Gold Silver Ratio – CoinSpot Bundle Launch

News

|

Posted 21/05/2021

|

9841

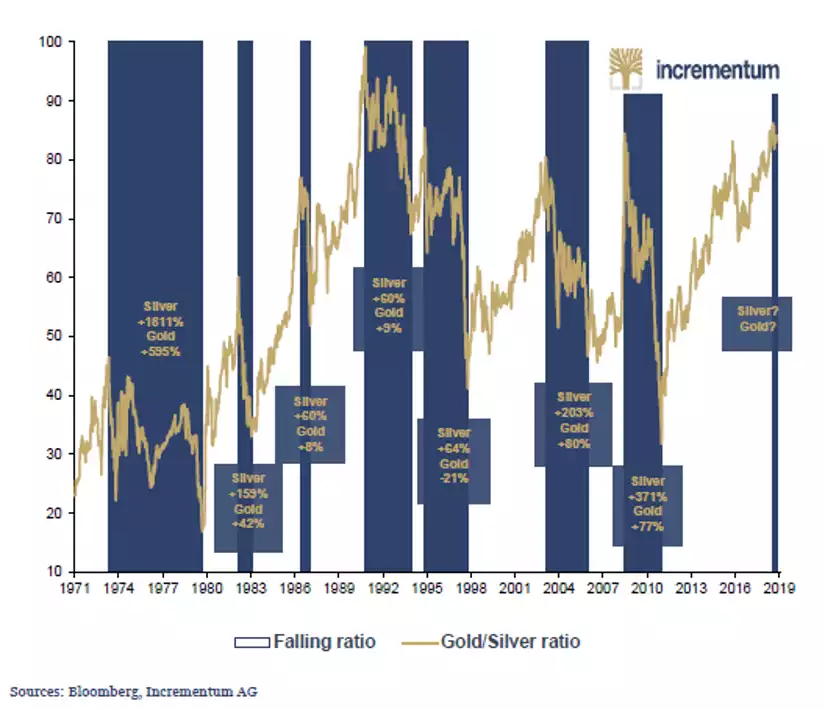

The Gold Silver Ratio is one of the key metrics studied by precious metals investors, and for good reason. This ratio of the gold price to the silver price has a wonderful track record of flagging not just the obvious relative price of each metal but also shares a strong correlation with the general precious metals markets rallying or turning bearish, i.e. a dropping GSR tends to see both metals rallying and vice versa but silver goes harder on the drop.

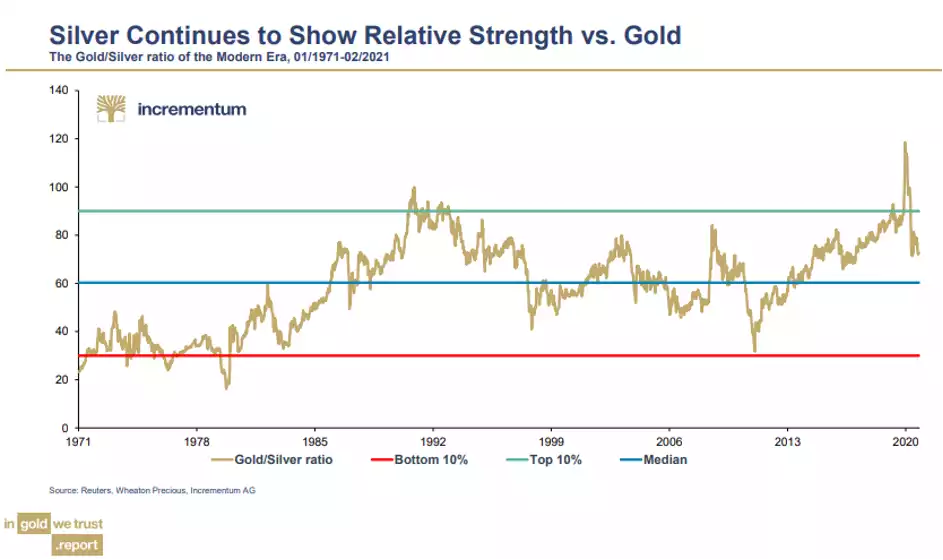

For a century the GSR formed an average around 45:1 with a trough of 18:1 in 1980 and a peak of 100:1 in 1991. Its last low of 30:1 in 2011 saw a silver price of $50, almost double that of today’s price. And then a little thing called COVID-19 came along and the market crash of March saw the ratio print a new all time high of over 125:1 as gold demonstrably outperformed silver in the panic.

From that GSR high of 125 in mid March 2020 silver has gone from (AUD) $20 to now sit at $35 up 75% and briefly seeing over $40 last August when gold and silver both topped. As we stand today, both metals are rallying off lows in late March when the GSR was 70 and now sitting at 67.5. That is nearly half that 122 high but still above its mean and mean reversion is what this is all about.

