Gold Supply 8% of What’s Needed

News

|

Posted 04/10/2016

|

4801

The CEO of Rangold, Dr Mark Bristow, told Mining Weekly recently that in the last 16 years a lack of new discoveries and reducing yields meant miners have failed to replace more than half the amount of gold mined.

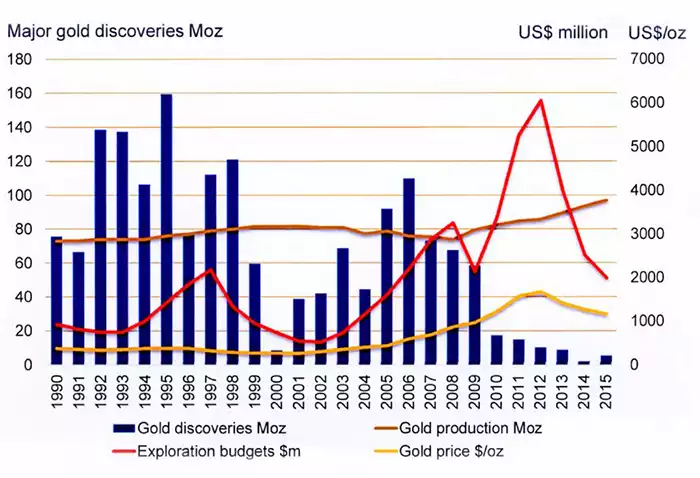

The graph below tells the very clear story. He said mine lives have fallen as lower grades (meaning lower yield, or the amount of gold per tonne that can be extracted) have now been calculated and when combined with plummeting new exploration yields he is predicting supply is heading for a ‘sharp fall’.

It appears the exploration equation is seeing a double whammy where it peaked in 2011 on the high gold price but was yielding very little in the way of actual new discoveries, and then the price fell sharply and so did exploration budgets with it. So less money was being spent on a declining discovery yield.

He stresses it’s not just new discoveries but the realisation of lower grades of already discovered reserves that needs to be factored. He estimates it will require the discovery of 90million new ounces per year to catch up, and to reverse this grade deterioration, 180 million ounces per year will need to be discovered. As you can see from the graph below, current discovery yields are in the order of 10 to 15 million ounces per year, around 6-8% of what is needed!

At the moment the gold price is being dictated more by speculative futures trading (COMEX) than fundamentals, but at some stage the rule of supply and demand must prevail.