Gold Hits New High as Favoured Safe Asset

News

|

Posted 02/03/2022

|

6475

Gold hit its highest level since the height of the financial COVID crash in 2020 this morning, hitting USD1950 or $2685 in Aussie dollar terms as the Ukraine situation escalates. Whilst bonds also rallied last night, gold has been the strongest safe haven, inflation hedge, risk-off asset.

Bloomberg note:

““The whole crisis has gone to a level that we couldn’t have believed, and investors are no longer saying we’ll buy some defensive stocks or bonds,” said Global CIO Office chief executive officer Gary Dugan.

“It’s now about buying gold especially against the backdrop of inflation risks that have been made worse by the conflict.”

“Gold may continue to outperform other haven assets, with an added tailwind from central bank purchases and also displaying its characteristic as an inflation hedge,” said Yeap Jun Rong, a strategist at IG Asia Pte.

“The conflict has not seen any signs of easing and further escalation may heighten risks of persistent inflationary pressures, which will continue to draw traction for gold prices.””

Whilst there has been plenty of talk of inflation, the growing fear now is of stagflation. Amid persistently high inflation, exacerbated of course by rising energy and commodity prices due to the Ukraine conflict, signs of dramatically softening economic growth abound. The stagflation bogeyman of high inflation with low growth was let out of the bag last night with the Atlanta Fed’s GDPNow Forecast dropping to just 0% for Q1 US GDP. From 1.7% barely 2 weeks ago, to 0.6% 1 week ago, they are now forecasting ZERO economic growth for the US economy this quarter. Put that against the red hot 7% CPI print and the picture is ugly.

Goldman Sachs are calling it as follows:

"the recent escalation with Russia create clear stagflationary risks to the broader economy, driven by higher energy prices, which reinforce our conviction in higher gold prices in coming months and our $2,150/toz price target."

“Gold acts as an effective geopolitical hedge, but only as long as the geopolitical event is severe enough to impact the US economy. This may be due to the fact that the Dollar itself often acts as a safe haven when tensions arise in other parts of the world, rather than gold. But when the US itself is affected, gold acts as a hedge of last resort. In our view, the ongoing global energy crisis and above-target US inflation mean that any disruption to commodity flows from Russia and Ukraine could raise concerns of a US inflation overshoot and a subsequent hard landing, which would be bullish for gold.”

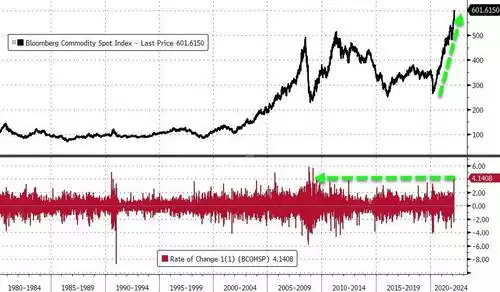

Last night commodities surged with the biggest daily price jump since 2009 in the GFC:

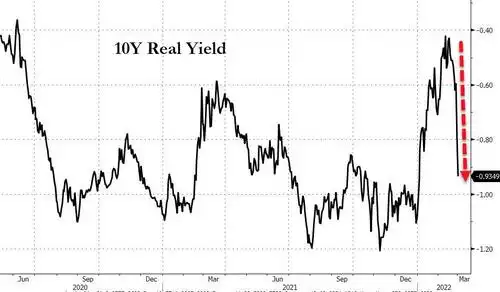

The mix of plummeting bond yields and high inflation saw a dramatic (if not somewhat predictable) reversal in 10 year Real Yields (10yr UST yield less inflation) more deeply into negative territory… just where gold likes it…

Despite the strong rally in US Treasuries and the USD as the other safe havens, there are growing stated concerns about the clearly demonstrated ability of the US to weaponise the world’s reserve currency. We have therefore seen the very strong buy up of gold by both investors and central banks as the ‘non counterparty risk’ alternative.

As our trademark says…. Balance your wealth in an unbalanced world….