Gold Rallies into “Super Thursday”

News

|

Posted 07/06/2017

|

5621

It was another strong night for gold and silver last night as the market becomes increasingly concerned about global events and is piling into safety. The so called “Super Thursday” events of the UK election, former FBI Director Comey’s senate testimony regarding alleged Trump interventions on the Russia case, and the ECB meeting have since been joined by the growing tensions around Qatar. Overnight the Saudi’s issued a 24 hour ultimatum to Qatar sparking growing concerns of military action. Overnight too, South Africa became the latest country to fall into a recession.

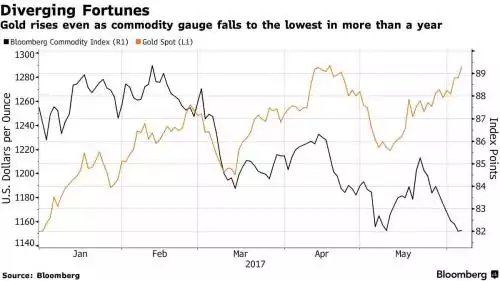

Money piled into US Treasuries (the other ‘safe haven’) as well with 10yr yields falling to their lowest since November. Indeed it has further cemented the anomaly of share prices rising at the same time as bond yields falling (normally, like gold, bond prices which are the inverse of bond yields, are uncorrelated with shares). The big question when looking at the graph below, is which of the two will break?

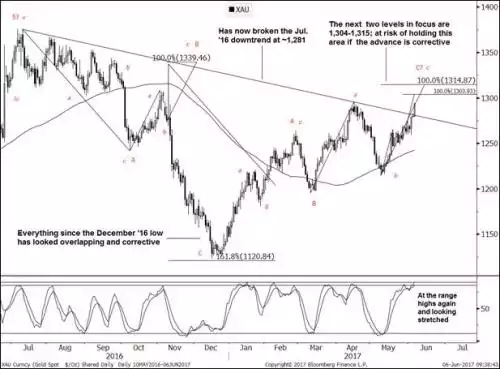

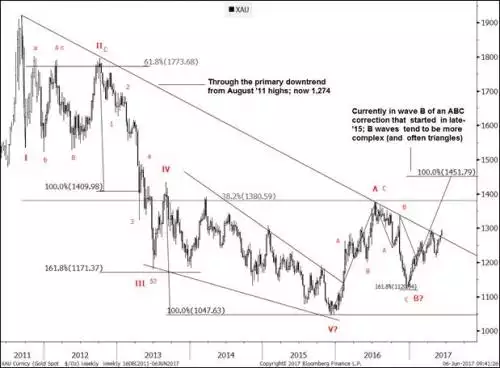

And so, like the bond prices, gold is hitting 7 month highs and in doing so has broken through some key technical resistance lines. If you are into charts:

First in the daily chart:

And also the weekly chart

So we are now looking for a break through the 1304 to 1315 level to see the next leg take off.

The other key divergence we are seeing at the moment is gold versus commodities. This should be no surprise as we find gold being put in the ‘commodity’ basket complete nonsense. Very little gold is ‘used’ as a commodity nowadays. Gold is a monetary asset and would be more at home being reported with other financial indices or currencies. Unsurprisingly commodities are low because world growth is low. That world growth is low despite record stimulus and debt (per yesterday’s article) means buying into a safe haven makes extraordinary sense right now… Refer Exhibit A below….