Both US & Euro Recession Dead Ahead

News

|

Posted 25/07/2022

|

8038

S&P Global Market Intelligence just released both their Euro and US PMI’s and at the time that both central banks are tightening monetary policy, both of two of the worlds largest economies are showing clear signs of heading into a recession.

We’ve discussed the ECB (here) and US Fed (here) tightening monetary policy after the ‘loosest’ run in history post GFC and then in overdrive post COVID. It’s also not unusual for a recession to follow a tightening cycle, it happens basically every time. What is spectacularly unusual this time is that they are tightening before economic lift off – at already low rates (ECB is now zero after they raised 0.5%!!), into an already weak economy, and into an unprecedented amount of debt to be serviced at the resulting higher rates.

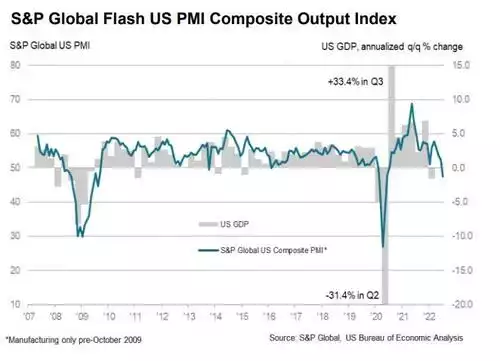

So where do S&P Global place us right now? First let’s look at the US and what S&P Global’s Chief Business Economist had to say:

“The preliminary PMI data for July point to a worrying deterioration in the economy. Excluding pandemic lockdown months, output is falling at a rate not seen since 2009 amid the global financial crisis, with the survey data indicative of GDP falling at an annualised rate of approximately 1%. Manufacturing has stalled and the service sector’s rebound from the pandemic has gone into reverse, as the tailwind of pent-up demand has been overcome by the rising cost of living, higher interest rates and growing gloom about the economic outlook.”, and

“An increased rate of order book deterioration, with backlogs of work dropping sharply in July, reflects an excess of operating capacity relative to demand growth and points to output across both manufacturing and services being cut back further in coming months unless demand revives. However, with companies’ expectations of future growth slumping to the lowest since the early days of the pandemic, any such revival is not being anticipated. Instead, firms are already reassessing their production and workforce needs, resulting in slower employment growth.”

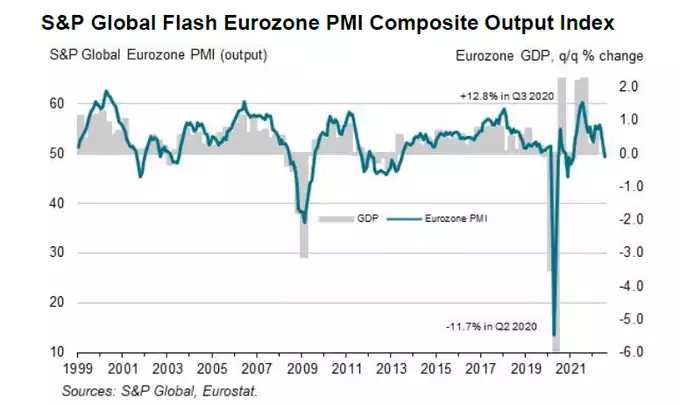

And in Europe:

“The eurozone economy looks set to contract in the third quarter as business activity slipped into decline in July and forward-looking indicators hint at worse to come in the months ahead.

Excluding pandemic lockdown months, July’s contraction is the first signalled by the PMI since June 2013, indicative of the economy contracting at a 0.1% quarterly rate. Although only modest at present, a steep loss of new orders, falling backlogs of work and gloomier business expectations all point to the rate of decline gathering further momentum as the summer progresses.

Of greatest concern is the plight of manufacturing, where producers are reporting that weaker than expected sales have led to an unprecedented rise in unsold stock. Production will likely need to be reduced as companies adapt to this weaker demand environment, in turn widely linked to rising prices.

In services, the boost to demand from the reopening of the economy has faded and growth is now at a near standstill, with customers often deterred by the increased cost of living and concerns about the outlook.”

And critically to our earlier comment about the extraordinary situation we find ourselves in this time, is that this is all coinciding with tightening policy!

“With the ECB raising interest rates at a time when the demand environment is one that would normally see policy being loosened, higher borrowing costs will inevitably add to recession risks.”

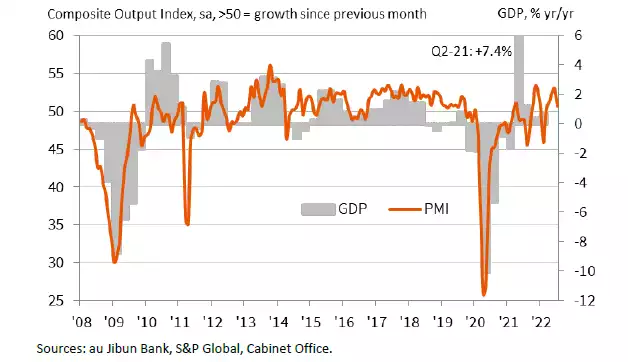

Japan rounds out the 3 biggest advanced economies in the world and whilst the full S&P report is not due until August, their Flash PMI paints a similar picture:

“Flash Japan PMI data pointed to sharp loss of growth in July, with the headline reading down to 50.6 from 53.0 in June. Manufacturing production fell for the first time in 5 months.”

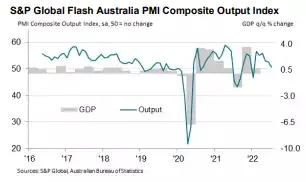

Australia’s Flash PMI likewise is falling but still in positive territory, for now. The big question for Australia is whether a recession can be held off when both the US and Euro are in one? We did it during the GFC but China was there to the rescue. That looks much less certain now.

What does seem almost certain now is that sooner rather than later the ECB and Fed will be forced to reverse course after barely starting and before getting inflation fully under control. That is more negative real interest rates and right in gold’s sweet spot.