Goldilocks US Employment Good For Gold

News

|

Posted 07/06/2021

|

6000

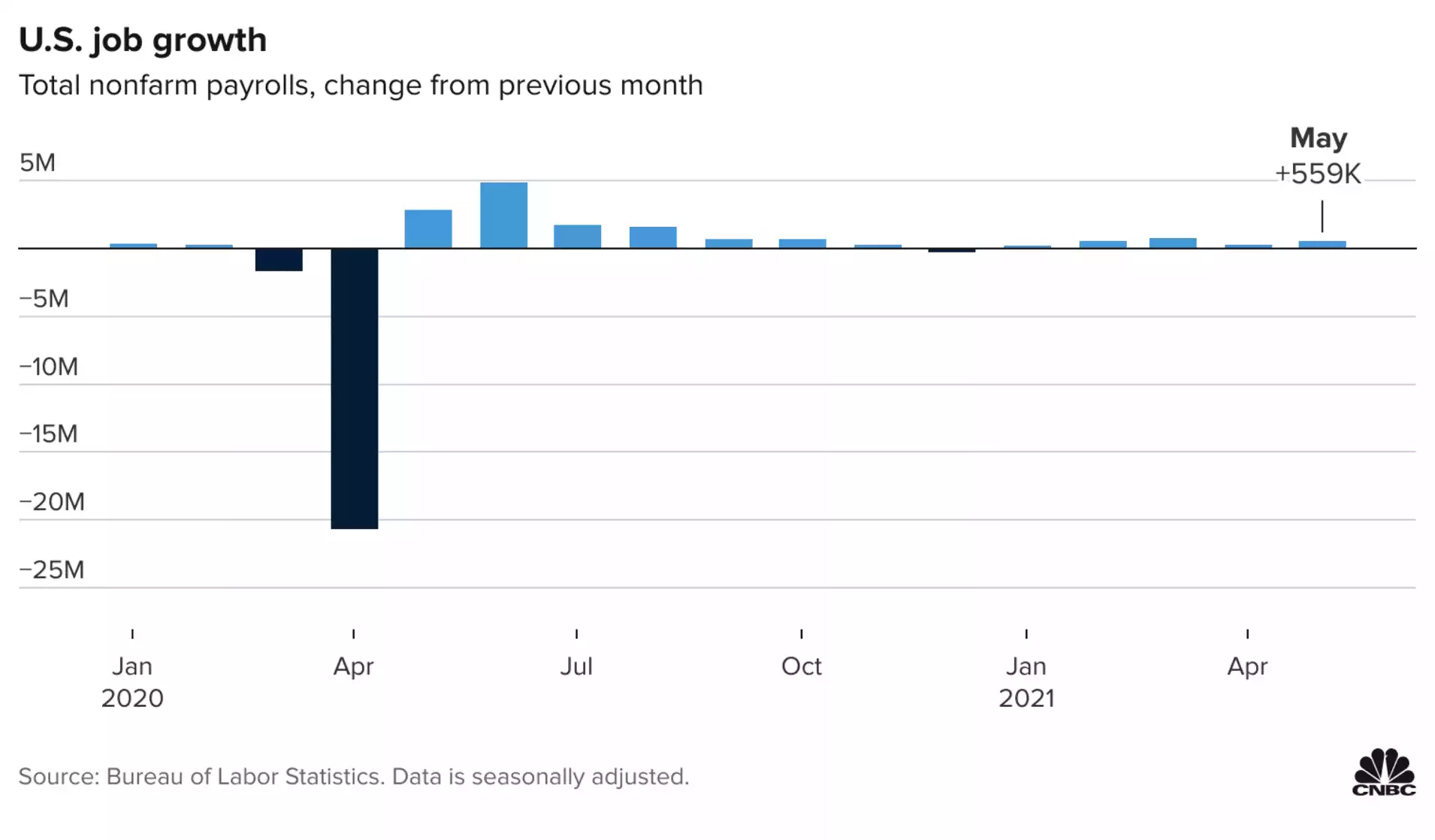

After the better than expected jobless claims we discussed Friday, the US nonfarm payrolls came out on Friday night and fell below expectations but was strong enough to maintain faith in an improving economy. It was the quintessential ‘goldilocks’ outcome.

