wow…