The chart below, albeit a little old now, shows how both metals rally when the GSR mean reverts but with silver vastly outperforming (of course given that dropping ratio).

Back in March we shared the latest on this topic from the same author as above, the pre-eminent In Gold We Trust annual report. The following chart looks at the period since we left the gold standard and started this epic credit cycle.

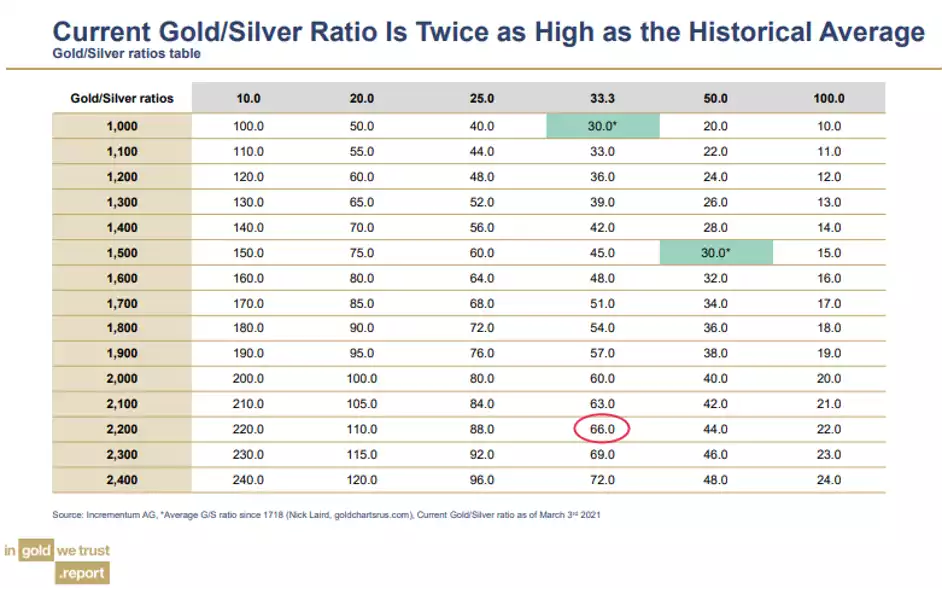

As you can see that 125 high in March 2020 has lifted the mean to around 60 for this period. Whether you adopt 60 or a longer term 45 or the 300 year average of 30, at 67 now we are still in a period where silver has the potential to outperform gold as we head down to 30 or 18, whichever you see as the relevant bottom. The table below is a ready reckoner to easily highlight how huge such a move would translate to price. They are using the 300 year average but if we look now at gold nominally at US$1800 you can see that a GSR (without that gold price moving) of 36 is $USD50 (AUD65) and 18 is $US100 (AUD130).

Importantly too, quietly on 8 March, just as gold bottomed after its post August 2020 decline, something happened that has only happened 4 times in the last 30 years… The 50-week moving average crossed below the 200-week moving average for the GSR as you can see in the chart below.

In 1993 silver went on to climb over 70%, in 2004 it went on to double, and in 2011 it rose 74% from the cross.

We are today proud to announce that CoinSpot have added a new ‘bundle’ called the Gold Silver Ratio bundle using our Gold Standard (AUS) and Silver Standard (AGS) bullion backed tokens. You can learn more about these here or at goldsilverstandard.com. The CoinSpot GSR Bundle is an optimised way to gain exposure to the precious metals market by balancing the allocation of gold and silver purchases based on the Gold-Silver Ratio (GSR).

The Gold-Silver Ratio Bundle is built on the basis of mean reversion and history rhyming. The bundle aims to optimise value growth in a portfolio of both gold and silver by purchasing whichever metal is considered more "undervalued" judging by the previous 30 years performance.

The bundle breaks the GSR price into 20 brackets between the high and low of the last 30 years. Updated on a weekly basis, whenever the GSR crosses into a different bracket, the bundle changes how much gold you are buying relative to silver. When the GSR is high, you will be buying more silver relative to gold and when the GSR is low, you will be buying more gold relative to silver. This means that you will always be buying the precious metal which is more "undervalued" compared to its counterpart. Simplistically at a 122:1 ratio (2020 high) you’d be buying 95% silver and at 31:1 ratio (2011) you’ll be buying 95% gold. As we sit today at a ratio of 67 you are buying 40% gold and 60% silver. This is a balanced mathematical approach that removes emotion.

Investing this way, particularly in regular consistent purchases, would have seen you dramatically outperform simply buying and holding either metal on its own.

We understand others will look at the still historically high ratio and go ‘all in’ silver as the higher potential trade and that is fine too.

However you wish to trade, we are seeing a falling GSR amid a gold rally and that is usually beautifully constructive for both metals.