Against expectations of a 671K print, the US added just 559K jobs in May, the second month below estimates. In our bad-news-is-good-news world, the market surged and the USD fell as that clearly maintained the Fed’s mandate to maintain easy monetary policy. The Fed’s mandate is to both keep inflation in check but also maintain full employment. That they have said the former will be transitory and the latter still not achieved with unemployment still at 5.8% (down from 6.1%), fears of tapering evaporated. The free money game continues… printers go brrrr…

Looking further under the bonnet, nearly all the new jobs were in ‘Leisure and Hospitality’ and education, both key beneficiaries in a reopening economy. But concerningly both construction and manufacturing were weak. The chart below puts these numbers into perspective when April 2020 changed the scale of everything.

Gold and silver had solid gains as the prospect of higher inflation but Fed capped interest rates meant deepening negative real interest rates look increasingly certain. All eyes will be on the next CPI print this Thursday night after last month’s hot 4.2% print.

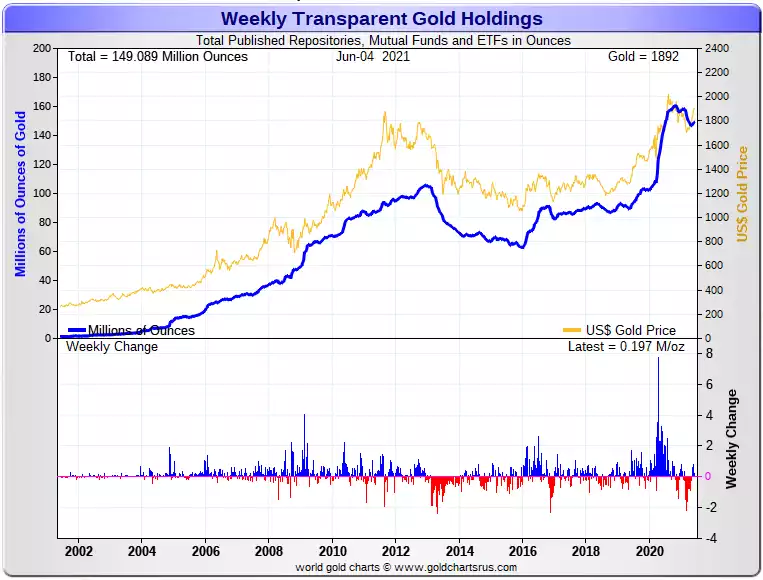

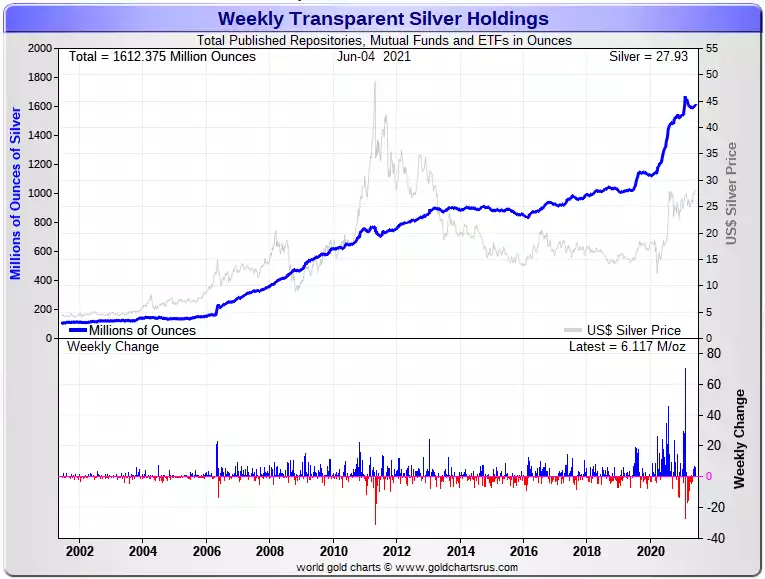

Even before this news, the inflows into gold and silver ETF’s, mutual funds and other reporting depositories were strong and continued what is now 5 weeks in a row of increases. The following charts illustrate that the August 2020 to March 2021 exit appear to be solidly correcting to the upside.