Gold, Silver, Property, Shares or Cash?

News

|

Posted 18/10/2016

|

5177

There are a lot of people looking to ‘down weight’ equities on growing calls of a crash nearing (as we reported yesterday). For many this leaves the choice of property, cash or precious metals as most people don’t understand how to access bonds, and many believe these will be an integral part of any crash.

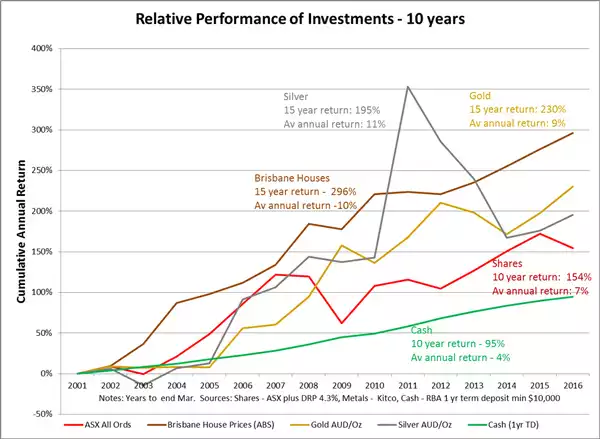

The chart below shows the relative performance of each asset class over the last 15 years (to March of each year). We’ve used it for Brisbane seminars so please excuse the Brisbane-centric House Price (and yes Sydney would be much higher). To remove the ‘gold doesn’t yield’ argument we include rental income for houses, dividend reinvestment plans for shares, and compounding interest on term deposits for cash.